Analysts See Room for Growth in Goldman Sachs MarketBeta US 1000 Equity ETF

Our analysis at ETF Channel reveals insights into the Goldman Sachs MarketBeta US 1000 Equity ETF (Symbol: GUSA), comparing its current trading price with average analyst expectations for the next year. The weighted average target price for GUSA stands at $57.92 per unit.

GUSA’s Current Position and Potential

Currently trading around $52.80 per unit, GUSA presents a potential upside of 9.70%, according to analysts’ target prices for its underlying holdings. Among these holdings, SiteOne Landscape Supply Inc (Symbol: SITE), Shift4 Payments Inc (Symbol: FOUR), and First Industrial Realty Trust Inc (Symbol: FR) show the most significant upside potential. Notably, SITE’s recent price of $140.20/share has an average target of $155.89/share, indicating an 11.19% increase. Similarly, FOUR’s target price of $114.83/share implies a possible gain of 10.95% from its current price of $103.49. Lastly, analysts expect FR to reach a target price of $57.69/share, which is 10.92% higher than its recent price of $52.01.

Performance Comparison of Key Holdings

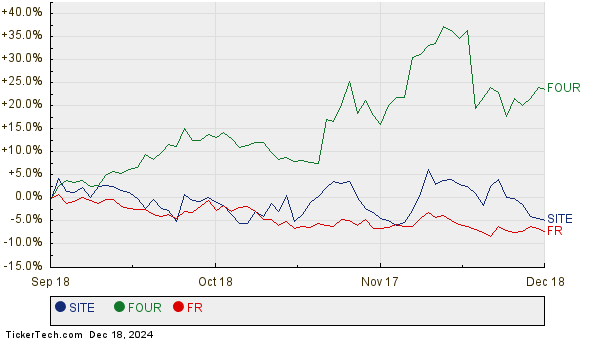

The following chart illustrates the twelve-month price history and stock performance of SITE, FOUR, and FR:

Analyst Target Prices Summary

Here is a summary of the current analyst target prices for GUSA and its top holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Goldman Sachs MarketBeta US 1000 Equity ETF | GUSA | $52.80 | $57.92 | 9.70% |

| SiteOne Landscape Supply Inc | SITE | $140.20 | $155.89 | 11.19% |

| Shift4 Payments Inc | FOUR | $103.49 | $114.83 | 10.95% |

| First Industrial Realty Trust Inc | FR | $52.01 | $57.69 | 10.92% |

The Verdict: Is This Optimism Justified?

Given these insights, it’s worth questioning whether analysts are justified in their price targets or if they might be overly optimistic about these stocks. Are their projections based on solid reasoning, or could they be lagging behind current industry trends? A higher target price compared to the current trading price often signals optimism, but it could also be a precursor to potential downgrades if expectations prove unrealistic. These considerations demand thorough research by investors before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Stocks with Recent Secondaries That Hedge Funds Are Selling

• Funds Holding TRST

• CNX Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.