Limbo: How low can the National Cash Grain Indexes go?

As I ponder the fate of the National Cash Grain Indexes, I am struck by a sense of déjà vu. These indexes seem to be thrilling us with a dance – reminiscent of the Limbo – as they bend over backward, sliding under a lower pole each time. Is this a region of neglect or are we in for a rhythm that leads to lower and lower levels?

Reflecting on Historical Trends

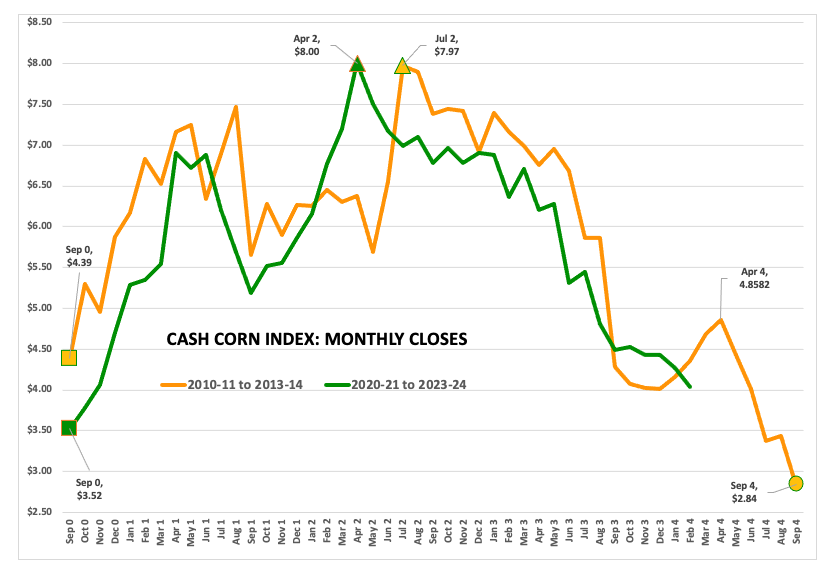

Reflecting on the past, a decade ago, the National Corn Index posted a high monthly close of $7.97 in July 2012 before plunging to a low monthly close of $2.84 in September 2014, marking a staggering 64% decrease. A similar pattern seems to be unfolding this time, with the index dropping from its high of $8.00 in April 2022 to nearly $3.98 as of the latest calculation. This equates to a loss of approximately 50%. Could the NCPI plunge below $3.00? The possibility certainly looms, especially with the market trend decidedly pointing downwards.

A Bearish Outlook

The National Soybean Price Index (NSPI) paints a similarly gloomy picture. In April, the cash index completed a head and shoulder top pattern on its monthly close-only chart, projecting a low monthly close of $10.25. The ongoing trade tensions have relegated the US to a secondary role in the global market, with export upswings primarily driven by weather issues in Brazil. The latest data further reinforces this pessimism, with US export demand on a consistent downward trajectory, down 19% from the previous marketing year. In this scenario, the intrinsic value of the soybean market appears undeniably bearish.

The Plight of HRW Wheat

The National HRW Wheat Index seems to be facing its own set of challenges, with its lowest pricing observed since December 2020. The available stocks-to-use ratio stands at 42.6%, a figure echoing the lowest month-end price and highest available stocks-to-use since November 2020. With the market shifting its focus to new-crop prospects, the prevailing bearish basis presents a daunting outlook for HRW wheat.

Hope on the Horizon?

Despite the prevailing grim sentiment, there is a glimmer of hope. Noncommercial traders holding net-short futures positions offer a flicker of optimism. Should this cohort opt to cover some of these positions, it could potentially catalyze a rally in the futures markets, exerting an upward pull on the cash indexes.

As we navigate these tumultuous waters, it’s essential to keep a keen eye on the trends and potential triggers that could upend the prevailing bearish sentiment and, perchance, breathe some life back into these somber grain markets.

More Grain News from Barchart

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.