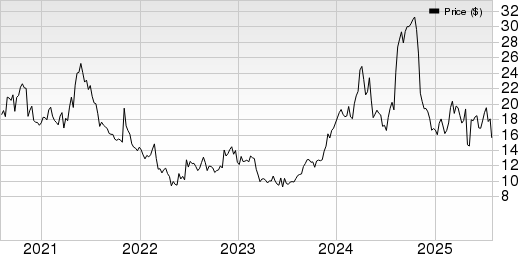

Hamilton Beach Brands Holding Company (HBB) reported a significant 18.2% decline in revenues for Q2 2025, totaling $127.8 million, down from $156.2 million a year prior. The company’s net income decreased to $4.5 million (33 cents per share) from $6 million (42 cents per share). In the same time frame, shares fell 4.5%, contrasting with a 0.1% decline in the S&P 500 index.

Cash flow from operations turned negative, with net cash used reaching $23.8 million in the first half of 2025, compared to a net cash inflow of $37.1 million in the previous year. Increased inventory levels and decreased purchases were primary factors in this downturn. Despite these challenges, management noted a gross margin improvement of 160 basis points to 27.5%.

CEO R. Scott Tidey attributed revenue challenges to higher tariffs (a 145% increase on China exports) causing trade disruptions and retailer uncertainty. Despite these macroeconomic pressures, the company is pursuing strategies to diversify manufacturing and expand its premium product offerings.