American Eagle Outfitters, Inc. (AEO) has embarked on a vigorous rally, propelled by its digital initiatives and robust strategies such as the Real Power Real Growth Plan. The company’s ascent is underpinned by brand supremacy and robust consumer demand. With a keen eye on curating a trend-right merchandise assortment, deepening customer relations through marketing, bolstering digital commerce, and prudently managing expenses, the company has fortified its position in the market.

Robust Holiday Results and Projections

American Eagle recently reported strong holiday results, with fourth quarter-to-date revenues increasing by approximately 8%. Notably, American Eagle and Aerie have both experienced substantial growth, providing a solid foundation for the company’s optimistic outlook. Management is confident in delivering significant earnings growth and operational rate improvement in the upcoming year, bolstered by inventory and promotional discipline, expense control prioritization, and gains from profit-improvement initiatives.

Focus on Real Power Real Growth Plan

American Eagle’s Real Power Real Growth value-creation plan has been instrumental in driving profitability through real estate and inventory optimization. The company remains committed to expanding the Aerie brand into new markets, embracing innovation, and cultivating a broader customer base. Additionally, management is dedicated to delivering sustainable profitability for the American Eagle brand through strategic initiatives.

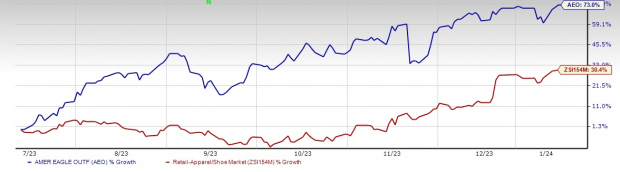

Image Source: Zacks Investment Research

American Eagle’s Aerie brand has exhibited consistent momentum, driven by strong demand in core apparel, the success of the OFFLINE brand, and a resurgence in intimates. Moreover, the company’s profit-improvement endeavors have been yielding positive results.

Financial analysts are also optimistic about Aerie’s parent company, with the consensus estimate for fiscal 2023 projecting notable sales and earnings per share growth. This positive sentiment has translated into a substantial 73% surge in American Eagle’s stock, outstripping the industry’s growth in the same period.

Other Solid Investment Opportunities

Aside from American Eagle, other top-ranked stocks to consider include Abercrombie & Fitch (ANF), Hibbett (HIBB), and Gap (GPS). These companies have also demonstrated strong growth potential and are worthy contenders for investment portfolios.

The allure of these stocks is further compounded by the potential of the electric vehicle revolution, presenting lucrative investment opportunities for those willing to seize the moment. As the demand for lithium batteries soars, investors have a chance to reap substantial gains.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar

To stay informed about emerging investment opportunities and receive the latest recommendations from Zacks Investment Research, download the free report: 7 Best Stocks for the Next 30 Days

For more insights, you can access the complete analysis of the listed companies here:

- Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

- American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

- The Gap, Inc. (GPS) : Free Stock Analysis Report

- Hibbett, Inc. (HIBB) : Free Stock Analysis Report

To read this article on Zacks.com click here

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.