Finding a good deal in the stock market can be just as satisfying as snagging a prime cut of meat at a discount. But like that $5 steak that tastes like cheap meat, not all bargains are worth it. However, long-term investors may find some true gems lurking on the sale rack. With the market hitting all-time highs, it can be challenging to uncover value. But fear not, here are three absurdly good consumer stocks that are within reach even for those with limited funds to invest.

Amazon: A Prime Cut of Value

Despite galloping up 70% over the past year, e-commerce and cloud company Amazon (NASDAQ: AMZN) still offers tremendous value for discerning investors. Amazon is a rare breed, reinvesting its profits at an unmatched level to drive growth. This strategy has propelled it to become the dominant force in American e-commerce with a 38% market share and the largest cloud platform in the world with a 31% share. Not stopping there, Amazon is venturing into the media space, amassing $47 billion in ad revenue in 2023 and set to stream an exclusive National Football League playoff game next season.

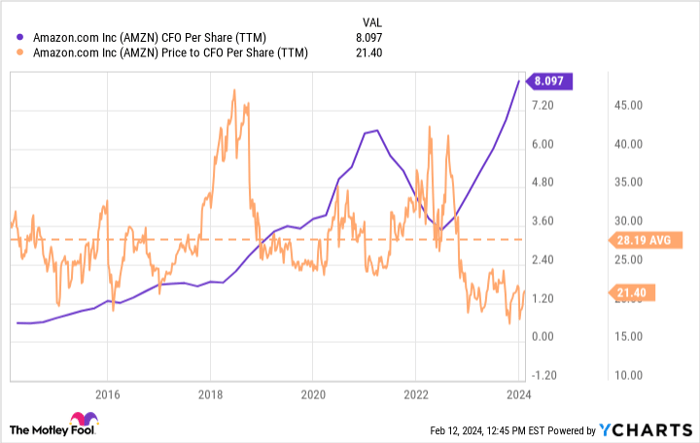

When considering the stock’s price tag, an analysis of the operating cash flow reveals that Amazon is still trading way below its historical levels. Furthermore, the company is now making more money per share than ever before. While the days of Amazon’s meteoric rise may be behind it, this stalwart of the corporate world is too good a company to be trading at such a bargain.

CFO = cash from operations. AMZN CFO Per Share (TTM) data by YCharts

Altria: Smoking Hot Dividends

Despite seeing its share price slide in recent years, tobacco company Altria Group (NYSE: MO) offers long-term investors a value proposition too good to ignore. Its core business of selling smokeable products has remained financially robust, reflected in one of the highest dividend yields in the market at nearly 10%. Supported by a steady profit stream and a sustainable 79% dividend payout ratio, Altria also holds potential in new revenue streams, notably Njoy, a heat-not-burn tobacco device it acquired for $2.75 billion last year. Additionally, Altria boasts ownership of a stake in Anheuser-Busch InBev worth roughly $13 billion, providing further financial flexibility.

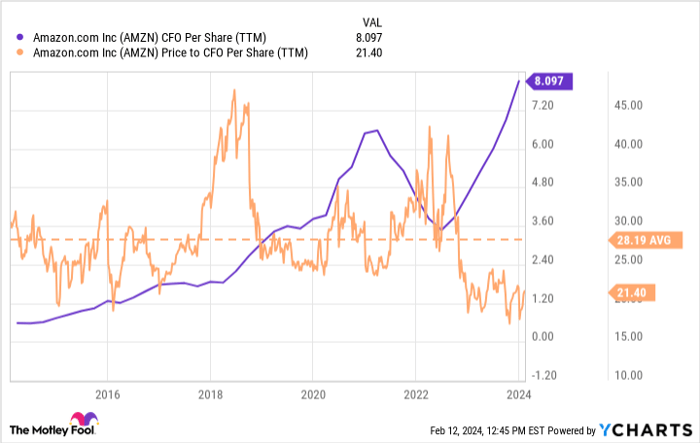

MO PE Ratio (Forward) data by YCharts

While concerns loom over Altria’s cigarette business in the long term, the stock presents an attractive proposition, trading at just 8 times earnings. This favorable valuation offers investors an opportunity to capitalize on the stock’s potential, particularly given the rock-solid nature of its dividends.

Coupang: A Diamond in the Rough

Similar to Amazon, South Korean e-commerce giant Coupang (NYSE: CPNG) is a force to be reckoned with. With a quarter of South Korea’s e-commerce market under its belt, Coupang has gained renown for its exceptional delivery services, offering next-day, and at times, same-day delivery for 99% of orders. In addition to its core e-commerce business, Coupang also provides online grocery delivery, meal delivery, and media and payment services.

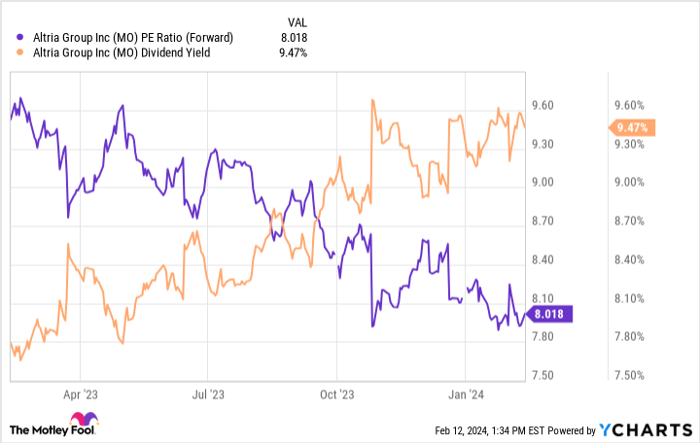

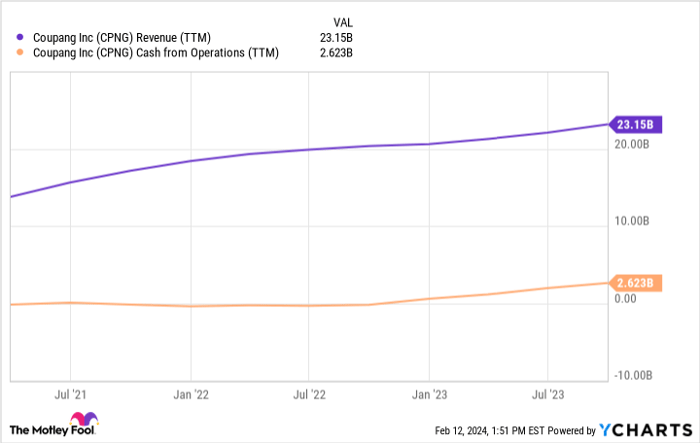

Riding the surge in active customers, which reached 20 million as of the third quarter of last year, Coupang has set its sights on Taiwan, a market boasting an additional 23 million potential customers. Despite losses in non-commerce businesses, the company’s surging operating cash flow signals robust support for its core commerce business.

CPNG Revenue (TTM) data by YCharts

Trading at only 10 times its operating cash flow, just half of Amazon’s valuation by the same measure, Coupang appears severely undervalued. Boasting nearly $5 billion in cash against just over $1 billion in debt and generating $1.8 billion in free cash flow over the past year, Coupang is in a formidable financial position, deserving far more credit than it is currently receiving.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Coupang. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.