The sartorial landscape is a turbulent ocean, filled with swift currents and unpredictable tides. However, in the midst of this tempest, The Gap, Inc. stands as a sturdy ship, navigating these waters with determination. Fueled by its robust strategic initiatives, particularly the Power Plan 2023 Strategy, the company is poised to harness the flourishing trends in the fashion realm.

Diving into the Strategy

Gap’s Power Plan 2023 Strategy is akin to a skilled gardener pruning the withered branches to allow the healthy ones to thrive. By focusing on enhancing profitable stores under the Old Navy and Athleta brands while closing less fruitful Gap and Banana Republic outlets, the company aims to bolster its omni capabilities and deliver sustained sales growth and robust cash flow.

The company is not merely drifting in these volatile waters. It has taken the helm firmly, steering towards calmer financial shores through vigilant cost-management measures. Gap’s efforts to streamline its operational model and structure have been akin to the intricate dance of a spider weaving its web, creating a cohesive organizational structure across its various brands. By aiming to achieve over $550 million in annualized cost savings, Gap is setting sail towards a horizon of increased profitability.

Gap’s journey toward financial success is further buoyed by lower airfreight costs and enhanced promotional strategies. These factors have not only fortified the company’s margins but have also bolstered its overall profitability. In a recent milestone, during the third quarter of fiscal 2023, Gap witnessed a substantial 390 basis points expansion in gross margin on a reported basis, and a 260 basis points expansion on an adjusted basis.

The Future Outlook

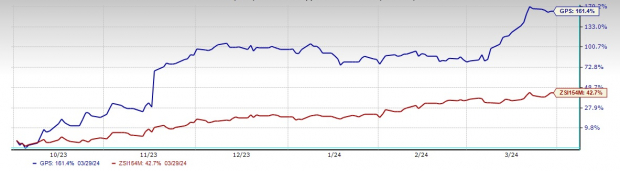

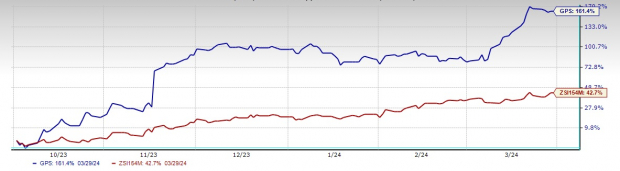

Emboldened by a VGM Score of A and a Zacks Rank #1 (Strong Buy), Gap seems to be on a trajectory towards prosperity. Analysts’ optimistic estimates, projecting an increase in sales and earnings per share for fiscal 2025, further underline the company’s potential to emerge as a promising investment opportunity in the fashion retail sector.

Exploring Additional Opportunities

In the rich tapestry of the market, there are other notable threads worth considering. Companies like Abercrombie & Fitch (ANF), American Eagle (AEO), and Deckers (DECK) have also caught the discerning eyes of investors seeking potential avenues for growth.

Despite the capricious nature of the market, these companies stand as beacons of hope, offering investors a chance to partake in their journey towards financial success. With Gap leading the charge, the horizon seems promising for those willing to navigate the intricate waters of the fashion retail sector.