Goldman Sachs initiated coverage of Viatris (BIT:1VTRS) with a Neutral rating on June 6, 2025. The average one-year price target for the company is €9.76/share, indicating a potential upside of 25.95% from the latest closing price of €7.75/share. Price forecasts range from a low of €7.15 to a high of €12.17.

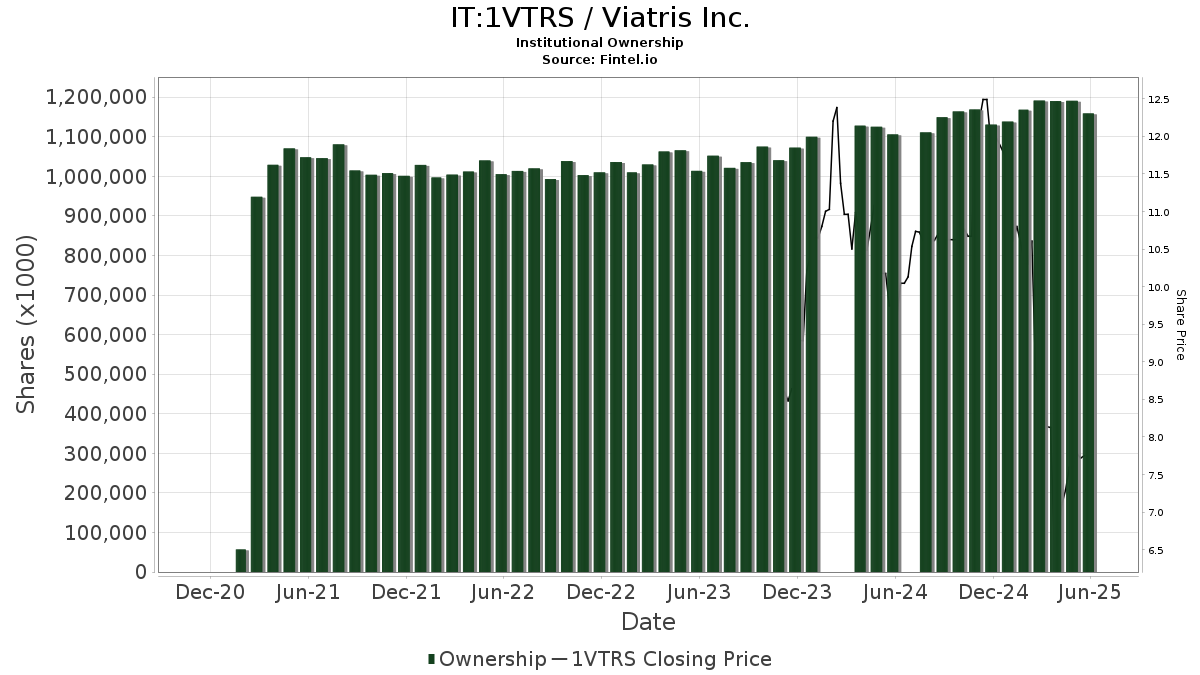

The projected annual revenue for Viatris is €15.581 billion, reflecting an increase of 8.73%. The projected annual non-GAAP EPS is €3.06. Currently, 1,653 funds report positions in Viatris, with total institutional shares decreasing by 2.62% to 1,158,925K shares over the last three months.

Price T Rowe Associates owns 74,461K shares (6.34% ownership), with a recent increase of 21.19%. Davis Selected Advisers holds 64,948K shares (5.53% ownership), reflecting a slight increase of 3.66%. Other notable shareholders include Vanguard’s Total Stock Market Index Fund with 37,699K shares (3.21% ownership) and Pacer US Cash Cows 100 ETF with 34,732K shares (2.96% ownership).