The Stock Market’s Response to Election Day: What to Expect

As Election Day arrives, many are filled with a mix of anticipation and apprehension. Soon, America will have chosen a new president. But a pressing question lingers: Does the stock market really react to the outcome of elections?

Our answer is simple: not really.

From an economic perspective, a Donald Trump presidency could lead to higher economic growth, but it may also mean increased inflation and interest rates. On the other hand, if Kamala Harris takes office, we might see slower economic growth, accompanied by lower inflation and interest rates.

Regardless of the election outcome, the ongoing AI Boom suggests that stocks will likely continue their upward trend.

Historical trends indicate that stock gains are probable no matter who takes the presidency. Looking at the past, we see clear evidence supporting this perspective.

Market Trends Over 16 Years: A Look Back

Our confidence stands firm that the AI investment boom will persist vigorously, irrespective of who wins the election. Major companies like Nvidia (NVDA), Amazon (AMZN), Apple (AAPL), Alphabet (GOOG), Microsoft (MSFT), and Meta (META) are set to invest billions in developing innovative AI technologies. This trend will likely lead businesses across various sectors to adopt AI solutions rapidly to enhance their productivity.

This adoption of AI is expected to boost revenue, profit margins, and overall profitability. Consequently, this growth is anticipated to drive stock prices higher.

Thus, regardless of the election results, we maintain a positive outlook for stocks leading into 2025.

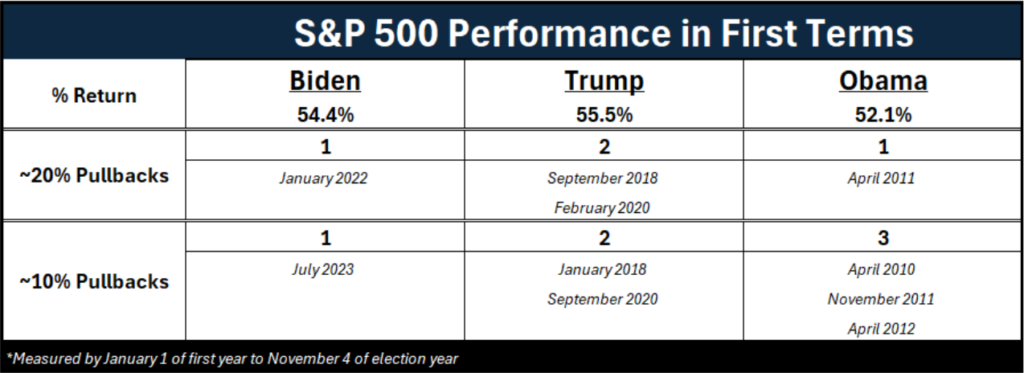

Our data supports this perspective well. Since President Biden took office in January 2021, the S&P 500 has appreciated approximately 54%. During Trump’s term, from January 2017 to November 2020, the S&P 500 increased by around 55%. Under Obama, from January 2009 to November 2012, the index saw a rise of about 52%.

Historically, over the roughly same span of time in these presidencies, the S&P 500’s increases remained strikingly consistent—hovering between 50% and 55%.

Throughout these years, the markets faced notable corrections. Under Biden, there was a significant drop of approximately 20%. Obama experienced a similar scenario, while Trump’s administration contended with two major declines exceeding 20%.

Overall, each presidency had one to two noteworthy corrections of about 20% during this time frame, alongside various pullbacks of around 10%.

Insights from Recent Presidential Terms

The S&P 500 experienced one minor pullback under Biden, two under Trump, and three under Obama. These figures highlight a consistent pattern in stock performance over the past 16 years.

In conclusion, Wall Street has largely remained indifferent to who occupies the White House, suggesting it may not change in the next four years.

We maintain a bullish stance on stocks, particularly due to confidence in AI’s potential to enhance operational efficiency across the economy.

As we closely monitor the upcoming election results, our optimistic outlook on AI stocks remains unchanged. Investing in these stocks might prove beneficial, as they could thrive regardless of the presidential outcome.

Now could be the perfect moment to consider AI stocks for potential gains.

On the date of publication, Luke Lango did not hold any positions in the mentioned securities.

P.S. Stay informed with Luke’s insights on the market by reading our Daily Notes! You can find the latest analysis on your Innovation Investor or Early Stage Investor subscription site.