Halozyme Therapeutics, Inc. HALO reported first-quarter 2024 adjusted earnings of 79 cents per share, which surpassed the Zacks Consensus Estimate of 69 cents. The company had recorded earnings of 47 cents per share in the year-ago period.

Total revenues increased 21% year over year to $195.9 million in the first quarter. The top line was driven by higher royalty payments from J&J JNJ for subcutaneous Darzalex (daratumumab) and Roche RHHBY for Phesgo, as well as increased milestone payments from collaboration partners.

Revenues, however, missed the Zacks Consensus Estimate of $202 million.

Several companies use HALO’s Enhanze technology to develop a subcutaneous formulation of their currently marketed drugs. Halozyme now has six marketed partnered drugs based on this technology, including the subcutaneous formulation of J&J’s Darzalex and Roche’s Phesgo.

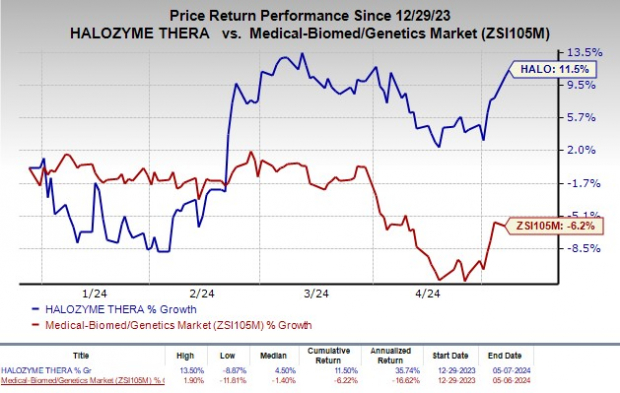

Shares of Halozyme have rallied 11.5% year to date against the industry’s decline of 6.2%.

Image Source: Zacks Investment Research

Quarter in Detail

Halozyme’s top line comprises product sales, royalties and revenues under collaborative agreements.

Royalty revenues totaled $120.6 million in the first quarter, up 21% from the year-ago quarter’s level. This was mainly due to robust demand for Darzalex and Phesgo. Royalty revenues accounted for nearly 61.5% of the company’s total revenues in the reported quarter. Royalty revenues beat our model estimate of $114.3 million.

Product sales came in at $58.6 million, down 3.6% from the year-ago quarter figure. HALO supplies API to ENHANZE partners like JNJ and RHHBY, contributing to revenues as well as higher sales of the proprietary product Xyosted, which was acquired from Antares Pharma in 2022. Product sales missed our model estimate of $71.1 million.

Revenues under collaborative agreements were $16.7 million in the first quarter, up from $1.7 million reported in the year-ago quarter.

Adjusted EBITDA was $115.7 million in the first quarter, reflecting a 55.7% increase from the prior-year quarter.

Halozyme had cash, cash equivalents and marketable securities of $463.5 million as of Mar 31, 2024, compared with $336 million as of Dec 31, 2023.

2024 Guidance

Halozyme reiterated its guidance for 2024 provided earlier this year.

The company still expects total revenues in the range of $915-$985 million in 2024, implying year-over-year growth of 10% to 19% on higher royalty revenue, collaboration revenues and growth in product sales from Xyosted.

Revenues from royalties are anticipated in the range of $500-$525 million.

Adjusted EBITDA is expected in the range of $535-$585 million, implying year-over-year growth of 26% to 37%.

The company expects adjusted earnings in the range of $3.55-$3.90 per share, indicating an improvement of 28% to 41% year over year. Halozyme’s earnings per share guidance does not consider the impact of potential future share repurchases.

In February 2024, Halozyme announced a third share repurchase program to buy back up to $750 million of the company’s common stock.

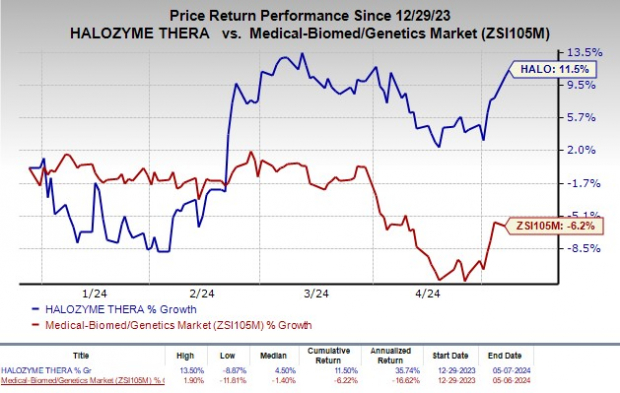

Halozyme Therapeutics, Inc. Price, Consensus and EPS Surprise

Halozyme Therapeutics, Inc. price-consensus-eps-surprise-chart | Halozyme Therapeutics, Inc. Quote

Zacks Rank & Stock to Consider

Halozyme currently has a Zacks Rank #3 (Hold).

A top-ranked stock in the healthcare sector is Ligand Pharmaceuticals Incorporated LGND, sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Ligand’s 2024 earnings per share have improved from $4.42 to $4.56. Year to date, shares of LGND have risen 2.5%.

Earnings of LGND beat estimates in each of the trailing four quarters, the average surprise being 84.81%.

Top 5 Dividend Stocks for Your Retirement

Zacks targets 5 well-established companies with solid fundamentals and a history of raising dividends. More importantly, they have the resources and will to likely pay them in the future.

Click now for a Special Report packed with unconventional wisdom and insights you simply won’t get from your neighborhood financial planner.

See our Top 5 now – the report is FREE >>

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Halozyme Therapeutics, Inc. (HALO) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.