Netflix, the streaming juggernaut among FAANG giants, has seen a remarkable evolution since its inception in 1997 when it focused on DVD rentals. Over the years, it deftly pivoted to digital streaming and has become a global entertainment behemoth. With an impressive subscriber base of nearly 260 million, Netflix stands tall as the 24th most visited website worldwide.

The Meteoric Rise YTD

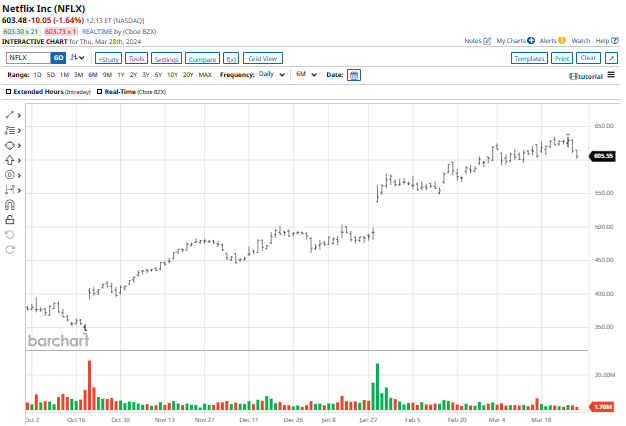

Netflix stock has surged by 24.4% year-to-date, outpacing the broader S&P 500 Index by a substantial margin. Currently trading a mere 4.5% below its 52-week high, Netflix’s trajectory has been nothing short of stellar in recent times.

In its Q4 earnings report released in January, Netflix showcased its financial prowess with a 12.5% year-over-year revenue surge to $8.83 billion. The standout performance was driven by a robust net subscriber growth of 13.1 million, smashing analysts’ predictions by a wide margin.

Analysts’ Divergent Perspectives

Evercore ISI recently upped Netflix’s price target to $640, indicating a potential 5.7% upside. The firm emphasized Netflix’s ability to broaden its user base through innovative subscription models. In contrast, Wedbush, while maintaining an “Outperform” rating, expressed caution about Netflix’s investor appeal in 2024 compared to the previous year.

The Market Consensus

Despite differing opinions, analysts collectively rate Netflix as a “Moderate Buy,” with a mean price target slightly below the current stock price. However, Wedbush’s bullish target of $725, offering a hefty 19.7% premium, underscores the optimism surrounding Netflix’s prospects.

Of the 40 analysts covering Netflix, 22 advocate a “Strong Buy,” reinforcing positive sentiment. While opinions vary, the consensus remains cautiously optimistic about Netflix’s future trajectory.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.