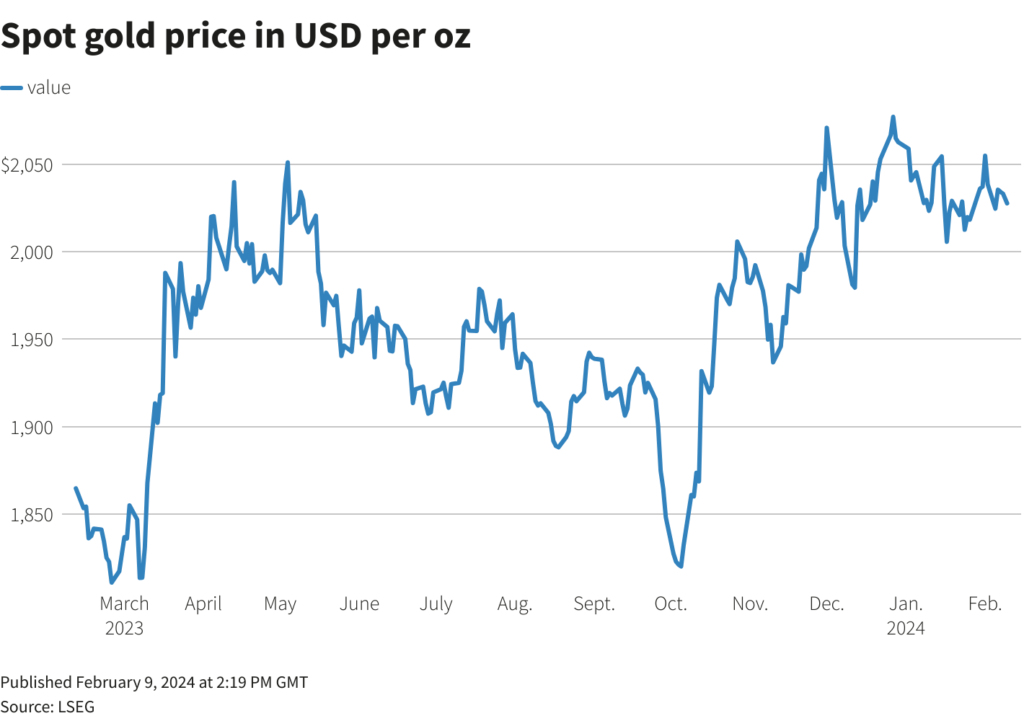

[Click here for an interactive chart of gold prices]

Amidst a two-week high in the benchmark 10-year US Treasury yields and a nearly two-month high in two-year yields, the non-yielding bullion has begun to lose its allure for investors. The rise in bond yields acts as a force of gravity, pulling gold prices downward.

“I do think that things are trending lower for the gold price, there is a pretty strong floor support at about $1,960 that I don’t expect to see gold go below,” said Everett Millman, chief market analyst at Gainesville Coins, in a Reuters note. The bullish market is now speculating how long this floor can withstand the pressure from rising bond yields.

Several Fed officials, including Chairman Jerome Powell, have recently expressed a preference for additional data supporting a continued decline in inflation before considering any rate cuts. The shift in the Fed’s stance is palpable, and it seems inevitable that we are entering an era of higher interest rates.

Market participants now eagerly await the consumer price index (CPI) figures for January, due on Tuesday. The information within this report will provide insight into the potential trajectory of interest rates and bullion prices in the coming weeks.

Currently, traders are indicating a 62% chance of an interest rate cut in May, according to the CME Fedwatch tool. However, this sentiment may shift significantly depending on the forthcoming CPI figures.

Elsewhere, palladium fell 2.9% to $861.06 per ounce and platinum was down 1.3% to $873.97. Prices of both metals were heading for a second weekly dip, further corroborating the downward trend in precious metal prices.

(With files from Reuters)