Investing, a realm historically inaccessible to the common man, has seen a transformation. What if you had a mere $500? Enter compounding – a force to be reckoned with over time. Yet, with a modest starting investment, where should one turn to sow the seeds? Look no further than an index fund – a collective of individual stocks unified under one symbol, designed to mirror a market index.

The Vanguard S&P 500 ETF (NYSEMKT: VOO) is your golden ticket to the world of stock markets. Why should investors consider parking at least their inaugural $500 in this bedrock index fund? Here are three compelling reasons.

1. The Buffett Stamp of Approval

Warren Buffett, the titan of stock pickers and Berkshire Hathaway’s esteemed CEO, oversees a colossal $365 billion stock portfolio comprising numerous companies. Despite his unmatched prowess, Buffett harbors only two index funds in his troves. Coincidentally, both trail the S&P 500, a deliberate choice elucidated by Buffett himself. At Berkshire’s 2020 shareholder conclave, he extolled the virtues of owning an S&P 500 index fund as the quintessential move for most investors. Notably, one of the endorsed index funds is the Vanguard S&P 500 ETF.

2. The Pinnacle Index Tracker

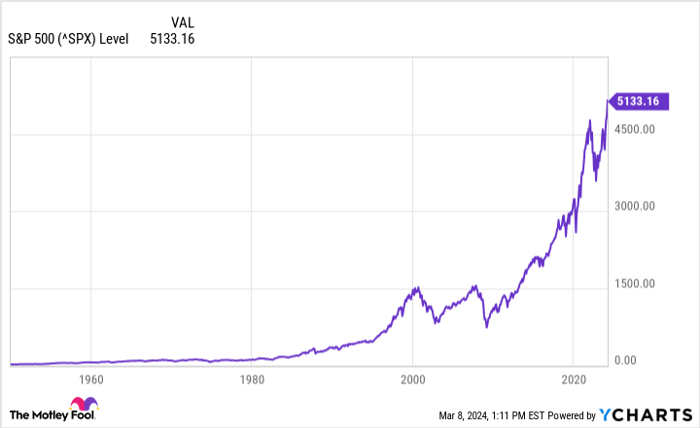

Buffett’s veneration for the S&P 500 is deeply rooted in logic. This index encapsulates around 500 of America’s most prominent corporations. Enshrined in the world’s largest economy, a company’s inclusion in the S&P 500 clasps a laurel of prestige, denoting membership in the cream of the business crop globally. Granted, markets can be tempestuous, reflecting the prevailing buyer-seller sentiments. Nevertheless, over the long haul, the S&P 500 perennially rebounds, scaling new zeniths. Today is no exception, with the index perched at historic highs.

A dalliance with the Vanguard S&P 500 ETF latches your fortunes to this financial juggernaut, demanding a paltry fee in return. Cognizant of operational costs, all funds levy an expense ratio. However, this fund’s ratio sits at a negligible 0.03%, barely a fraction of a cent off your $500 investment.

3. Instant Diversification, a Stroke of Genius

The Vanguard S&P 500 ETF’s pièce de résistance? Instant diversification. With a meager $500, purchasing numerous stocks remains a mirage. However, one share of this fund instantly exposes you to every S&P 500 constituent. You acquire a minuscule stake in the enigmatic “Magnificent Seven” and hundreds more!

The allure of pinning your $500 on a single stock might be strong. Yet, envision the scenario where that solitary company falters. Since its inception, the S&P 500 has demonstrated resilience. Barring an apocalyptic economic debacle, it promises to endure a decade, two, or even five hence. Your $500 shall labor tirelessly for you during this span. Nowhere else will you unearth a more judicious employment for your $500 than in the Vanguard S&P 500 ETF.

Wrestling with the decision of investing $1,000 in Vanguard S&P 500 ETF? Before plunging in, ponder this:

The Motley Fool Stock Advisor analysts recently unveiled their preferred 10 stocks for prospective investors, with Vanguard S&P 500 ETF not making the cut. These 10 selections are poised to yield substantial returns in the looming years. Stock Advisor equips investors with a blueprint for triumph, featuring portfolio-building counsel, regular analyst updates, and bimonthly stock tips. Since 2002, the Stock Advisor service has eclipsed the S&P 500 returns thricefold.

Now is the time to scrutinize those 10 chosen stocks.

*Stock Advisor returns as of March 11, 2024

Justin Pope has no vested interest in any of the enumerated stocks. The Motley Fool endorses and holds positions in Berkshire Hathaway and Vanguard S&P 500 ETF, with robust disclosure principles.

The sentiments expressed belong to the author and do not necessarily mirror Nasdaq, Inc.’s outlooks.