In a recent trading desk note, Marcus Garvey, head of Macquarie commodities strategy based in Singapore, and a team of analysts, brought forth compelling evidence of the industrial commodity sector’s revival.

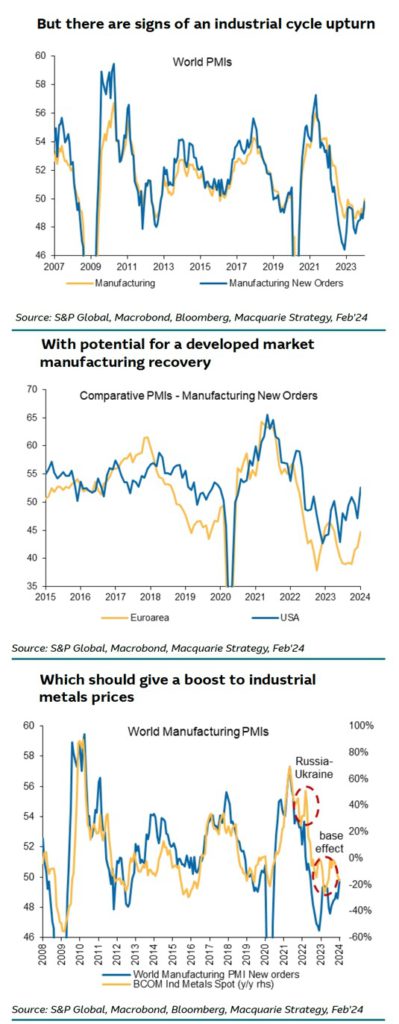

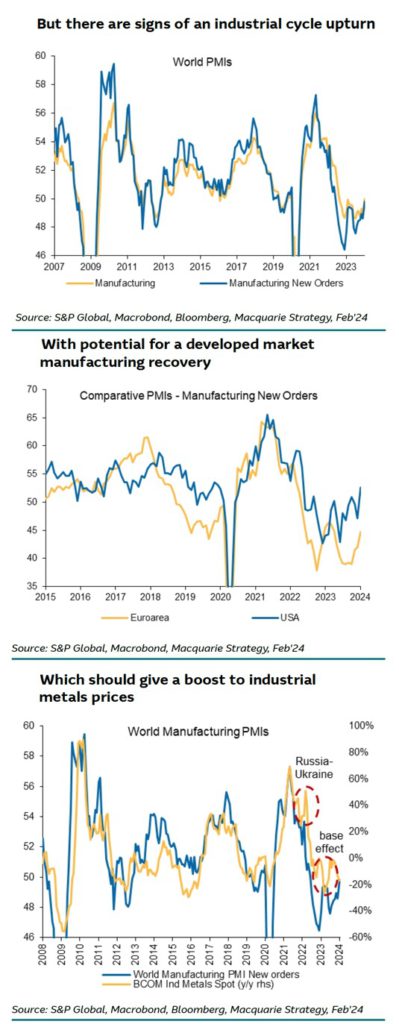

According to the note, the full set of PMIs for January, particularly the world manufacturing new orders which saw a 1.2pp increase to 49.8, marks a potential turning point for the global industrial cycle, bearing bullish implications for industrial commodities demand.

Furthermore, expectations of a smaller reduction in US interest rates this year, as opposed to previous estimates, have bolstered the dollar and exerted downward pressure on metal prices – a relationship that typically moves in opposite directions.

Despite the above, Macquarie pointed out that “commodity prices have a far more consistent relationship with global growth than with FX.”

The investment bank also underscored the increasing US goods demand, which it views as “reaccelerating,” albeit from a higher base. Additionally, Macquarie noted the potential for a developed market manufacturing recovery and a restocking cycle in Europe.

While China has refrained from broad-based economic stimulus thus far, the note highlighted the remarkable strength shown in fixed asset investment in infrastructure, particularly led by renewables, and certain sectors, including autos, notably electric cars.

“Ultimately, if commodity prices are lifted by a pick-up in global industrial production, the implications for goods inflation may become self-inhibiting, by reducing the scope for further central bank easing,” Macquarie stated.

Consequently, they advised, “But that is an ex-post problem, not an ex-ante one, suggesting to us that dips should now be bought.”

Macquarie concluded that “Selectively at least, in those markets where fundamentals are already relatively tight or have the potential to tighten quickly. Especially if positioning gets short.”