Exploring the Upsides

Alcon, a key player in the pharmaceutical and medical device industry, stands poised for growth in the foreseeable future. The company’s Surgical business is a beacon of success, driven by a diverse portfolio and continuous innovation. With a dominant market share in Implantables, Alcon is reshaping the industry landscape with products like Vivity and PanOptix.

Looking ahead, Alcon’s 2024 roadmap features revolutionary devices like the UNITY VCS Phacovit, promising substantial market penetration. The company’s emphasis on next-generation consumables and the impending launch of UNITY DX for diagnostics underscore its commitment to cutting-edge solutions.

In the Vision Care segment, Alcon continues its robust performance, fueled by the growing demand for contact lenses and ocular health products. Noteworthy launches like Total 30 for astigmatism and multifocal lenses signal a commitment to innovation and customer-centric solutions, ensuring a bright future for this division.

Spotlight on Stable Solvency

Despite economic uncertainties, Alcon’s solid financial standing instills confidence in investors. Ending the last quarter with a healthy cash position and manageable debt obligations, the company navigates global disruptions with resilience. Improvements in interest coverage further solidify Alcon’s position as a stable investment option in a volatile market.

Addressing the Downsides

Nevertheless, Alcon grapples with macroeconomic challenges, including inflationary pressures and supply chain disruptions, impacting its margins. The competitive landscape in both Surgical and Vision Care businesses poses ongoing threats, demanding strategic agility and innovation to sustain growth amidst fierce competition.

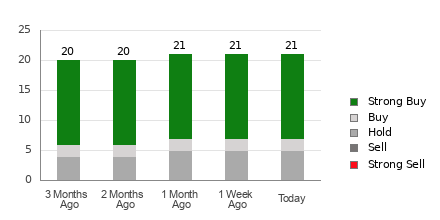

Analyst Projections and Expert Insights

Analysts foresee a positive outlook for Alcon, with a stable consensus estimate for earnings per share in 2024 and anticipated revenue growth. As investors weigh their options, key picks in the medical space such as DaVita, Cardinal Health, and Stryker offer compelling alternatives with strong growth potential and solid financial performance.

From a historical standpoint, Alcon’s journey mirrors the evolution of the healthcare industry, navigating changing landscapes with resilience and innovation. As the company charts its course in the coming years, investors remain eager to capitalize on its growth trajectory and market leadership.

The Rise of the Top Semiconductor Stock: A Future Powerhouse

The recent performance of the leading semiconductor manufacturer has captivated investors. With an average earnings surprise of 5.8% last quarter, the company has set itself apart in a landscape dominated by giants like NVIDIA, a behemoth that soared more than +800% post-recommendation. While NVIDIA’s strength is undeniable, a new player in the field, approximately 1/9,000th of its size, is garnering immense attention and admiration from analysts. This underdog possesses the potential for exponential growth, making it a tantalizing prospect in the market.

A Glimpse into the Future

Fueled by remarkable earnings growth and a rapidly expanding customer base, this semiconductor stalwart is strategically positioned to meet the insatiable demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor industry is on the brink of a revolution, with projected manufacturing figures skyrocketing from $452 billion in 2021 to a staggering $803 billion by 2028. The rapid evolution of technology and the increasing integration of chips into various devices and systems are propelling this company to the forefront of the sector.

Claim Your Free Stock Analysis Now >>

Interested in Stryker Corporation (SYK)? Get Your Free Stock Analysis Report Here

Unlock a Free Stock Analysis Report for DaVita Inc. (DVA) Now

Access Free Stock Analysis Report for Cardinal Health, Inc. (CAH) Here

Get Your Free Stock Analysis Report for Alcon (ALC) Today

Learn more about the investment potential of Alcon (ALC) here on Zacks.com

For additional insights, visit Zacks Investment Research

Please note that the views expressed here belong to the author and may not necessarily align with those of Nasdaq, Inc.