Werner Enterprises, Inc. (WERN) is mired in multiple headwinds, which, we believe, have made it an unimpressive investment option.

Let’s delve deeper.

Southward Earnings Estimate Revision:The Zacks Consensus Estimate for second-quarter 2024 earnings has been revised 46.9% downward over the past 90 days. For 2024, the consensus mark for earnings has moved 34.3% south in the same time frame. The bearish alterations in estimate revisions underscore a notable decline in brokers’ confidence in the stock.

Weak Zacks Rank and Style Score:Werner currently carries a Zacks Rank #5 (Strong Sell). The company’s current Value Score of C shows its unattractiveness.

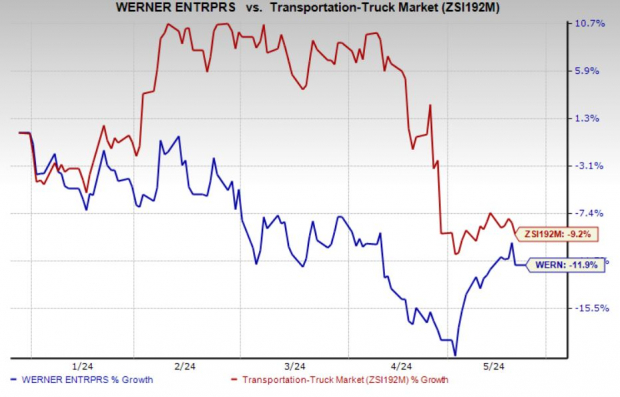

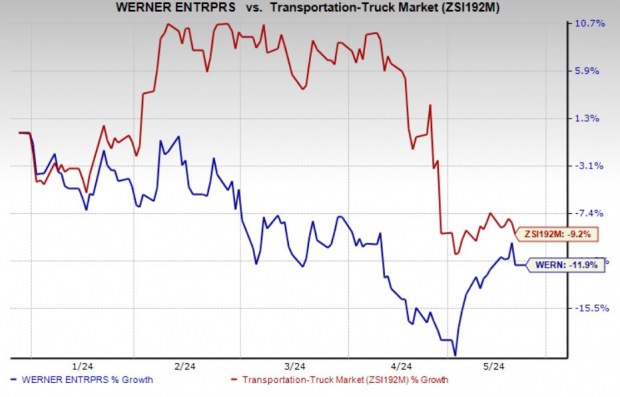

Unimpressive Price Performance:WERN has lost 11.9% so far this year compared with the industry’s decline of 9.2%.

Image Source: Zacks Investment Research

Negative Earnings Surprise History: Werner has a disappointing earnings surprise history. The company’s earnings lagged the Zacks Consensus Estimate in each of the last four quarters, delivering an average miss of 20.66%.

Other Headwinds: Werner is suffering from weak freight demand. As a result of the weakness in the freight market, management gave a bearish 2024 guidance regarding the Truckload Transportation Services (TTS) segment. For 2024, Werner now anticipates TTS truck growth to decline in the range of 6%-3% (prior view: between [3%] and breakeven).

WERN’s weak liquidity position is also concerning. At the end of first-quarter 2024, the company’s cash and cash equivalents stood at $60.33 million, much lower than the long-term debt (net of current portion) of $596.25 million. This implies that the company does not have sufficient cash to meet its current debt obligations.

Stocks to Consider

Some better-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have risen 18.4% in the past year.

Trinity raised 2024 earnings per share guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Werner Enterprises, Inc. (WERN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.