Google’s Upcoming Earnings: What Investors Should Know

Alphabet Inc. (GOOGL) is set to announce its third-quarter earnings on Tuesday, October 29th, after market hours. Here’s what you need to be aware of ahead of the report:

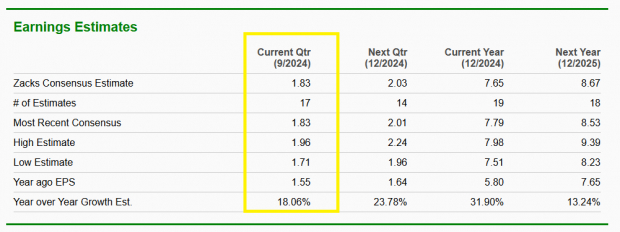

What Wall Street Expects

According to Zacks Investment Research, Wall Street analysts anticipate Google will report earnings of $1.83 per share for the third quarter, marking an impressive growth of 18.06% from the previous year. Overall sales projections stand at $72.85 billion, which is a 13.73% increase year-over-year.

Image Source: Zacks Investment Research

Predicted Stock Price Movement

The options market currently suggests that GOOGL could move up or down by around 6% following the earnings announcement.

History of Stock Responses Post-Earnings

Over the last five quarters, Google’s stock has experienced declines in three of those sessions after earnings reports. Here are the past returns:

· -5.04%

· +10.22%

· -7.50%

· -9.51%

· +5.78%

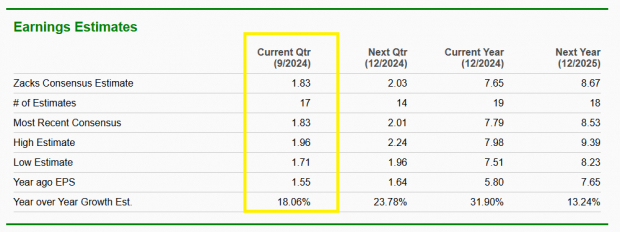

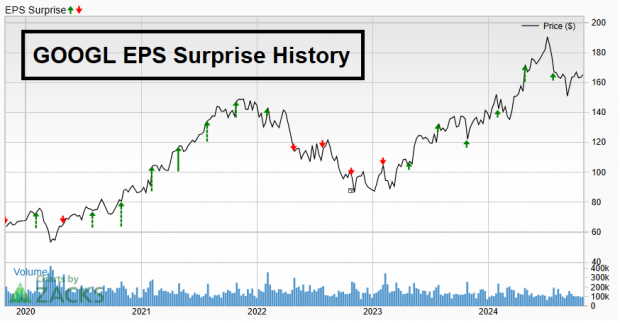

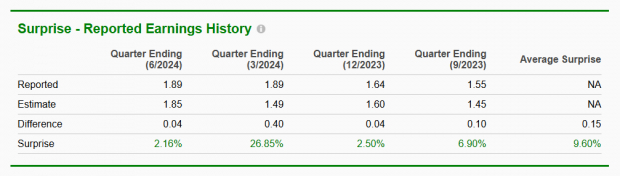

Earnings Surprises: A Trend?

Alphabet has consistently beaten Zacks Consensus Estimates in 14 out of its last 20 quarters.

Image Source: Zacks Investment Research

On average, the company has outperformed estimates by 9.60% over the past four quarters.

Image Source: Zacks Investment Research

Valuation Insights

Google’s stock remains relatively undervalued, trading at a price-to-earnings ratio of 23.71x. Historically, its P/E ratio has fluctuated between approximately 17x and 37x.

Image Source: Zacks Investment Research

In comparison, Google is currently the most affordable option among the “Magnificent 7” companies, which also include Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Nvidia (NVDA), Tesla (TSLA), and Meta Platforms (META).

Key Technical Levels to Monitor

Here are some important price levels for GOOGL before the earnings report:

· Shares are currently above their 200-day moving average, which is about 3.4% lower at $161.29.

· The swing low for Google is $147.22.

· Short-term resistance is identified at $169.16.

· There is an unclosed price gap at $183.61, while all-time highs are marked at $191.75.

The current price patterns suggest that GOOGL may experience volatility beyond the implied market movement, as contractions typically lead to significant expansions.

Image Source: TradingView

Three Key Factors to Monitor

Investors should keep an eye on the following during the earnings call:

1. Cloud:

“`html

Google Cloud Shines Amidst Competitive Landscape

Strong Cloud Revenue Fuels Growth

Google’s Cloud business is proving to be a crucial growth engine for the tech giant. In Q2, the company generated over $10 billion in cloud revenues, making up roughly 12% of its total revenues. This marks a significant 28.8% increase compared to the same period last year, highlighting the Cloud as a primary focus for expansion.

Generative AI: A Major Focus

Google is pushing ahead with its generative AI initiatives through the development of its Gemini large language model. Analysts on Wall Street anticipate that Google’s AI business could grow robustly, projecting a compound annual growth rate (CAGR) of about 50% through 2030.

Concerns About Search Revenue

While Google’s search business continues to be a significant contributor to overall ad revenues, some skeptics worry that AI advancements might disrupt this sector. Critics argue that ongoing AI developments could potentially reduce profit margins. However, as of now, there is no substantial evidence to support this claim.

What Not to Expect

The ongoing legal scrutiny from the Department of Justice (DOJ) regarding monopolistic practices affecting Alphabet is not anticipated to impact discussions around the company. This legal battle continues to unfold, keeping the focus on business operations.

Access Zacks’ Recommendations for Just $1

This isn’t a gimmick.

Years ago, we offered our members 30-day access to all our investment picks for just $1, with no obligation to continue. Many have taken advantage of this offer, while others remained skeptical. Our aim is to familiarize you with services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which achieved 228 positions with impressive double- and triple-digit gains in 2023 alone.

Curious about the latest stock advice from Zacks Investment Research? You can download 5 Stocks Set to Double for free by clicking here.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

“`