BlackBerry Limited is set to unveil its fourth-quarter fiscal 2024 results on Apr 3.

Analysts are expecting a loss of 3 cents per share, a figure that has remained steady for the last 60 days. Notably, the company posted a loss of 2 cents per share in the corresponding quarter of the previous year.

The most recent quarter saw BlackBerry reporting adjusted earnings per share (EPS) of 1 cent, a significant turnaround from the prior-year quarter’s non-GAAP loss of 5 cents. Total revenues for the quarter were $175 million, modestly higher than the $169 million recorded in the previous quarter. However, the reported revenues fell short of the Zacks Consensus Estimate by 12.2%.

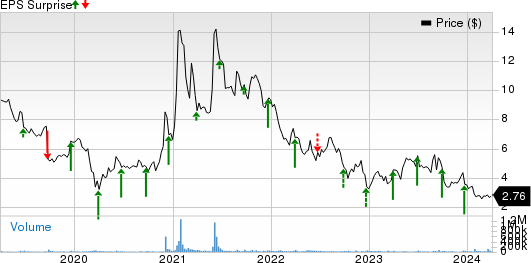

Unveiling BlackBerry Limited’s Price and EPS Surprise

Take a peek at BlackBerry Limited’s price and EPS surprise. | BlackBerry Limited Quote

Exploring Recent Developments

The surge in demand for BlackBerry’s cybersecurity solutions is expected to provide a significant boost. The company’s performance is likely to have been further buoyed by robust activity in the automotive sector, driven by strong demand for solutions in the advanced driver assistance systems market.

The rapid uptake of the QNX platform in the Auto and General Embedded market is a promising development. Notably, sustained success in securing new contracts is anticipated to bolster the QNX royalty backlog.

The company’s management is eyeing total revenues in the range of $150-$159 million for the fiscal fourth quarter.

On the flip side, BlackBerry foresees a dip in fourth-quarter IoT revenues due to UAW labor disputes disrupting production volumes for key customers. Furthermore, setbacks in software programs at major automakers present a significant challenge. The IoT business is now expected to bring in revenues between $62 and $66 million.

For the Cybersecurity business, revenues are estimated to range from $83 to $88 million. Management anticipates a revenue impact stemming from a reassessment of certain large government deals in terms of their likelihood, size, and timing.

Noteworthy Milestones

On Mar 26, 2024, BlackBerry inaugurated a Cybersecurity Center of Excellence in Kuala Lumpur. The facility aims to provide cybersecurity training and cyber threat intelligence to assist Malaysia and its regional partner countries in identifying and mitigating cyber threats against governments.

Moreover, updates on the progress of segregating business divisions were shared by BlackBerry on Feb 13, 2024. The company anticipates annual net profit improvements of $100 million, in addition to the $50 million in annual cost savings previously disclosed. The establishment of dedicated leadership teams for separate entities, along with external consultants aiding in the division process, were highlighted. Management reiterated the revenue outlook for Q4 of fiscal 2024.

BB announced on Jan 10, 2024, that its IVY platform is being leveraged by the Mobility in Harmony Consortium for the advanced development of its next-gen Project X and future passenger and commercial vehicle reference platforms.

Simultaneously, management unveiled the launch of QNX Everywhere to address the rising demand for qualified embedded systems developers globally. Aiming to bridge the skill gap in the global developer ecosystem, QNX Everywhere provides accessible learning opportunities for students, academic institutions, and researchers to familiarize themselves with QNX technologies.

Model Insights

The predictive model for BlackBerry does not definitively forecast an earnings beat this time around. The Odds of an earnings beat increase when a positive Earnings ESP collides with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold).

In this instance, BlackBerry has an Earnings ESP of 0.00% and holds a Zacks Rank #3. For more insights into potential stock movements before they’re public, unleash our Earnings ESP Filter.

Other Stocks to Consider

If you’re hunting for promising stocks, our model suggests considering these picks, which exhibit the right mix to potentially surpass earnings expectations this time.

Commerce Bancshares, Inc. boasts an Earnings ESP of +5.88% paired with a Zacks Rank #2. The company is all set to disclose its first-quarter 2024 results on Apr 16. Gain insights into today’s elite Zacks #1 Rank stocks.

The Zacks Consensus Estimate for CBSH’s upcoming quarter’s earnings stands at 79 cents per share, with revenues expected to hit $384.4 million.

Delta Air Lines, Inc. is another notable contender with an Earnings ESP of +3.32% and a Zacks Rank #3. DAL is lined up to announce its first-quarter 2024 earnings on Apr 10.

The market consensus projects earnings of 33 cents per share and revenues amounting to $12.88 billion for DAL’s impending quarter.

JPMorgan Chase & Co., with an Earnings ESP of +0.94% and a Zacks Rank #3, is poised to unveil its first-quarter 2024 results on Apr 12.

The Zacks Consensus Estimate predicts earnings and revenues for JPM’s forthcoming quarter to reach $4.21 per share and $40.8 billion, respectively.

For real-time updates on earnings releases, lock into the Zacks Earnings Calendar.

Discover All of Zacks’ Recommendations for Just $1

It’s true.

A few years back, we shocked our followers by offering a 30-day peek at all our selections for merely $1. No strings attached.

While many seized this opportunity, others hesitated, suspecting a hidden catch. And the catch? Well, we simply wanted to introduce you to our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more. In 2023 alone, these services have closed a remarkable 162 positions with double- and triple-digit gains.

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

Read the full article on Zacks.com by clicking here.

The insights presented are the author’s own and do not necessarily align with those of Nasdaq, Inc.