The Rising Price Target

The stock market waters are stirring as the price target for Hawaiian Electric Industries (NYSE:HE) experiences a notable surge. The one-year average price target for HE has been refreshed, now standing proudly at $9.01 per share. This vigorous escalation marks a remarkable 17.78% increase from the prior estimate of $7.65, dated January 16, 2024.

These numbers illustrate an exciting shift in the tides, setting the stage for a potentially dynamic period of growth and prosperity for investors in Hawaiian Electric Industries.

Keeping Up with Fund Sentiment

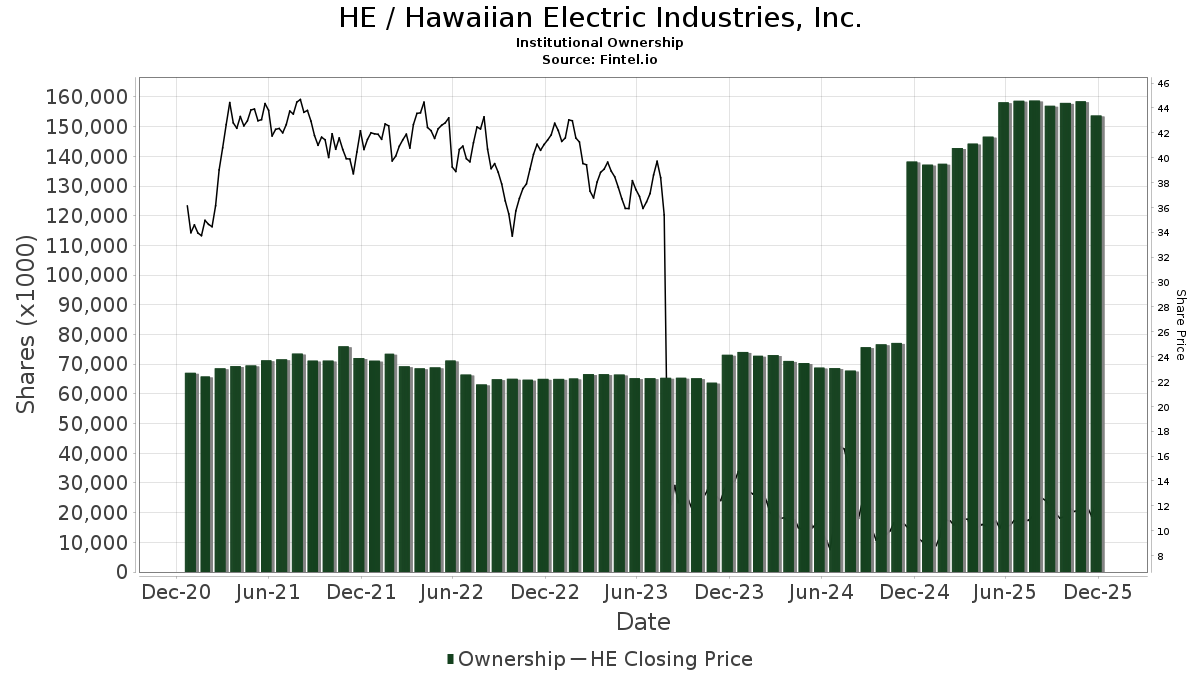

Steering our attention to the fund sentiment surrounding Hawaiian Electric Industries, it’s evident that there are 578 funds or institutions that have reported positions in HE. This denotes a decrease of 16 owners, equating to 2.69% in the last quarter alone. Meanwhile, the average portfolio weight dedicated to HE stands at 0.08%, witnessing a decline of 21.72%.

Despite these fluctuations, there is a notable uptick in the total shares owned by institutions. Over the past three months, there has been a 2.82% surge, with 75,137K shares now under institutional ownership.

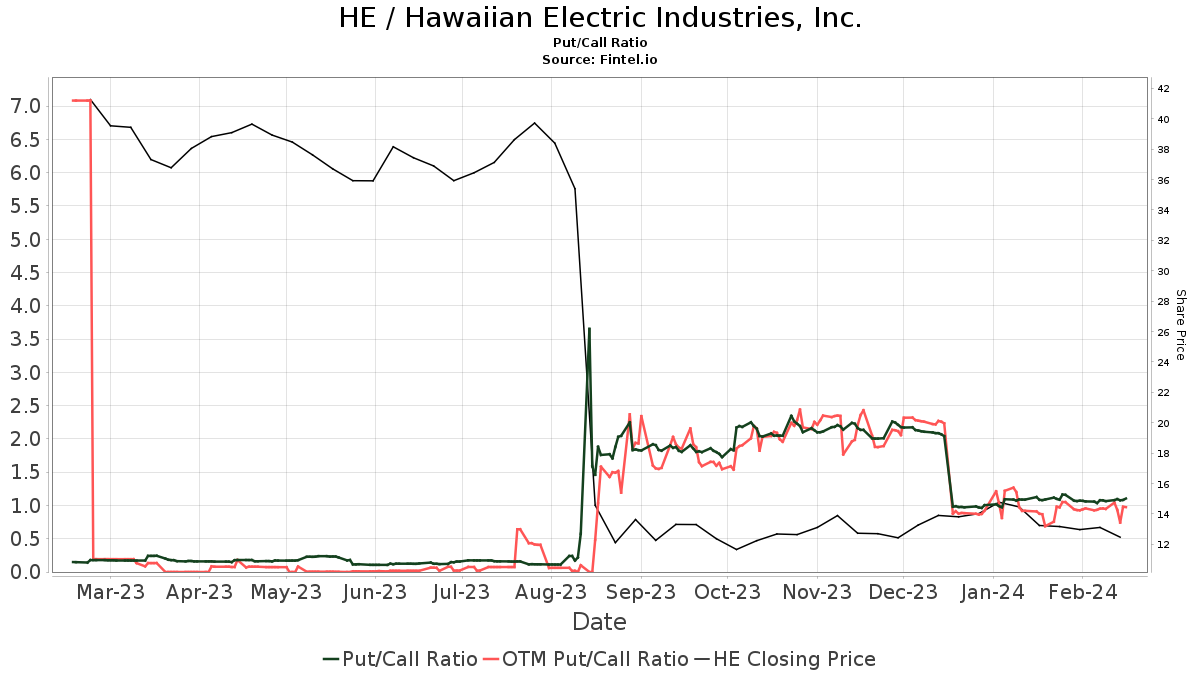

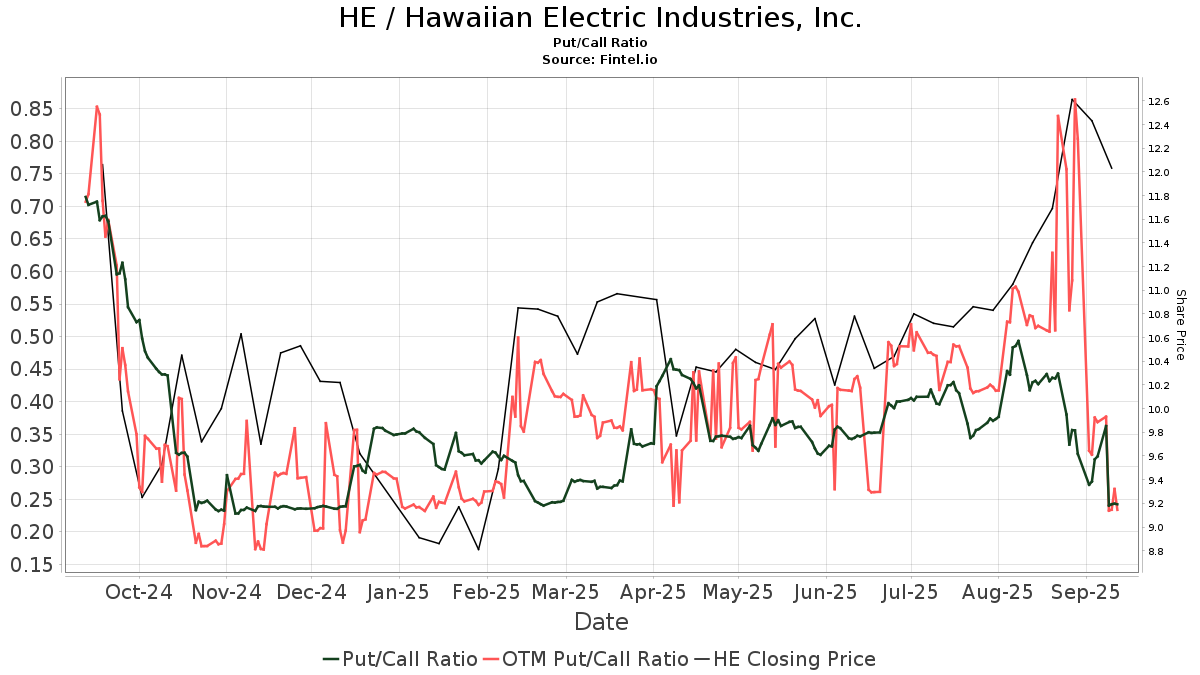

The put/call ratio for HE currently stands at 1.14, painting a picture of a slightly bearish outlook for the future of the stock.

Insights into Shareholder Activity

Delving into the actions of notable players in the market, Aqr Capital Management’s stake in Hawaiian Electric Industries has seen a significant shift. The firm presently holds 4,681K shares, representing 4.25% ownership of the company. This position reflects a decrease of 30.75% as compared to its prior filing.

Similarly, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares and NAESX – Vanguard Small-Cap Index Fund Investor Shares have adjusted their positions in HE, each showcasing fluctuations in ownership and portfolio allocation over the last quarter.

Two Sigma Investments, known for its strategic maneuvers, has decreased its portfolio allocation in HE by 8.57%, a decision that reverberates across the market as investors observe and adapt to the changing landscape.

Two Sigma Advisers, another prominent player, has displayed a nuanced approach by decreasing its ownership of Hawaiian Electric Industries by 2.12% while simultaneously increasing its portfolio allocation by 3.19% over the last quarter.

Hawaiian Electric Industries: Illuminating the Path Forward

Known as the largest electricity provider in the tropical haven of Hawaii, Hawaiian Electric Industries, Inc. radiates vitality, supplying power to 95% of Hawaii’s vivacious population. Through its electric utilities, namely Hawaiian Electric Company, Inc., Hawaii Electric Light Company, Inc., and Maui Electric Company, Limited, HE illuminates the path toward a brighter and more sustainable future.

Fintel: Navigating the Seas of Investment Research

Embark on a voyage with Fintel, your trusty navigator in the vast ocean of investing. Our platform acts as a lighthouse, guiding individual investors, traders, financial advisors, and small hedge funds toward better decision-making and enhanced profits. With an arsenal of data spanning fundamentals, analyst reports, ownership insights, and fund sentiment analysis, Fintel equips you to navigate the choppy waters of the financial world with confidence.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.