Carter’s, Inc. CRI is on a trajectory that exudes promise and potential growth, owing much to its astute business maneuvers. The company’s stronghold lies in its effective pricing strategies, adept inventory management, and innovative product enhancements. Furthermore, the benefit reaped from favorable ocean freight rates, reduced inventory provisions, and a decline in distribution and freight costs has played a significant role in elevating its margins and overall profitability.

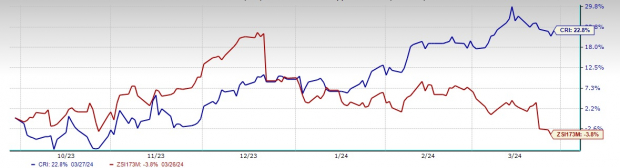

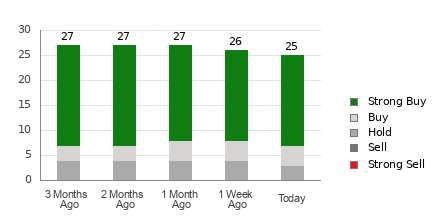

Such prowess has translated into a commendable upsurge of 22.8% in the shares of this apparel and related products retailer, a notable feat when juxtaposed against the industry’s 3.8% decline over the last half-year. Bolstering this performance is a stellar VGM Score of A, fortifying its standing as a current Zacks Rank #3 (Hold) company.

Market analysts echo an optimistic outlook for the company. The Zacks Consensus Estimate for 2024 sales and earnings per share (EPS) currently stands at $3 billion and $6.45, respectively. These projections reflect a healthy growth trajectory of 1.6% and 4.2% year over year. Looking ahead to 2025, the consensus estimate for sales and EPS stands at $3.1 billion and $6.81, respectively, showcasing robust year-over-year growth of 3.5% and 5.7%.

Peering Beneath the Surface

Carter’s has left no stone unturned in recalibrating its pricing strategies to resonate with prevailing market conditions and augment profitability. Witnessing enhanced price realization and profit margins, the company attributes this success to the resilience of its product lineup, reduced ocean freight rates, and superior inventory management.

Image Source: Zacks Investment Research

Furthermore, Carter’s strategic focus on indispensable core products, especially in inflationary markets, coupled with an attractive value proposition maintaining average retail prices around $11, positions it as a compelling choice for budget-conscious consumers. The company’s pricing ethos centers on keeping its brands competitively priced, typically within a $1 or $2 range of private label brands, a tactic that has proven instrumental in sustaining market competitiveness.

Despite grappling with the repercussions of inflation and resultant curtailed consumer spending, Carter’s has witnessed an optimistic shift in demand trends within its wholesale segment. This vertical has benefited from streamlined inventories with wholesale customers since the onset of 2023, leading to a notable uptick in demand exceeding projections for the fifth consecutive quarter during the final quarter of 2023.

Peering into the future, Carter’s foresees a landscape marked by reduced product costs, anticipated to bolster its product portfolio and refine price points, thereby amplifying profitability. The management remains sanguine about an improved demand trajectory and a more favorable macroeconomic climate as the year unfurls, with projections of sales and earnings upticks slated for the latter half of the year. Expectations are pinned on sustained conservative inventory commitments by wholesale customers, gross margin expansion fueled by reduced ocean freight rates and product costs, alongside a surge in higher-margin retail sales.

Summing it up, Carter’s emerges as a sound investment prospect, imbued with the aforementioned attributes.

Zeroing in on Robust Selections

Distinguished alternatives on the market include household names such as Ralph Lauren RL, Royal Caribbean RCL, and lululemon athletica LULU.

Ralph Lauren, a purveyor of footwear and accessories, currently flaunts a Zacks Rank #1 (Strong Buy). RL boasts a streak of four consecutive quarters with an average earnings surprise of 18.7%.

The Zacks Consensus Estimate for the ongoing fiscal year paints a picture of Ralph Lauren’s sales and EPS climbing by 2.7% and 22.7%, respectively, from the figures recorded a year earlier. For an overview of today’s Zacks #1 Rank stocks, click here.

Royal Caribbean secures a Zacks Rank of 1 at present, boasting a trailing four-quarter earnings surprise averaging 26.4%.

Earmarked by the Zacks Consensus Estimate, RCL is on track to witness a growth surge of 14.7% in 2024 sales and 47.9% in EPS from the levels reported in the corresponding period of the prior year.

An epitome of yoga-inspired athletic wear, lululemon athletica sports a Zacks Rank #2 (Buy) presently.

The future trajectory for lululemon athletica’s sales and EPS in the current fiscal year showcases a robust growth of 12.1% and 11.2%, respectively, from the figures of the prior year. The company has a track record of maintaining a 9.7% average earnings surprise over the past four quarters.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

To enlighten readers, Zacks has crafted a supplementary report shedding light on this explosive growth stock and four other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

Free Stock Analysis Report on Royal Caribbean Cruises Ltd. (RCL)

Obtain a Comprehensive Stock Analysis Report on Ralph Lauren Corporation (RL)

Detailed Stock Analysis Report on lululemon athletica inc. (LULU)

Access a Detailed Stock Analysis Report on Carter’s, Inc. (CRI)

For further details, view this article on Zacks.com by clicking here.

Visit Zacks Investment Research for more information

Author’s views and opinions are presented in this piece and may not necessarily align with those of Nasdaq, Inc.