GSK Acquires Pipeline Drug efimosfermin from Boston Pharmaceuticals

GSK plc has announced its agreement to acquire the lead pipeline drug efimosfermin alfa from Boston Pharmaceuticals, a biopharmaceutical company based in Massachusetts.

Efimosfermin is an investigational long-acting version of the FGF21 protein aimed at treating steatotic liver disease (SLD), commonly known as fatty liver disease. Currently, Boston Pharma is evaluating the drug in mid-stage trials for metabolic dysfunction-associated steatohepatitis (MASH), a specific form of SLD. This drug was initially licensed from Novartis (NVS) by Boston Pharma in 2020.

GSK aims to develop efimosfermin to address more advanced stages of SLD, including alcohol-related liver disease (ALD). The company plans to explore its use as a standalone treatment as well as in combination with its investigational siRNA therapeutic, GSK’990, which is also in mid-stage studies for SLD.

The decision to acquire efimosfermin stems from promising mid-stage data demonstrating its potential to reverse liver fibrosis and halt disease progression in MASH patients. GSK believes the drug could set a new standard of care for MASH, with an option for monthly dosing, anticipating a commercial launch by 2029.

According to the terms of the deal, GSK will pay an upfront fee of $1.2 billion to Boston Pharma. Additionally, Boston Pharma may receive up to $800 million in potential milestone payments. GSK will also be responsible for making success-based milestone payments and tiered royalties to Novartis.

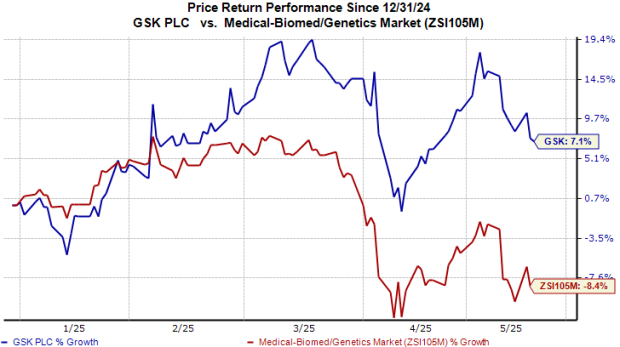

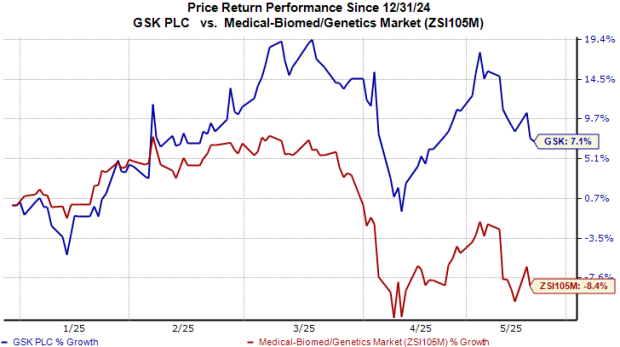

GSK’s Stock Performance

Year-to-date, GSK shares have seen a 7% increase, contrasting with an 8% decline in the industry overall.

Image Source: Zacks Investment Research

GSK’s Strategic Intent

This acquisition reflects GSK’s strategy to expand its pipeline as several key drugs near the end of their exclusivity period, notably the dolutegravir HIV franchise, which will expire around 2028-2029.

Looking ahead, GSK aims to achieve sales exceeding £40 billion by 2031. To reach this goal, the company is focusing on therapeutic areas such as HIV, immunology/respiratory, and oncology. Currently, GSK has 18 candidates in late-stage development or undergoing regulatory review.

This year, GSK intends to launch five new products or line extensions. The FDA has already approved two products — Blujepa (for uncomplicated urinary tract infections) and Penmenvy (a 5-in-1 meningococcal vaccine) — in the first quarter of 2025. Regulatory decisions on the remaining three — Blenrep (relaunch for multiple myeloma), depemokimab (for severe asthma and chronic rhinosinusitis with nasal polyps), and Nucala (for COPD) — are still pending, with final decisions expected throughout 2025.

GSK and iTeos Conclude Anti-TIGIT Development

In a separate announcement, GSK stated that it is terminating the development of belrestotug, an anti-TIGIT antibody, which it had been developing in collaboration with iTeos Therapeutics (ITOS).

This decision follows an interim analysis indicating that the drug did not meet the efficacy criteria for continued development. Consequently, GSK and iTeos will cease all belrestotug-related studies, including a late-stage trial that was actively enrolling participants.

This conclusion represents a setback for GSK’s oncology pipeline, as the company had invested $625 million as an upfront payment to iTeos Therapeutics for the rights to develop this drug in 2021.

GSK PLC Sponsored ADR Price

GSK PLC Sponsored ADR price | GSK PLC Sponsored ADR Quote

GSK’s Zacks Rank

GSK currently holds a Zacks Rank of #2 (Buy).

5 Stocks Set to Double

Each was selected by a Zacks expert as a favorite stock likely to gain 100% or more in 2024.

This article is subject to the views and opinions of the author and may not necessarily reflect those of Nasdaq, Inc.