Honeywell International Inc. (HON) witnesses a resurgence in its commercial aviation segment, riding high on the wings of a robust air travel sector. As the travel industry takes flight, the demand for aircraft parts and services provided by Honeywell sees a substantial uptick, propelling its Aerospace segment forward. With a promising outlook for 2024, the company forecasts organic sales in the Aerospace division to climb in the low double digits.

The Building Automation segment of HON also experiences a surge in demand fueled by growing building projects. Projections for 2024 indicate organic sales growth in the low single digits with commendable margin performance. Honeywell predicts an overall revenue range of $39.1-$39.7 billion for 2024, with organic revenue expected to grow 5-6% year-over-year.

Through strategic acquisitions, such as the recent purchase of CAES Systems and Carrier’s Global Access Solutions business, Honeywell is fortifying its defense technology offerings and positioning itself as a key player in the security solutions sector for the digital era. An impending acquisition of Air Products’ liquefied natural gas process technology and equipment business further underlines the company’s expansion strategy.

Committed to delivering value to its shareholders, Honeywell prioritizes dividend payouts and share buybacks. Notably, the company increased its quarterly dividend rate by 5% in September 2023, showcasing its dedication to rewarding investors.

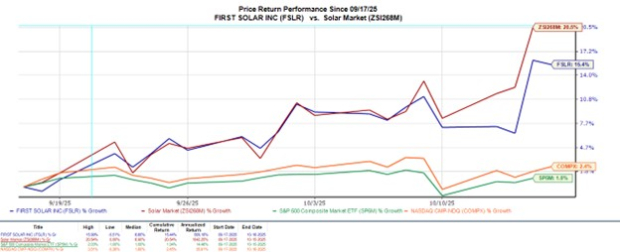

Stock Performance and Market Trends

Image Source: Zacks Investment Research

Honeywell’s stock, holding a Zacks Rank #3 (Hold), has seen a 10.7% rise in its shares over the past year, outperforming the industry’s growth of 9.2%.

However, challenges lurk in the Industrial Automation segment, where lower demand for projects has impacted the warehouse and workflow solutions businesses. Additionally, a slump in the sensing and safety technologies division poses concerns due to weakened demand for personal protective equipment. The segment witnessed an 8% decline in sales in the second quarter of 2024.

Mounting debt levels also cast a shadow on the company’s financial health. Honeywell closed the second quarter with long-term debt hitting $20.9 billion, marking a notable increase from $16.6 billion at the end of 2023. Furthermore, interest expenses and other financial charges remained elevated at $250 million in the quarter.

Top Picks in the Industry

Among the top-ranked stocks in the industry are:

Vector Group Ltd. (VGR) – Zacks Rank #2 (Buy), showing a positive average earnings surprise and an upward trajectory in 2024 earnings estimates.

Federal Signal Corporation (FSS) – Zacks Rank #2, with consistent earnings surprises and an optimistic outlook for 2024 earnings.

Carlisle Companies Incorporated (CSL) – Zacks Rank #2, boasting a strong earnings surprise history and a positive trend in 2024 earnings estimates.

Discover Potential Gainers

Uncover hidden gems with Zacks’ expert recommendations for stocks set to double in 2024. With success stories of past recommendations soaring to unprecedented heights, this is an opportunity to delve into promising ventures before they hit mainstream attention.

Explore These 5 Potential Home Runs Now >>

For more insights from Zacks Investment Research, download the Free Stock Analysis Reports here

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.