The Generous Dividend Announcement

Take heed, investors – Hang Seng Bank Limited – Depositary Receipt () has made a bold move by declaring a hefty $0.41 dividend per share on February 22, 2024. This quarterly payment, totaling $1.64 annually, marks a significant increase from the previous $0.14 per share.

To partake in this dividend windfall, stocks must be acquired before the ex-dividend date of March 5, 2024. Shareholders in the books as of March 6, 2024, can expect to receive this bounty on April 1, 2024.

The Investment Landscape: Fund Sentiment and Price Forecast

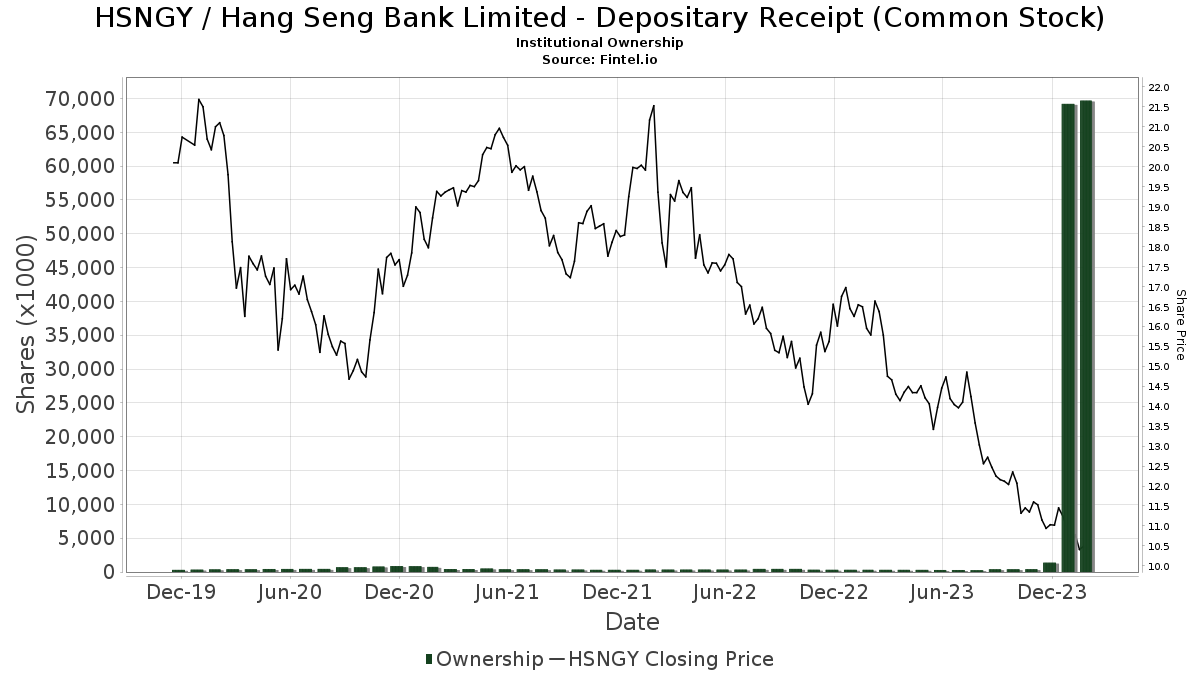

Who’s in on the action? A notable 241 funds or institutions have staked their claim in Hang Seng Bank Limited – Depositary Receipt () – an increase of 2 owners, signaling a subtle upward trend. The average portfolio weight among all funds backing HSNGY is now at 0.12%, showing a modest drop of 12.33%. Cumulatively, institutional shares have surged by 0.33% over the past three months, reaching 69,678K shares.

Looking into the crystal ball, analyst forecasts are painting a rosy picture. With an average one-year price target of 12.93 as of February 24, 2024, the predictions suggest a promising 14.23% rise in the stock value. Projections span from a low of 10.86 to a high-flying $16.02, underlining the potential for growth from the current closing price of 11.32.

Examining Shareholder Actions

What about other stakeholders? In the ecosystem of investors, VGTSX – Vanguard Total International Stock Index Fund Investor Shares stands out by holding 9,860K shares. This prominent player increased its stake by 1.73% in the latest filing. Conversely, EFAV – iShares Edge MSCI Min Vol EAFE ETF slightly decreased its holding by 0.14%, reducing its HSNGY portfolio share by 18.20% over the quarter.

The ebbs and flows continue as VTMGX – Vanguard Developed Markets Index Fund Admiral Shares raised its ownership by 1.21% to 5,804K shares, while FSKLX – Fidelity SAI International Low Volatility Index Fund saw a marginal decrease of 0.25% in its 4,075K shares. Changes in portfolio allocation for these players range from 7.95% to 22.47%, illustrating the dynamic nature of investor sentiment toward Hang Seng Bank Limited – Depositary Receipt ().

Fintel is your trusted companion in the investment arena, offering crucial insights for a variety of stakeholders. Our platform houses a wealth of data, from fundamentals to analyst reports, ensuring you have a complete view of the market landscape. With our exclusive stock picks driven by advanced quantitative models, we pave the way for optimized profits in the tumultuous world of investments.

Indulge in the realm of knowledge and opportunity with Fintel – the ultimate ally for investors, traders, financial advisors, and small hedge funds alike. Seize the moment – click to learn more and embark on your journey to financial success.

This illuminating narrative was originally presented on Fintel.

The thoughts and perspectives expressed here are the author’s own and may not necessarily align with those of Nasdaq, Inc.