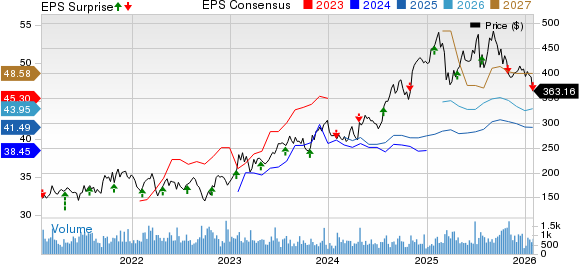

Group 1 Automotive (GPI) reported a fourth-quarter 2025 adjusted earnings per share (EPS) of $8.49, a 15.3% decline from $10.02 year-over-year, and below the Zacks Consensus Estimate of $9.36. The automotive retailer’s net sales were $5.58 billion, missing expectations of $5.66 billion but improving from $5.50 billion in the prior year.

New vehicle retail sales totaled $2.77 billion, down 3.2% from the previous year, with 55,035 units sold—a 5% year-over-year decrease. Conversely, used-vehicle retail sales increased by 5.2% to $1.74 billion, with 55,474 units sold. Total debt rose to $3.70 billion from $2.91 billion over the year. As of December 31, 2025, the company had $32.5 million in cash and equivalents, a decline from $34.4 million a year prior.

In the U.S. segment, revenues increased by 0.4% to $4.25 billion but gross profit dropped by 0.7% to $691.2 million. The U.K. segment saw revenues rise by 1.4% to $1.33 billion with a slight gross profit decline of 0.1%. The company also repurchased 755,792 shares at an average price of $403.60, totaling $305 million.