Goldman Sachs Initiates ‘Buy’ Recommendation for DexCom Stock

Goldman Sachs began coverage of DexCom (LSE:0A4M) with a Buy rating on May 30, 2025.

Current Fund Sentiment

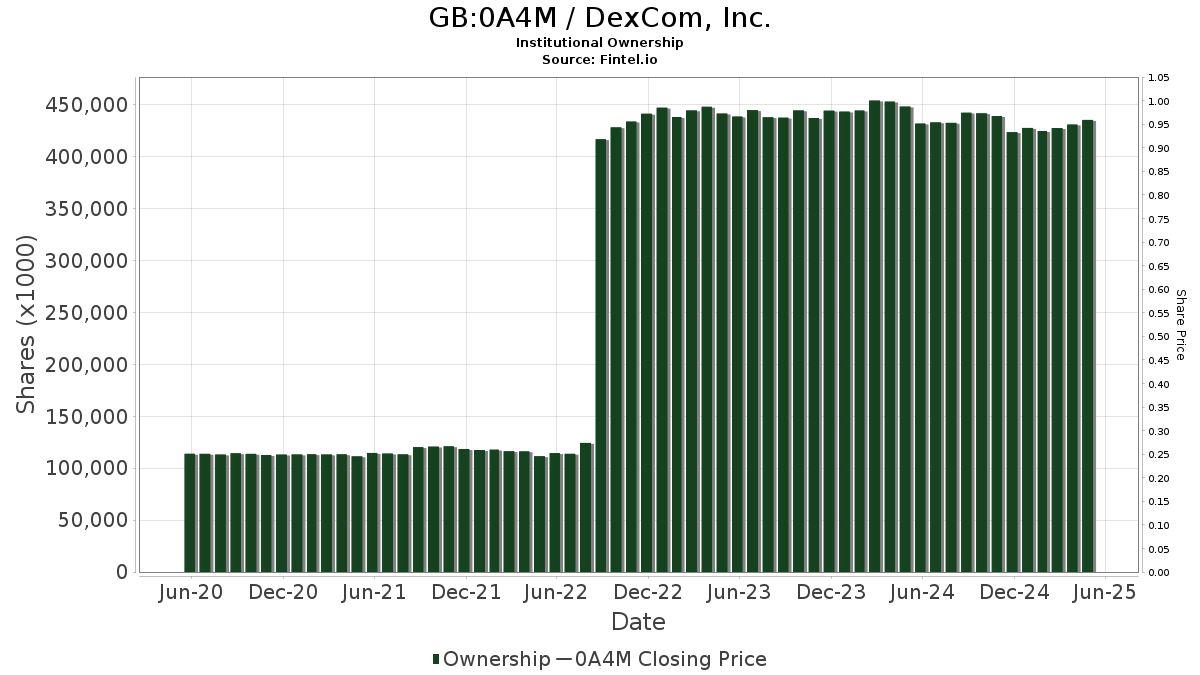

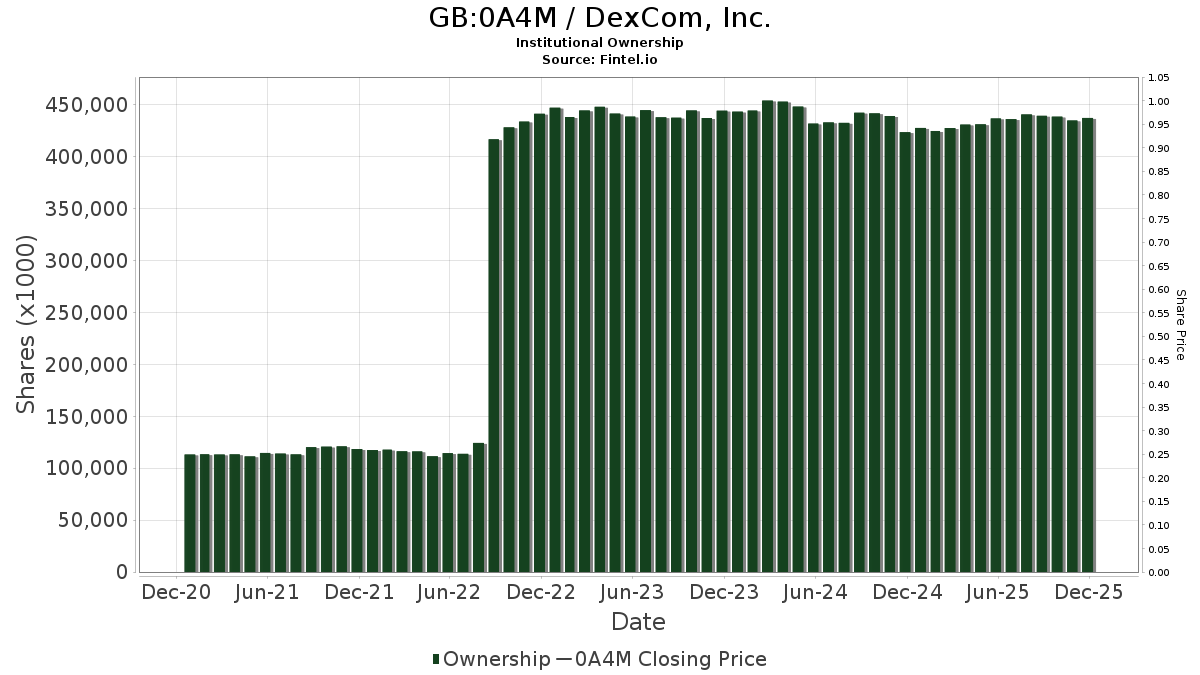

Currently, 1,818 funds hold positions in DexCom, reflecting a decrease of 71 funds, or 3.76%, from the previous quarter. Fund allocation to 0A4M averages 0.24%, which is an increase of 1.37%. Institutional ownership rose by 2.16% over the last three months, totaling 436,857K shares.

Transactions by Major Shareholders

Baillie Gifford now holds 14,180K shares, equating to 3.62% ownership, down from 14,613K shares, a reduction of 3.05%. Its portfolio allocation in 0A4M decreased by 63.38% in the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) owns 12,360K shares, representing 3.15% ownership, up from 12,259K shares, an increase of 0.81%. However, the portfolio allocation for 0A4M saw a 7.65% decrease last quarter.

Capital Research Global Investors decreased its stake from 14,372K shares to 12,037K shares, representing 3.07% ownership. This marks a 19.40% decline and a 22.22% drop in portfolio allocation.

Vanguard 500 Index Fund (VFINX) holds 10,858K shares, which is 2.77% ownership, up from 10,573K shares, a 2.62% increase. Its portfolio position in 0A4M decreased by 7.92% last quarter.

Jennison Associates has increased its shares from 7,644K to 10,523K, representing 2.68% ownership—a 27.36% increase. Nonetheless, the firm decreased its portfolio allocation by 25.84% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.