Those following the electric vehicle market are likely aware that Tesla (NASDAQ: TSLA) recently showcased robust third-quarter results. The profits surpassed expectations, and the company hinted at continued growth in production. This news drove the stock up by 22% on Thursday, much to investors’ delight.

However, to truly grasp Tesla’s latest performance, one must look beyond the numbers.

Strong Results Signal a New Era

During the third quarter ending in September, Tesla reported $25.2 billion in revenue, translating to earnings of $0.72 per share. Although the revenue was slightly below forecasts, it marked an 8% increase from the same period last year. On the earnings front, the company exceeded forecasts of around $0.60 per share, showing a slight improvement from the previous year’s Q3 earnings. Total deliveries reached 462,890 vehicles, just shy of the projected 463,897, yet still better than the 435,059 delivered in the same quarter last year.

These figures, while impressive, require additional context.

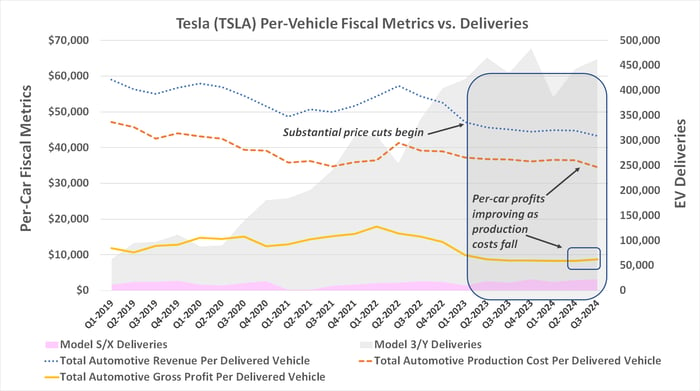

The key to understanding Tesla’s current success lies in its past. Since early 2022, the production and delivery of the lower-priced Model 3 accelerated, accompanied by significant price cuts introduced earlier this year. These factors have previously pressured the company’s profits, as production costs did not decrease proportionally to the price drops.

Now, a shift appears to be underway.

As illustrated below, effective management has resulted in a reduction of production costs to an average of $34,544 per car in Q3. Consequently, Tesla’s gross profit per vehicle rose from $8,269 in Q2 to $8,698 in Q3. This marks the first quarter-to-quarter increase in per-car profitability since early 2022 and comes at a time when the vehicle price cuts were outpaced by reductions in production costs.

Data source: Tesla Inc. Chart by author.

It’s worth noting that the per-vehicle revenue noted above includes regulatory credits and leasing income.

Nevertheless, it appears that Tesla’s automobile division is turning a significant profitability corner. With this new trajectory in sight, investors can feel optimistic about income growth, especially as the company aims to roll out an even lower-priced car. This shift also allows Tesla to justify investing further in production capacity.

A Pivotal Moment for Investors

This is the key takeaway: despite last year’s high costs without much payoff, it now seems that the strategy was beneficial. Production is increasing again, and notably, profits are following suit.

While one strong quarter does not establish a trend, every trend begins with such progress.

Importantly, this is encouraging news for current and potential shareholders. With Chief Executive Officer Elon Musk projecting 20% to 30% growth in unit sales next year, increased profitability alongside expanded production offers a promising outlook for investors who have remained patient.

Invest Wisely with Expert Advice

Listening to insights from our analysis team can prove valuable. For context, Stock Advisor has achieved an impressive average return of 819%—significantly outperforming the S&P 500’s 170% returns.*

The team recently identified what they consider the 10 best stocks to buy currently, with Tesla on the list, but there are also nine other noteworthy stocks to consider.

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.