By RoboForex Analytical Department

Gold Prices Surge Amid Weakening US Dollar and Global Tensions

Gold prices saw a significant uptick, surpassing 2,620 USD per troy ounce on Tuesday. This surge resulted from a depreciating US dollar, causing investors to seek clarification on the upcoming monetary policy set by the Federal Reserve. Currently, the chance of a Fed rate cut in December is estimated at 59%, which is a slight decrease from previous forecasts.

Market Reactions to Political Moves

Market participants are keeping a keen eye on the cabinet selections by US President-elect Donald Trump. His potential protectionist policies could have a direct impact on gold prices. The anticipation surrounding crucial appointments that may influence Trump’s economic strategies contributes to heightened market sensitivity.

Geopolitical Tensions Fuel Demand for Safe-Haven Assets

In addition to political developments, rising geopolitical tensions across the globe have considerably increased the demand for safe-haven assets, making gold more appealing. Following recent declines, investors are returning to the market at what they view as favorable price points, potentially reinforcing gold’s long-term growth trajectory.

Technical Analysis Of XAU/USD

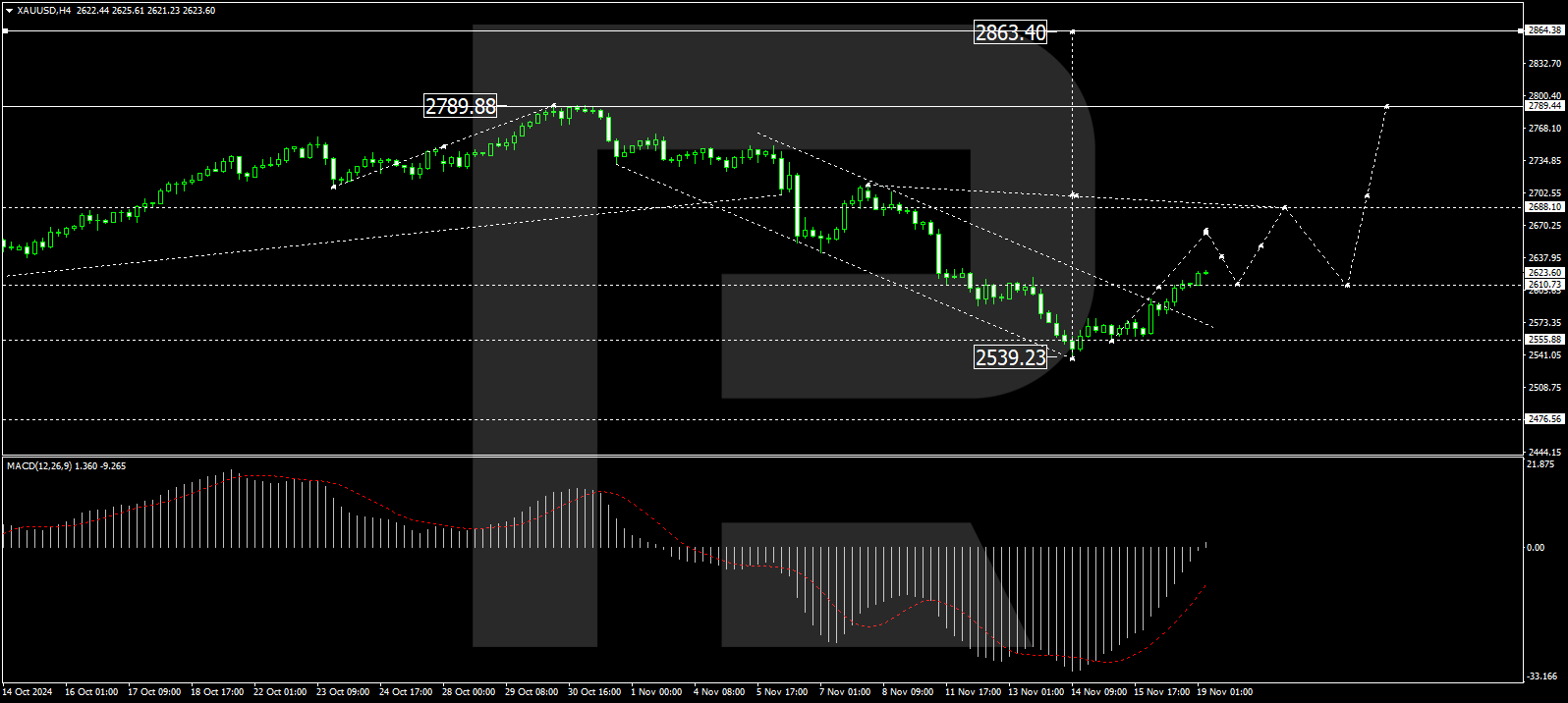

H4 chart: According to the H4 chart, the market has completed a correction down to 2,537 and is now set for a growth wave aiming for 2,688. If this target is achieved, a potential dip back to 2,610 could occur before pushing further towards 2,790. This optimistic view is supported by the MACD indicator, which shows the signal line moving upwards from below zero.

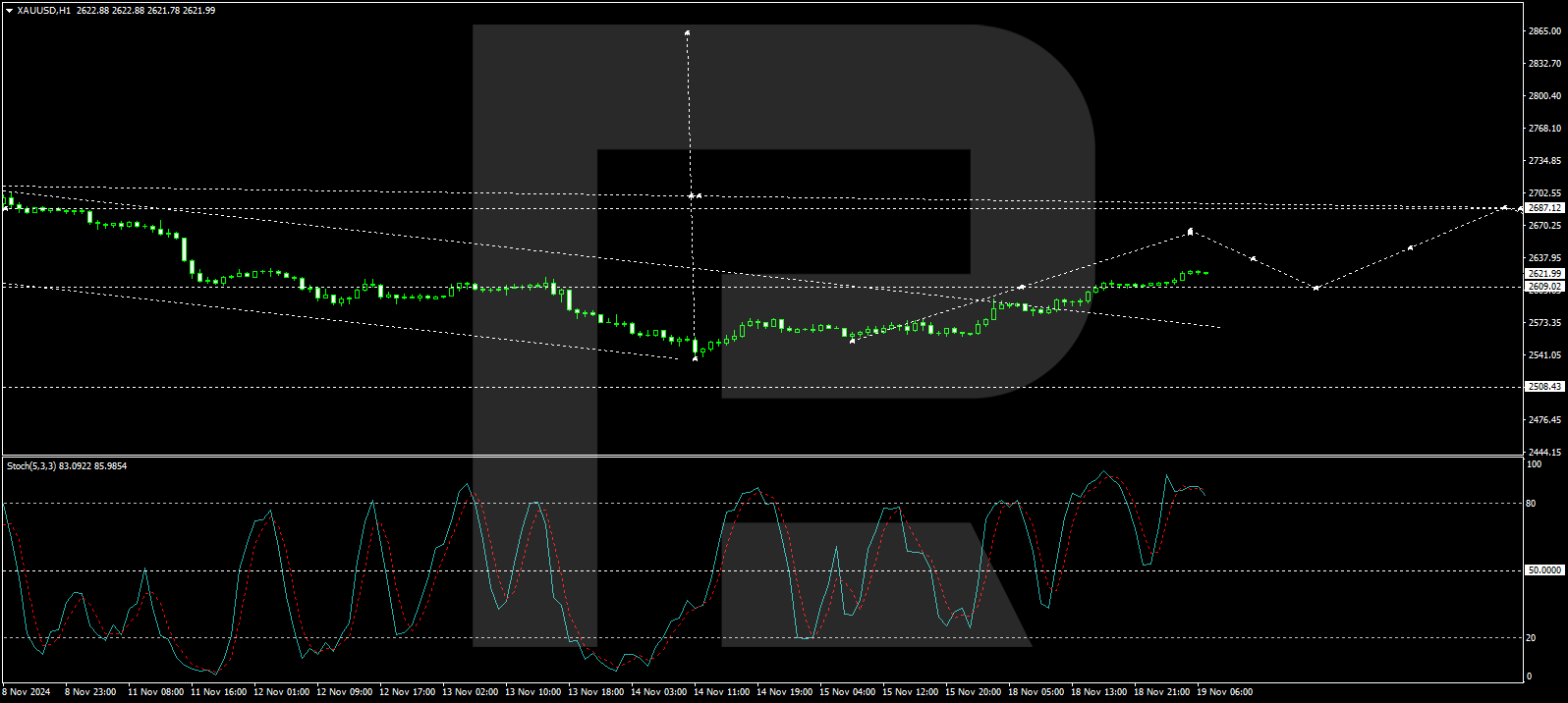

H1 chart: On the H1 chart, gold is entering the early stages of a growth wave towards 2,688. The price has stabilized around 2,609, forming a narrow consolidation range. An anticipated break above this range could target 2,660. Once that level is reached, a minor pullback to 2,609 may occur before continuing the upward trend towards 2,688. Current forecasts are supported by the Stochastic oscillator, which indicates strong upward momentum with its signal line moving towards 80 from above 50.

Disclaimer

Forecasts expressed here are based on the author’s opinion. This analysis should not be viewed as trading advice. RoboForex is not liable for any trading outcomes resulting from the recommendations and reviews provided here.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs