Gold Surges Past $2,900 as Tariff Fears Fuel Safe-Haven Demand

Gold Hits New Heights Amid Trade Tensions

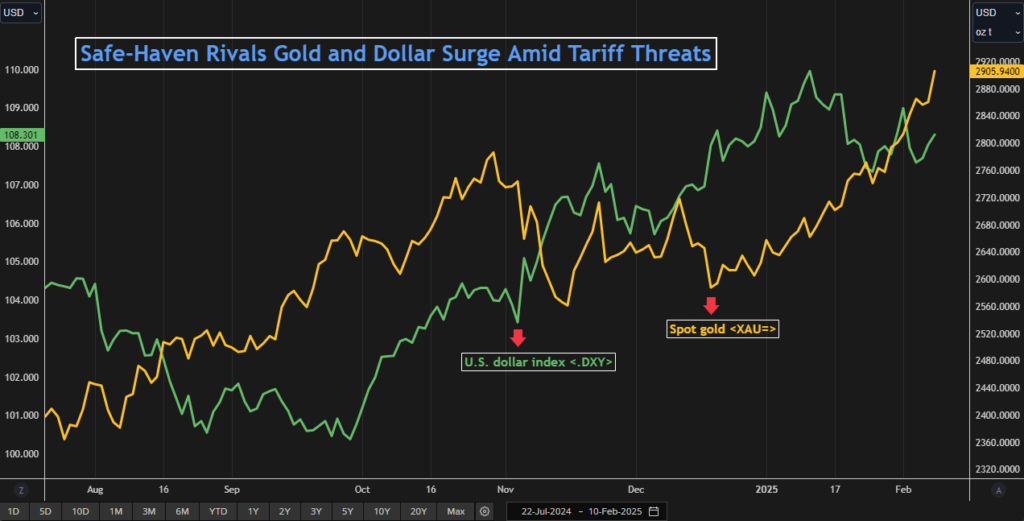

Gold continued its impressive rally on Monday, breaking through the significant $2,900 barrier for the first time. This surge occurred following U.S. President Donald Trump’s recent threats to impose tariffs, which led to increased demand for safe-haven assets.

As of 12:15 ET, spot gold reached $2,902.16 per ounce, marking a 1.4% increase during the session. Earlier, it peaked at a record-setting $2,911.18 per ounce. In New York, U.S. gold futures mirrored this rise, also climbing 1.4% to $2,929.60 per ounce.

This sharp increase follows Trump’s announcement of a new 25% tariff on all steel and aluminum imports, along with plans to introduce reciprocal tariffs soon.

“The rise in gold prices is a clear response to the tariff situation, reflecting growing uncertainty and tension in global trade,” said Marex analyst Edward Meir in a recent note.

Investor concerns about potential inflation due to these tariffs are mounting, with the Consumer Price Index (CPI) and Producer Price Index (PPI) data set to be released later this week.

If the inflation data turns out to be lower than expected, it could weaken the dollar and push gold prices higher. Conversely, stronger-than-anticipated data could increase U.S. yields, potentially putting mild pressure on gold prices, although buyer interest in dips remains strong, Meir noted.

Gold’s Momentum Grows

This latest increase marks the seventh time in 2025 that gold has set a new record. So far this year, bullion has risen nearly 11%, building on an impressive 27% gain in 2024.

Market analysts suggest that gold could hit the $3,000 mark, especially if the trade war escalates and demand for safe-haven assets grows stronger. “Gold is clearly eyeing the $3,000 level. The market is incredibly strong, and it’s a matter of when, not if,” stated independent analyst Ross Norman, as reported by Reuters.

He added that while some profit-taking may occur, the overall momentum seems unyielding.

Concerns around tariffs have led to unusually high premiums for gold contracts in New York, prompting significant withdrawals of bullion from England.

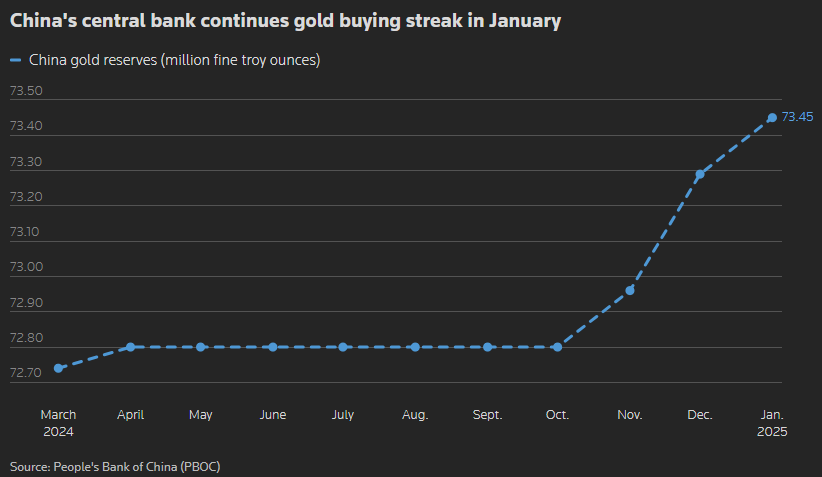

Central banks are playing a pivotal role in this market shift. According to the World Gold Council, their gold purchases surged 54% year-on-year in the final quarter of 2024, coinciding with Trump’s electoral win.

China’s central bank notably added gold to its reserves for the third consecutive month in January, a point highlighted by recent official data.

“The resumption of gold purchases by the People’s Bank of China, alongside new policies allowing insurance funds to invest in gold, seems to be fueling the bullish momentum for bullion,” commented Han Tan, chief market analyst at Exinity Group.

(With files from Reuters)