Reports indicate that the first wave approval process for numerous spot Bitcoin ETFs is in its conclusive stages at the SEC. This development is widely anticipated and could significantly impact the cryptocurrency market, as well as related assets. The approval is expected to have a profound effect on assets such as Grayscale Bitcoin Trust (GBTC).

The Road to Approval

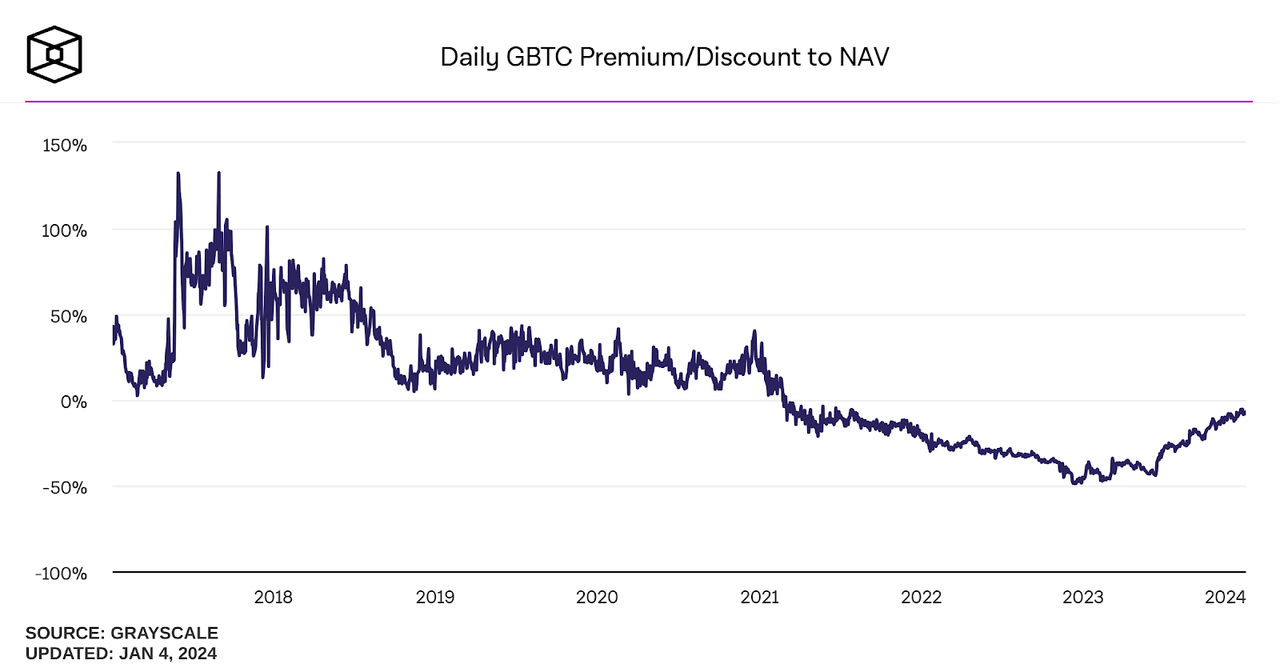

Grayscale Bitcoin Trust (GBTC) has seen its discount to net asset value (“NAV”) narrow as the cryptocurrency market sentiments improved over the past year. This trend is expected to continue as the timeline for a spot Bitcoin ETF approval draws near. The narrowing discount is fueled by anticipation of approval for the conversion of the GBTC fund to a spot Bitcoin ETF.

There are two potential scenarios that could unfold after the approval process – one if GBTC gets approval to convert to a spot ETF, and another if it doesn’t. In the former case, GBTC’s price is likely to narrow out the current discount and align with NAV, providing arbitrage gains to GBTC holders. Conversely, if GBTC doesn’t get approval, its discount to NAV could widen, resulting in a lower market price for GBTC shares.

There is also the concern that if other ETFs get approved before GBTC, the perception of GBTC’s closed-end structure might become less desirable, leading to a widened discount to NAV and a lower market price for its shares.

In light of these considerations, investors are urged to exercise caution in their exposure to GBTC’s potential premium or discount to NAV as the ETF approvals unfold in the coming days or weeks.

Investor Moves and Considerations

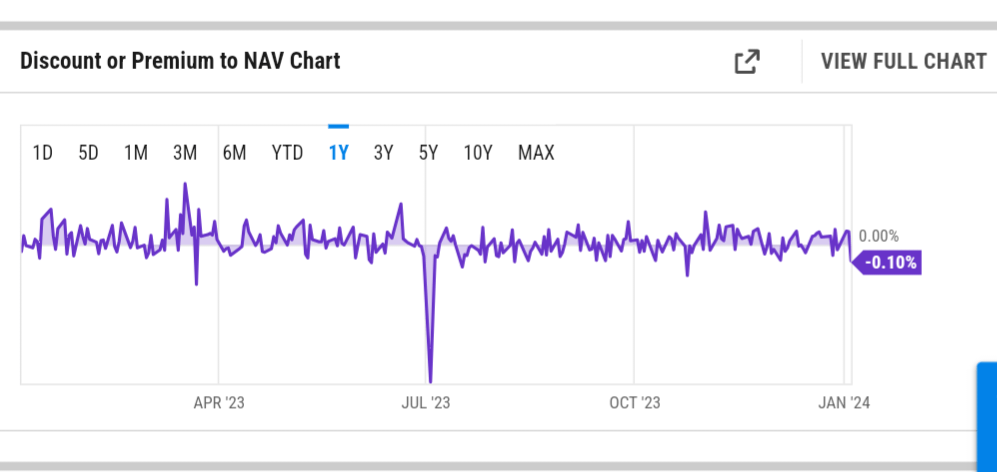

ARK Invest’s recent decision to sell its entire remaining GBTC holding and purchase ProShares Bitcoin Strategy ETF (BITO) shares signals a shift towards risk mitigation. BITO currently maintains a slight premium or discount to NAV due to its utilization of Bitcoin futures contracts, providing a level of risk management compared to holding GBTC.

Should approval for the conversion of GBTC to a spot Bitcoin ETF materialize, it raises the question of what early-mover advantage it will have over other ETFs. One potentially differentiating factor to consider is the expense ratio and fees, integral components of the ETF structures. Notably, Grayscale has not yet disclosed its ETF fee structure.

It is important to note that the assets discussed in this article do not trade on a major U.S. exchange, and investors should be aware of the associated risks.