Gold Prices Stagnate, Offering Dividend Opportunities Amid Economic Shifts

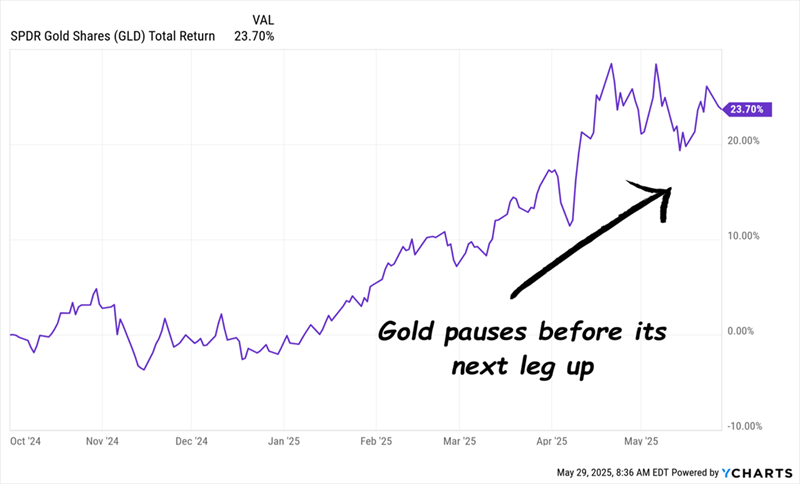

Gold prices have flattened, presenting a chance to consider two dividend options yielding up to 8.3%.

Despite recession concerns, they may be exaggerated. Key indicators suggest a bullish trend for gold prices. Here’s a detailed analysis of the situation and the expected financial benefits.

The Current Economic Landscape: “No-Landing” Economy

Last fall, the concept of a “no-landing” economy in the US emerged, defined by ongoing growth alongside persistent inflation. This scenario has largely materialized.

Critics might point to a GDP contraction in the first quarter. Although GDP did decline, the underlying details tell a different story.

The drop stemmed from increased imports, which negatively influence GDP calculations. Also, government spending decreased due to budget cuts, while consumer spending remained stable.

This situation isn’t indicative of real weakness but rather a temporary skew in the data.

Impact of Government Policies on Gold Prices

Consecutive quarters of decline would indicate an official recession, something officials like President Trump and Treasury Secretary Scott Bessent are keen to avoid before the midterms. Federal Reserve Chair Jay Powell shares this sentiment.

Anticipate continued governmental and Federal Reserve efforts to maintain low interest rates and stimulate economic growth. Inflation, or the perception of it, should support rising gold prices.

Fiscal Measures to Support Gold Prices

The newly proposed “One Big, Beautiful Bill” aims to stimulate the economy via tax cuts, though it will add to the growing deficit. Significant tax breaks may benefit lower-income taxpayers, potentially increasing consumer spending and driving inflation.

This legislation has passed the House and is expected to progress in the Senate due to bipartisan support.

In addition, Jay Powell recently escalated the Fed’s bond purchases by $20 billion monthly, reinforcing market liquidity.

Furthermore, Treasury Secretary Scott Bessent may continue a strategy of short-term Treasury financing, which could stabilize long-term interest rates and ultimately keep borrowing costs down.

These developments may sustain inflation concerns, making the recent pullback in gold ripe for investment.

Gold Investment Opportunities

Gold Play No. 1: GAMCO Global Gold, Natural Resources & Income Trust

The GAMCO Global Gold, Natural Resources & Income Trust (GGN) currently offers an 8.3% yield but has previously faced challenges due to its discount to net asset value.

While GGN’s discount is 2.3%, it remains an improvement from year-end premiums, indicating a less popular trade as gold outlook brightens.

Historically, such discounts can lead to price rebounds as they shift to premiums, evidenced by earlier gains reaching 13% when last noted.

However, GGN is not a pure gold entity; around 60% of its holdings include mining stocks and energy companies like Exxon Mobil Corp. (XOM).

Gold Play No. 2: Mining Stocks and Energy Trends

For investors in gold, consider the position of companies like Newmont Corp. (NEM), the largest gold miner, amid rising gold and energy prices. The interplay between these elements will significantly shape future investments.

Gold Prices Surge While Crude Oil Prices Remain Low

Crude oil is currently priced around $62, close to the lows seen in 2021. This is significant, as energy constitutes a major input cost for miners.

In contrast, gold is selling for approximately $3,300, remaining near historic highs despite a slight pullback. This scenario presents a favorable environment for gold miners.

Newmont’s Q1 revenue surged by 25% year-over-year, with earnings per share (EPS) rising from $0.14 to $1.68. This impressive performance highlights the company’s strong positioning.

Despite this success, Newmont shares are trading at only 12 times forward earnings, considerably below the five-year average of 19.3. The company currently offers a yield of 1.9%, with a dividend based on fluctuating gold prices, covering just 27% of the last 12 months’ free cash flow.

Outlook for Gold Miners: Potential for Growth

Future expectations indicate that gold prices may rise while energy costs remain low, which could positively impact Newmont.

This makes Newmont an attractive option for investors willing to accept some volatility in dividends. Additionally, higher gold prices can boost the 8.3% payout of other gold investment vehicles.

Corporate Bonds: Contrarian Opportunity Amid Recession Fears

Recession concerns persist, but recent monetary policy shifts by leaders like Powell indicate that interest rates may stabilize. This environment creates a potential opportunity in corporate bonds.

A notable corporate-bond fund is currently yielding 11% and pays monthly dividends. This fund’s strategy is designed to thrive in various market conditions:

- If growth increases, the fund’s strong management secures long-term bonds with high yields, supporting the 11% income.

- If growth slows, the high-yield bond portfolio could increase in value, contributing to price appreciation.

This bond fund is poised to issue its next monthly dividend soon. Early investors could secure a dividend in just a few weeks.

Disclaimer: The views expressed in this article belong to the author and do not reflect those of Nasdaq, Inc.