Is Bitcoin a Safe Haven as Recession Risks Grow?

Wall Street’s recession signals are becoming increasingly loud. As traditional markets prepare for potential downturns, Bitcoin (BTC/USD) has seen a robust rally, prompting investors to question whether this cryptocurrency is the new “digital gold” or merely a fad with clever marketing.

Rising Recession Probabilities

Forecasts for a recession in the U.S. are escalating sharply. In just a few days, JPMorgan increased its recession probability estimate from 40% to 60%. Similarly, S&P Global raised its estimate from 25% to 35%. Notably, Goldman Sachs and HSBC now anticipate a 35%–40% chance of a recession.

Related: JPMorgan Raises Recession Risk to 60% Amidst Historic Tax Hikes

James Toledano, COO of Unity Wallet, highlights the seriousness of the situation: “Economic growth is expected to stall between 0.1% and 1%. Many believe these risks are already reflected in equity prices, but I remain skeptical that we’ve bottomed out.”

Investment Strategies in a Downturn

For those looking to navigate a potential recession, products like the Direxion Daily S&P 500 Bear 3X Shares (SPXS) or the Direxion Daily Total Bond Market Bear 1X Shares (SAGG) may provide means to hedge against downturns in equities and bonds. Conversely, investors may find safer havens in sectors like utilities and consumer staples via the Utilities Select Sector SPDR ETF (XLU) or the Consumer Staples Select Sector SPDR Fund (XLP), which might outperform in these turbulent times.

Bitcoin’s Performance and Market Sentiment

Amid these economic concerns, Bitcoin is showing resilience, gaining over 25% in the last six months and staying just below $86,000, although it hasn’t yet managed to break that psychological barrier.

Toledano commented, “Bitcoin’s appeal as a decentralized asset is growing, particularly in light of volatility in traditional markets. The current macroeconomic uncertainty may paradoxically support Bitcoin’s surge, despite elevated risks across all market sectors, including crypto.”

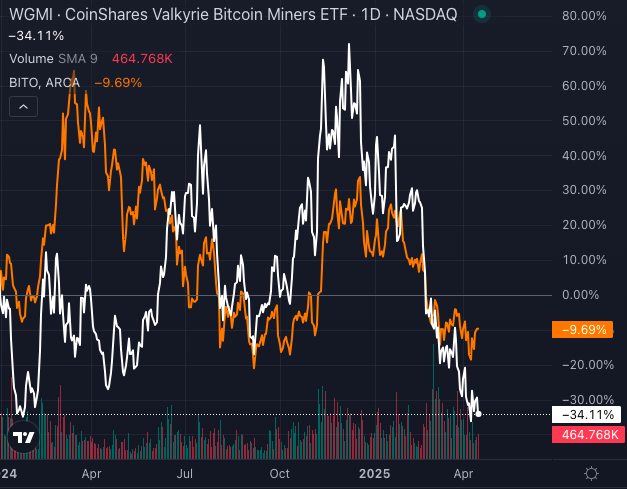

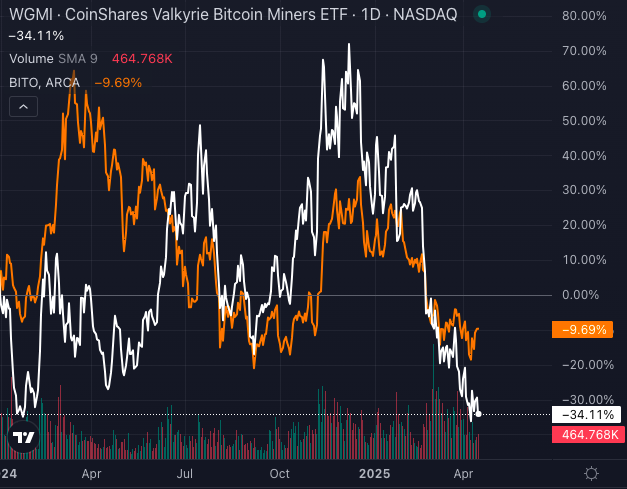

Chart created using Benzinga Pro

Future Outlook for Retail Investors

As recession fears mount, the decision for retail investors remains: will they hold onto Bitcoin or succumb to panic? For those betting on Bitcoin’s continued upward momentum, products like the CoinShares Valkyrie Bitcoin Miners ETF (WGMI) or the ProShares Bitcoin Strategy ETF (BITO) offer avenues to engage in the crypto market without needing to manage digital wallets.

Conclusion: A Bold Yet Volatile Bet

As recession probabilities rise and market stability falters, Bitcoin presents an enticing opportunity for some investors. However, it is essential to recognize that volatility is a double-edged sword, affecting gains just as easily as losses.

Read Next:

Photo: Yalcin Sonat via Shutterstock

Market News and Data brought to you by Benzinga APIs