In a market buzzing with excitement and record highs, there are still diamonds in the rough waiting to be discovered. As investors eagerly scout for opportunities, these five undervalued stocks are shining bright, presenting a unique chance to capitalize on untapped potential in a time of frenzy.

For those seeking fresh stock ideas in today’s landscape, this curated list offers a promising starting point.

The Unseen Potential of PayPal

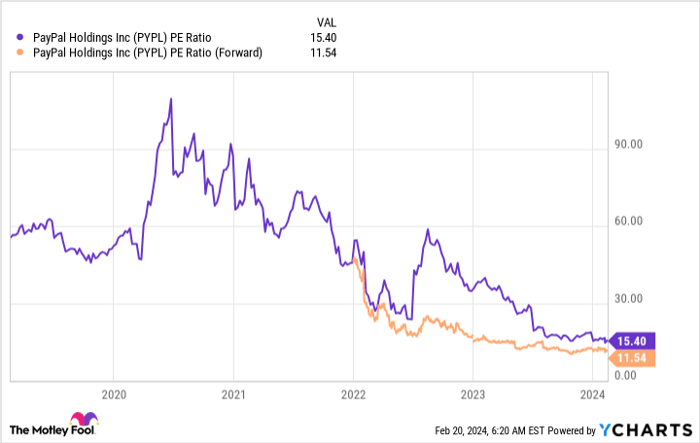

PayPal (NASDAQ: PYPL) stands out as a hidden gem amidst the crowd. Beyond its familiar face as a payment processor, PayPal boasts a diverse product portfolio driving substantial growth. In the fourth quarter, while revenue surged by 9% and earnings per share (EPS) soared by 61% to $1.29, the market sentiment towards PayPal remains surprisingly subdued, pricing it as a stagnant or declining entity.

Trading at a modest 11.5 times forward earnings, PayPal’s stock is a glaring opportunity given its robust business performance and undervalued status.

PYPL PE Ratio data by YCharts

The underestimation of PayPal’s growth potential is a paradox that savvy investors can exploit.

MercadoLibre: Beyond the Amazon Comparison

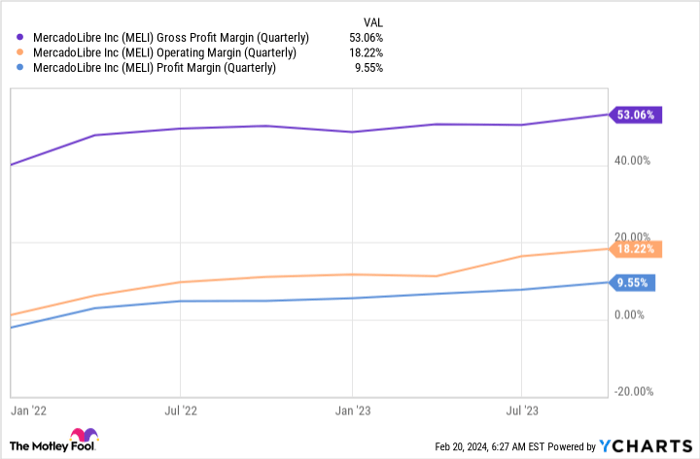

MercadoLibre (NASDAQ: MELI) is often likened to the “Amazon of Latin America,” yet its offerings extend far beyond a mere e-commerce platform. Boasting a robust e-commerce and fintech sector, MercadoLibre has recently witnessed substantial growth. Both its commerce and fintech divisions saw a remarkable revenue uptick of 76% and 61% year over year, respectively, on a currency-neutral basis.

With a gross profit margin trading well below its historical average, MercadoLibre emerges as an enticing investment prospect at around 6.8 times sales.

MELI Gross Profit Margin (Quarterly) data by YCharts

The hidden value in MercadoLibre’s stock showcases the treasure trove awaiting those with a discerning eye.

Airbnb: Defying the Odds

Airbnb (NASDAQ: ABNB) has continuously defied skeptics, weathering storms such as the COVID-19 pandemic, economic downturns, and regulatory challenges. Amidst adversity, Airbnb has consistently demonstrated growth, with its revenue in Q4 surging by 17% year over year.

Trading at an attractive 26 times free cash flow, Airbnb’s stock presents a compelling investment opportunity, especially considering its ambitious stock buyback program worth up to $6 billion.

With prudent management and a flourishing business model, Airbnb’s undervalued stock is ripe for the taking.

dLocal: The Unsung Hero

dLocal (NASDAQ: DLO) operates stealthily in the shadows, providing essential payment processing services for emerging markets such as Indonesia, India, Peru, and Egypt. Servicing major players like Amazon, Nike, and Shopify, dLocal’s revenue soared by 47% year over year in the third quarter, underpinning its rising popularity.

Trading at a modest 21 times forward earnings, dLocal’s astronomical growth potential packaged in an undervalued stock makes it a promising contender for exponential returns.

Visa: The Timeless Performer

The indomitable Visa (NYSE: V), a stalwart in the credit card processing realm, continues to outshine competitors with its unwavering growth trajectory, shareholder-friendly buyback programs, and enhancing profitability. In the fiscal first quarter of 2024, ended Dec. 31, 2023, Visa reported a 9% revenue spike and a 20% increase in EPS year over year.

Trading at a modest 32 times earnings, Visa’s historically low valuation is a rare opportunity for investors seeking stability amidst the volatility of high-growth stocks.

The resilience and consistency of Visa’s performance present a compelling case for long-term investors to capitalize on the current discounted price.

Discovering Hidden Treasures

As the market brims with possibilities, these undervalued growth stocks offer investors a chance to uncover hidden treasures ripe for growth in a sea of exuberance.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions in Airbnb, Amazon, dLocal, MercadoLibre, PayPal, Shopify, and Visa. The Motley Fool positions in and recommends Airbnb, Amazon, MercadoLibre, Nike, PayPal, Shopify, and Visa. The Motley Fool recommends long January 2025 $47.50 calls on Nike and short March 2024 $67.50 calls on PayPal. The Motley Fool maintains a disclosure policy.

The perspectives and opinions shared in this article reflect the thoughts of the author and may not necessarily align with those of Nasdaq, Inc.