The government, which came to power in a coup last July, rules the continent’s biggest uranium producer after Namibia and has a 20% stake in Madaouela. There’s a risk the junta could revoke GoviEx’s mining permit, the company said on Friday.

“The company is committed to developing the project and is working with the Niger government towards a mutually beneficial solution that complies with applicable law and protects the company’s rights,” it said in a release. “While there is no guarantee of the outcome of these discussions, GoviEx is committed to exploring all viable options.”

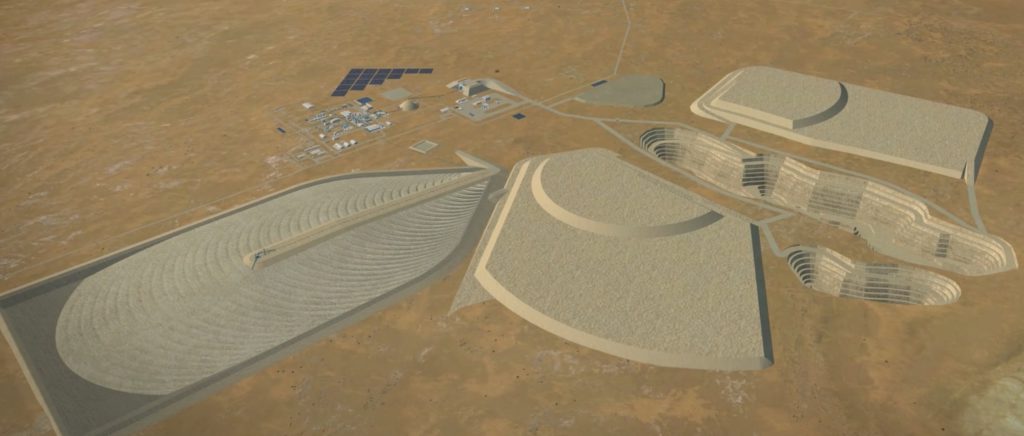

The Vancouver-based company is trying to secure more than $200 million in debt financing for the project estimated to cost $343 million to build. Lenders are conducting due diligence on funding, the company says. It has filed an environmental report required before start-up and begun initial site work such as building an access road. It plans an open pit and underground mine with life of more than 20 years.

Madaouela, with forecast output of nearly 2.7 million lb. a year, could push Niger higher than its current ranking of seventh-largest uranium producer behind Kazakhstan, Canada and Namibia to more than Russia, according to the World Nuclear Association.

Feasibility study

The project hosts proven and probable reserves of 5.4 million tonnes grading 0.87 kg per tonne uranium oxide (U3O8) and 123.1 parts per million molybdenum for 12.3 million lb. U3O8 and 664 tonnes molybdenum, according to a 2022 feasibility study.

Production is forecast at 50.8 million lb. of U3O8 over the life of the mine.

The study used a uranium price of $65 per lb. and a molybdenum price of $11 per lb. for an after-tax net present value (at an 8% discount rate) of $140 million and an internal rate of return of 13.3%. Spot uranium has increased to about $90 per lb. and molybdenum to roughly $20 per lb. since then.

Madaouela has one of the world’s largest resources, GoviEx executive chairman Govind Friedland said.

“The company was able to do this because it cooperated with governments and worked with locals to create a mutually beneficial outcome,” Friedland said in the release. “Our commitment to the country remains and we will use all appropriate means available to us to ensure that we continue to develop the project.”

GoviEx also has the mine-permitted Muntanga uranium project in Zambia where it expects to publish a feasibility study in this year’s second half. In January last year, the company sold its uranium-silver-copper Falea project in Mali to African Energy Metals (TSXV: CUCO) in a C$5.5 million cash-and-share deal.