Goldman Sachs’ GUSA ETF Shows Strong Upside Potential, Analysts Say

In a recent analysis of ETFs at ETF Channel, we investigated the underlying holdings of the Goldman Sachs MarketBeta US 1000 Equity ETF (Symbol: GUSA). The findings reveal that the ETF has an implied target price of $59.10 per unit, based on analysts’ 12-month forecasts for those holdings.

Current Market Position for GUSA

GUSA recently traded at around $52.51 per unit, indicating a 12.55% potential upside according to the average analyst targets of its underlying assets. Noteworthy among these assets are AngloGold Ashanti plc (Symbol: AU), Qiagen NV (Symbol: QGEN), and Elastic NV (Symbol: ESTC), all of which demonstrate significant expected growth relative to their current prices.

Individual Holding Performance

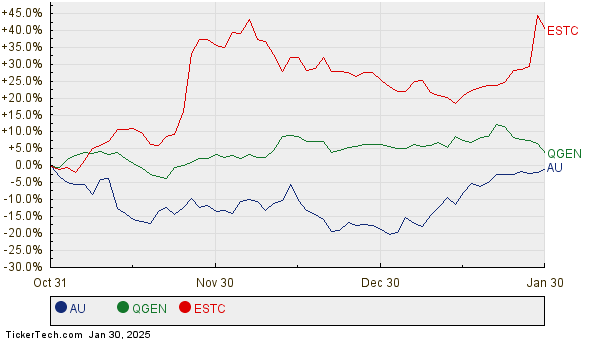

AngloGold Ashanti (AU) is currently priced at $28.48 per share, with analysts projecting a target of $33.25—a potential increase of 16.75%. Similarly, Qiagen (QGEN) stands at $43.77, with an average target of $50.83, suggesting a 16.13% rise. Elastic (ESTC) is trading at $113.29, with a target estimate of $129.04, reflecting an upside of 13.91%. The following chart illustrates the twelve-month performance of AU, QGEN, and ESTC:

Analyst Target Summary

The table below summarizes the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Goldman Sachs MarketBeta US 1000 Equity ETF | GUSA | $52.51 | $59.10 | 12.55% |

| AngloGold Ashanti plc | AU | $28.48 | $33.25 | 16.75% |

| Qiagen NV | QGEN | $43.77 | $50.83 | 16.13% |

| Elastic NV | ESTC | $113.29 | $129.04 | 13.91% |

Investor Considerations

As we assess these targets set by analysts, questions arise. Are the projections based on sound reasoning, or do they reflect overly optimistic views? Such high targets may signify confidence in future performance, yet they can also lead to potential downgrades if targets do not align with market realities. Investors should conduct thorough research to understand these dynamics better.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

FSAC Historical Stock Prices

XGN Videos

PCYG shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.