Goldman Sachs Upgrades Wingstop: A Bright Future Ahead

Analysts Predict 28% Price Increase

Fintel reports that on November 8, 2024, Goldman Sachs upgraded its outlook for Wingstop (NasdaqGS:WING) from Neutral to Buy.

Current Price Target Analysis

As of October 22, 2024, the average one-year price target for Wingstop is $435.06 per share. Analysts project a low of $363.60 and a high of $514.50. This average price target indicates a potential rise of 27.97% from the most recent closing price of $339.98 per share.

Understanding Fund Sentiment

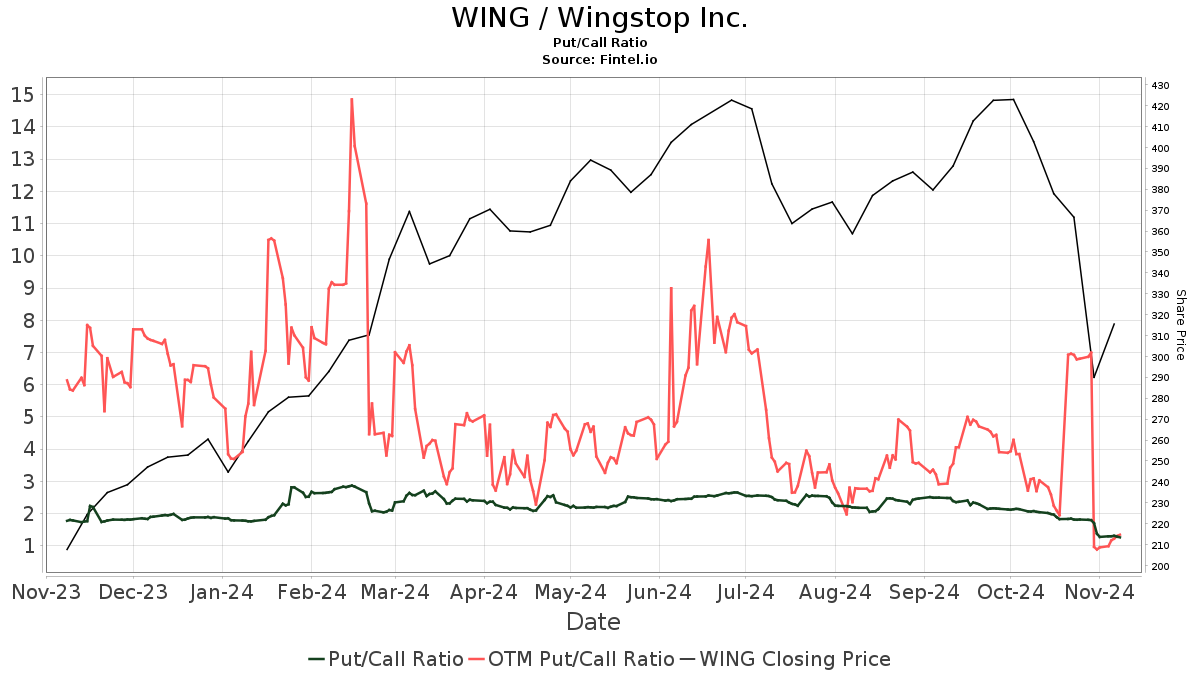

Currently, 1,063 funds or institutions report positions in Wingstop, marking an increase of 62 owners or 6.19% from the previous quarter. The average portfolio weight of all funds invested in WING stands at 0.33%, up by 5.76%. Despite this interest, total shares owned by institutions declined by 1.10% over the last three months to 34,869K shares. The put/call ratio of WING is at 1.26, signaling a somewhat bearish outlook among traders.

What Are Institutional Investors Doing?

American Century Companies holds 1,165K shares, which is 3.99% ownership. Previously, they reported 1,305K shares, showing a decline of 12.04%. Despite this reduction, they increased their portfolio allocation for WING by 0.26% in the last quarter.

American Century Companies holds 1,165K shares, which is 3.99% ownership. Previously, they reported 1,305K shares, showing a decline of 12.04%. Despite this reduction, they increased their portfolio allocation for WING by 0.26% in the last quarter.

Federated Hermes owns 1,052K shares, accounting for 3.60% ownership. This is a drop from 1,093K shares, reflecting a decrease of 3.93%. However, they raised their allocation in Wingstop by 14.23% lately.

Price T Rowe Associates has decreased its holdings significantly, now at 936K shares or 3.21% ownership, down from 2,274K shares, which is a staggering decline of 142.83%. They have reduced their portfolio allocation for WING by 53.62% in the past quarter.

The Vanguard Total Stock Market Index Fund Investor Shares holds 926K shares (3.17% ownership), slightly increasing from the previous 923K shares, showing a growth of 0.34% in its portfolio allocation.

The iShares Core S&P Mid-Cap ETF has 914K shares (3.13% ownership), slightly down from 916K shares, indicating a minor decrease of 0.24%. Still, they raised their allocation to WING by 17.80% last quarter.

Wingstop: A Brief Overview

(This description is provided by the company.) Founded in 1994 and based in Dallas, TX, Wingstop Inc. operates and franchises over 1,500 locations worldwide. The company aims to serve up flavor with its classic wings, boneless wings, and tenders, all cooked to order and tossed in a variety of 11 flavors. Wingstop’s menu also offers signature sides like fresh-cut fries and made-from-scratch dips.

Fintel is one of the leading investing research platforms for individual investors, financial advisors, and hedge funds, providing comprehensive data on market fundamentals, analyst reports, and fund sentiment.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.