Goldman Sachs Upgrades Old Dominion Freight Line to Buy

On June 2, 2025, Goldman Sachs changed its outlook for Old Dominion Freight Line (BIT:1ODFL) from Neutral to Buy.

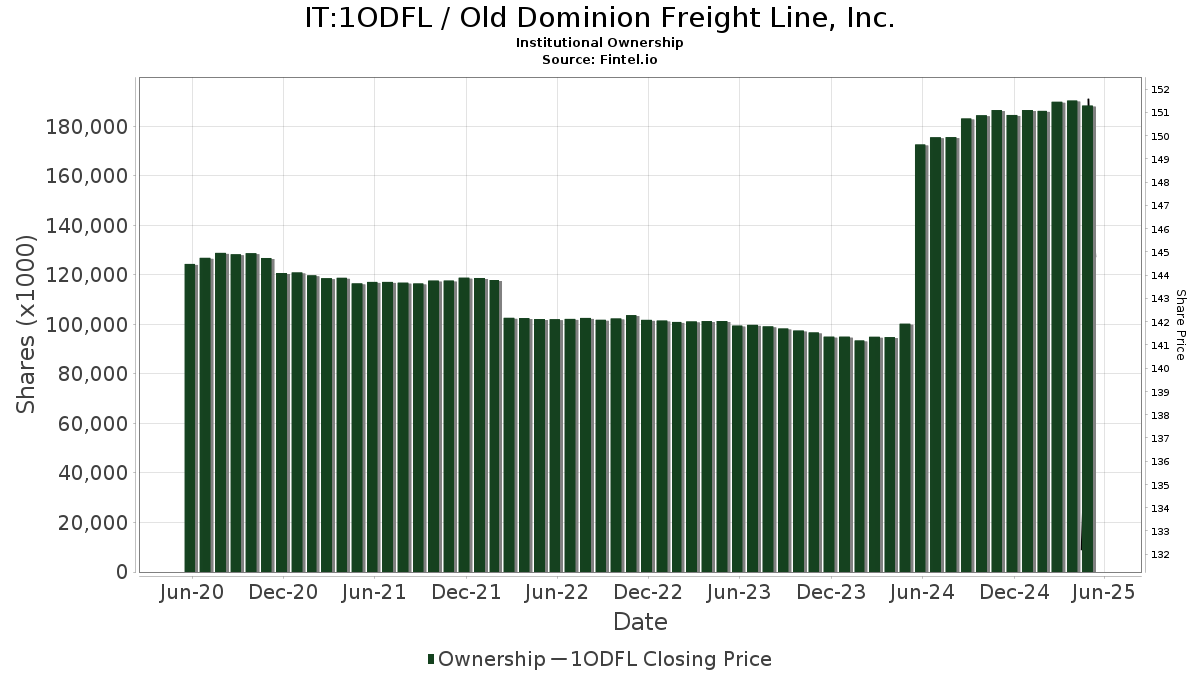

Fund Sentiment Update

Currently, 1,720 funds report positions in Old Dominion Freight Line, reflecting a decrease of 64 funds or 3.59% from the previous quarter. The average portfolio weight for all funds in 1ODFL is 0.28%, up by 2.35%. Over the last three months, total shares owned by institutions fell by 0.36%, totaling 188,452K shares.

Actions of Major Shareholders

Price T Rowe Associates owns 13,814K shares, equating to 6.54% ownership. This marks a 14.24% decrease from its previous holding of 15,781K shares and a 57.10% reduction in portfolio allocation over the last quarter.

CIBC Private Wealth Group has 8,676K shares, representing 4.11% of the company. This is a slight decline of 0.12% from 8,686K shares, leading to a 4.44% decrease in portfolio allocation in the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares holds 6,041K shares for 2.86% ownership, reflecting an increase of 0.38% from last quarter’s 6,018K shares, although portfolio allocation decreased by 1.79% over the same period.

Bank of New York Mellon has 5,651K shares, holding 2.67% ownership. This is down by 3.94% from 5,873K shares, resulting in a substantial 91.21% decrease in portfolio allocation.

The Vanguard 500 Index Fund Investor Shares owns 5,220K shares, representing 2.47% ownership. This is an increase of 2.56% from the previous 5,086K shares, despite a 1.71% decline in portfolio allocation.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.