Goodyear Tire’s Stock Soars After Positive Q3 Earnings Report

Shares of Goodyear Tire (GT) jumped 23% following the company’s third-quarter 2024 results. The report highlighted adjusted earnings per share (EPS) of 37 cents, exceeding the Zacks Consensus Estimate of 25 cents. In comparison, the company posted an EPS of 36 cents during the same quarter last year.

The firm reported net revenues of $4.82 billion, down 6.2% from the previous year, which fell short of the Zacks Consensus Estimate of $4.98 billion, primarily due to reduced replacement volume.

Stay tuned for quarterly updates: Check out Zacks Earnings Calendar.

Tire volume for the quarter totaled 42.5 million units, reflecting a decline of 6.2% compared to the corresponding quarter last year.

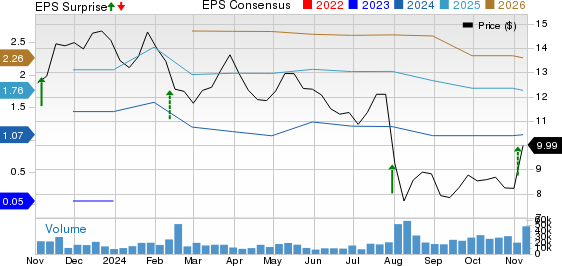

Goodyear Tire & Rubber Company Price, Consensus, and EPS Surprise

The Goodyear Tire & Rubber Company price-consensus-eps-surprise-chart | The Goodyear Tire & Rubber Company Quote

Performance by Region

Breaking down performance by regions, the Americas segment reported revenues of $2.86 billion, an 8.4% year-over-year decline that did not meet our expectation of $2.97 billion. The segment’s operating income of $251 million also dropped by 2.7% from the previous year, impacted by lower replacement volume, inflationary pressures, and increased raw material costs. This was below our forecast of $269.5 million.

The Europe, Middle East and Africa segment delivered revenues of $1.35 billion, down 1.9% from last year, also missing our estimate of $1.37 billion, largely due to adverse foreign exchange effects and lower replacement volumes. However, operating income in this region was $24 million, a 9% year-over-year increase supported by the Goodyear Forward plan and better pricing efforts. This figure exceeded our expectation of $19.4 million.

In the Asia Pacific segment, revenues fell 4.6% year over year to $618 million, which again missed our estimate of $681.4 million. Nonetheless, operating profit increased by 28.6% from the same quarter last year to $72 million, aided by improved pricing strategies and lower net inflationary costs. This result also outperformed our forecast of $69.2 million.

Financial Health Overview

On the expense side, selling, general & administrative costs decreased to $663 million, down from $673 million the prior year.

As of September 30, 2024, Goodyear had $905 million in cash and cash equivalents, slightly up from $902 million at the end of 2023. However, long-term debt and finance leases rose to $7.43 billion, an increase from $6.83 billion as of December 31, 2023. In terms of capital expenditure, the figure for the first nine months reached $912 million, marking an increase from $807 million during the same period last year.

Revised Outlook for 2024

Looking ahead, Goodyear has revised its capital expenditure forecast for the full year 2024 to $1.20 billion, down from a previous estimate of $1.25 billion. The company now anticipates interest expenses to be around $525 million and depreciation and amortization to be about $1 billion.

Zacks Rank and Stock Suggestions

Goodyear currently holds a Zacks Rank of #3 (Hold).

For investors seeking alternatives, consider stocks in the automotive sector that are performing well, such as Dorman Products, Inc. (DORM), Tesla, Inc. (TSLA), and BYD Company Limited (BYDDY), all rated #1 (Strong Buy) by Zacks. A complete list of today’s #1 Rank stocks can be found here.

The Zacks Consensus Estimate projects that DORM will experience a year-over-year sales growth of 3.66% and earnings growth of 51.98% in 2024. The EPS estimates for the next two years have increased by 25 cents and 21 cents, respectively, over the past week.

Similarly, TSLA’s 2024 sales are expected to grow by 2.94%, with recent EPS revisions showing improvements of 20 cents for 2024 and 13 cents for 2025 over the past month.

Lastly, BYDDY is forecasted to see sales and earnings growth of 23.61% and 31.51%, respectively, in 2024, with EPS estimates rising by 23 cents and 26 cents in the past week.

Explore Clean Energy Stocks with Great Potential

Energy plays a crucial role in our economy, representing a multi-trillion dollar industry that has birthed many of the world’s largest companies.

Cutting-edge technologies are increasingly pushing clean energy options like solar power and hydrogen fuel cells to the forefront, drawing significant investment across these sectors.

Emerging leaders in clean energy stocks may present some of the most promising investment opportunities.

Download “Nuclear to Solar: 5 Stocks Powering the Future” for Zacks’ top picks at no cost.

For the latest recommendations from Zacks Investment Research, you can also access “5 Stocks Set to Double” free of charge.

The Goodyear Tire & Rubber Company (GT): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Dorman Products, Inc. (DORM): Free Stock Analysis Report

BYD Company Limited (BYDDY): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.