Goldman Sachs Upgrades Charles Schwab’s Outlook to Buy

Fintel reported on April 25, 2025, that Goldman Sachs raised its outlook for Charles Schwab (BMV:SCHW) from Neutral to Buy.

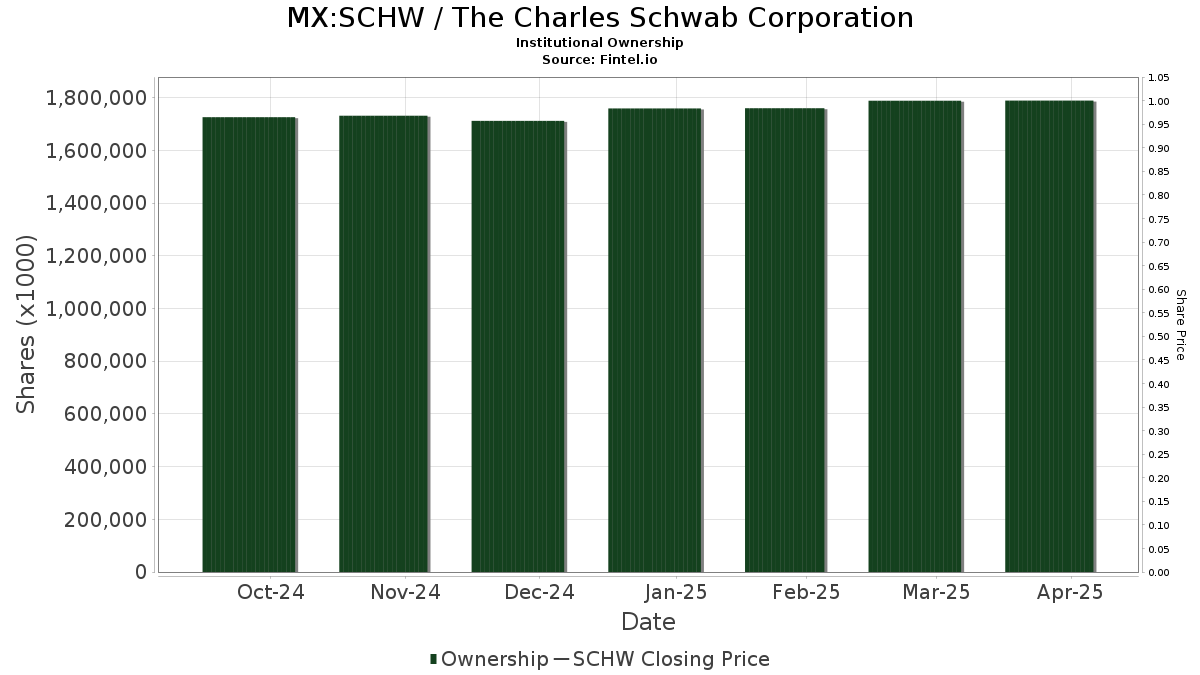

Institutional Holdings Analysis

Toronto Dominion Bank now holds 185,493K shares, reflecting a 10.21% ownership stake. This is a slight increase from their previous report of 185,425K shares, signifying a growth of 0.04%. Furthermore, the firm elevated its portfolio allocation in SCHW by 2.02% over the last quarter.

Dodge & Cox holds 89,370K shares, which constitutes 4.92% ownership of the company. Previously, they reported 89,588K shares, indicating a decrease of 0.24%. However, the firm increased its SCHW portfolio allocation by 17.23% during the last quarter.

Price T Rowe Associates holds 73,095K shares representing 4.03% ownership. They reported previously owning 87,814K shares, which is a decrease of 20.14%. This firm decreased its SCHW portfolio allocation by 4.83% last quarter.

DODGX – Dodge & Cox Stock Fund now holds 60,286K shares, accounting for a 3.32% ownership stake. Their prior holdings were 60,346K shares, indicating a decrease of 0.10%. Nonetheless, they raised their portfolio allocation in SCHW by 18.27% over the last quarter.

JPMorgan Chase holds 49,064K shares, representing 2.70% ownership. Their previous report noted 48,307K shares, reflecting an increase of 1.54%. JPMorgan Chase also raised its SCHW portfolio allocation by 13.66% in the most recent quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.