Goldman Sachs Rates DexCom as ‘Buy’; Fund Ownership Insights

Goldman Sachs commenced coverage of DexCom (BMV:DXCM) on May 30, 2025, issuing a Buy recommendation.

Fund Sentiment Analysis

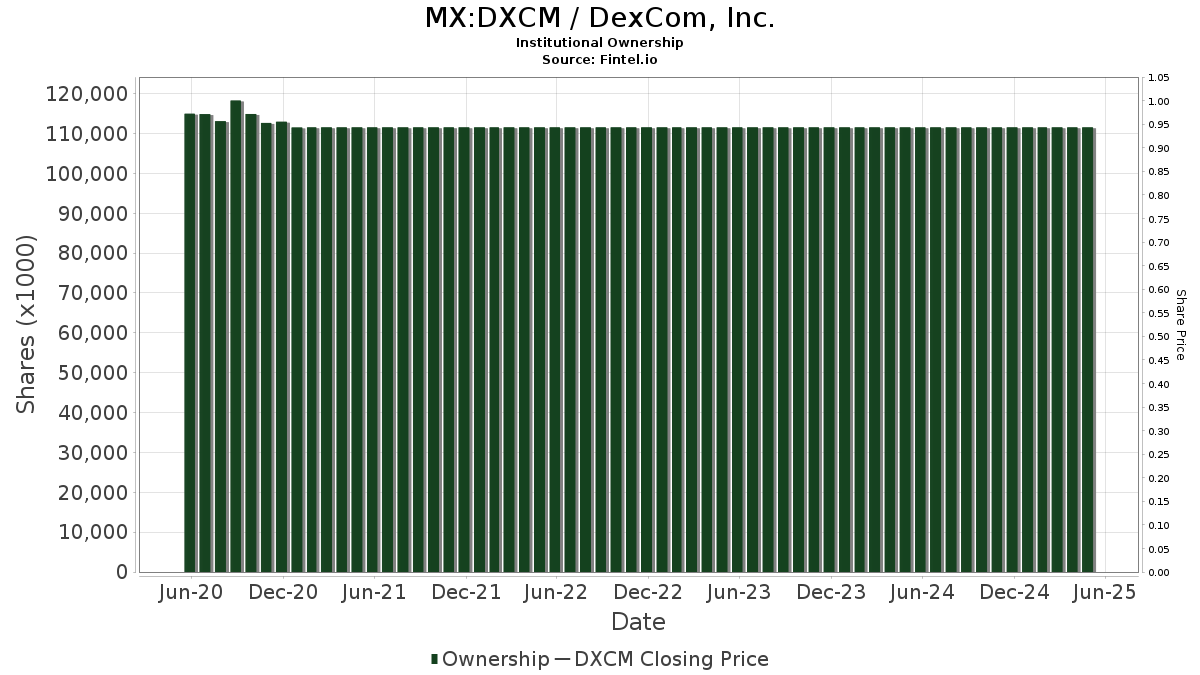

Currently, 1,644 funds are reporting positions in DexCom, reflecting a quarterly increase of 20 funds, or 1.23%. The average portfolio weight for all funds investing in DXCM is 0.40%, up by 18.59%. However, total institutional shares owned decreased by 1.32% in the last three months, totaling 111,550K shares.

Institutional Shareholder Movements

Baillie Gifford owns 14,180K shares, accounting for 3.69% ownership, down from 14,613K shares—a decrease of 3.05%. Their portfolio allocation in DXCM dropped by 63.38% over the last quarter.

Vanguard Total Stock Market Index Fund (VTSMX) holds 12,360K shares, representing 3.22% ownership. This is an increase from 12,259K shares, marking a rise of 0.81%, while its portfolio allocation in DXCM declined by 7.65% over the last quarter.

Capital Research Global Investors owns 12,037K shares, reflecting 3.13% ownership, down from 14,372K shares—a decrease of 19.40%. This firm reduced its portfolio allocation in DXCM by 22.22% in the last quarter.

Vanguard 500 Index Fund (VFINX) possesses 10,858K shares, equal to 2.82% ownership, up from 10,573K shares, an increase of 2.62%. The firm’s allocation in DXCM declined by 7.92% over the quarter.

Jennison Associates has 10,523K shares, representing 2.74% ownership, up from 7,644K shares—a significant increase of 27.36%. Nevertheless, they decreased their portfolio allocation in DXCM by 25.84% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.