Alphabet Inc. (NASDAQ:GOOG) aka Google reported much-anticipated results for its fourth quarter on Tuesday, January 30th, beating the Street’s profit estimate.

Google once again demonstrated a robust advertising business, with 13% sales growth in the search unit in the fourth quarter. However, ad sales falling short of the Street’s expectations triggered a 6% stock plunge after Q4 2023 earnings.

Despite the market’s response, it’s clear that Google is experiencing robust growth in ad sales and strength in cloud, making its stock an interesting option and presenting a potential buying opportunity following the recent correction.

Reaffirmed Confidence in Google Stock

Following Google’s Q3 2023 results, the stock’s price weakness justified a Buy stock classification in my view. The accelerating growth momentum in search indicates a strong corporate sector and consumer base.

Add to that the fact that Google is generating significant free cash flow, or FCF, which underpins its value proposition.

Market Overreacted to Google’s Fourth Quarter Results

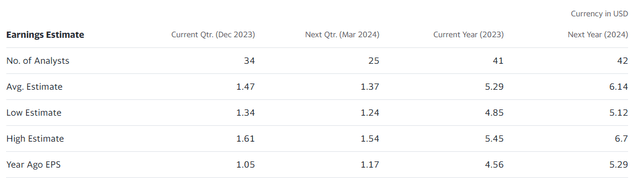

Google outperformed the Street’s profit estimates for the fourth quarter with $1.64 per share in profits, surpassing the anticipated $1.59. The company consistently beat profit expectations throughout 2023 in terms of EPS.

Although Google disappointed the market with ad sales, its overall performance in 2023 was impressive.

Impressive Advertising Strength and Cloud Growth

Having suffered from an advertising market downturn in 2022, Google has clearly turned the tide. The search unit’s $48.0 billion in sales in the fourth quarter represented a 12.7% YoY growth, the fourth consecutive quarter of sales growth in search. Furthermore, cloud-related sales grew by 25.7% YoY, showcasing substantial improvement over Q3 2023.

The 6% price plunge after earnings seems unjustified in light of Google’s double-digit growth momentum across all major business lines, including search, YouTube, and cloud.

Technical Support for a Buying Opportunity

The GOOG technical setup remains positive, despite the recent 6% price plunge. The market has recognized and rewarded Google’s gradually recovering strength in the advertising business, as reflected in the surge above the 50-day moving average line. This correction presents a buying opportunity, with strong support expected at the 50-day moving average line at $140.55.

Reasons to Buy the Dip: A Discounted Deal After Q4

Besides the growth momentum in Google’s fast-growing units, search and cloud, the stock is attractively priced at an earnings multiple of 23.5x, down from 25.0x. Analysts project $6.14 per share in profits this year, reflecting only 6% YoY profit growth. However, given the recovery trends in Google’s search business, a more sensible growth assumption would be 10-15% YoY, which would result in estimated profits of $6.38-6.67 per share in 2024, potentially translating to a “real” earnings multiple of only 22.0x.

The Underestimated Potential: Google’s 2023 Earnings Report

When Google released its Q3 2023 earnings report, the stock market barely seemed to blink. However, underneath this seemingly routine financial event lays a treasure trove of overlooked data. Rather than focusing solely on Google’s ad sales, one ought to consider the substantial underlying free cash flow and the company’s robust profitability. During Q3 2023, Google generated an impressive $7.9 billion in free cash flow, alongside an astounding $20.7 billion in total profits for Q4 2023. These figures tell a story of immense strength, often obscured by the overshadowing presence of ad revenue.

The Unseen Risks in Plain View

Although the future appears bright, it would be remiss to ignore the potential pitfalls that Google must navigate. The company’s reliance on advertising sales, while historically lucrative, poses a significant risk. In an economy where corporate and consumer spending might contract, Google’s ad sales could be dealt a double blow, as they are intricately linked to shifts in consumer spending. Furthermore, the company’s venture into cloud services, although promising, is heavily reliant on corporate spending, making it susceptible to this same contraction.

A Fresh Perspective on Market Behavior

Amidst the enticing figures of Google’s financial report, the market’s reaction seemed disproportionately muted. The stellar performance of Google’s search and cloud divisions during the fourth quarter, and its continued expansion, were seemingly eclipsed by a shortfall in ad sales that didn’t quite meet the Street’s estimates.

While the market, focusing on quarterly returns, may have missed the forest for the trees, it is important not to underestimate the significance of Google’s foundational growth. The search segment’s robust 13% year-on-year sales growth, in particular, stands as a testament to the enduring value of Google’s offerings. Looking forward, the projected increase in digital advertising spending for 2024 sets a positive tone for sales growth, supplementing the notion that the market’s conservative 6% year-on-year growth in earnings per share may, in fact, prove to be a cautious underestimation.

Reflecting on the market’s response, one might discern an opportunity where others see disappointment. While the market may have miscalculated Google’s fourth quarter, the reality of its strong performance remains incontrovertible. Thus, any short-term downturn is less a cause for concern than a golden opportunity for discerning investors to bolster their position in this enduring behemoth.