Boyd Gaming Corporation BYD is benefiting from its focus on expansion initiatives and consideration of Las Vegas’ local market for driving its portfolio accompanied by encouraging online betting prospects.

This multi-jurisdictional gaming company showcases a VGM Score of A, backed by a Value Score of A and a Growth Score of B. This positive trend signifies bullish analysts’ sentiments and robust fundamentals in the near term.

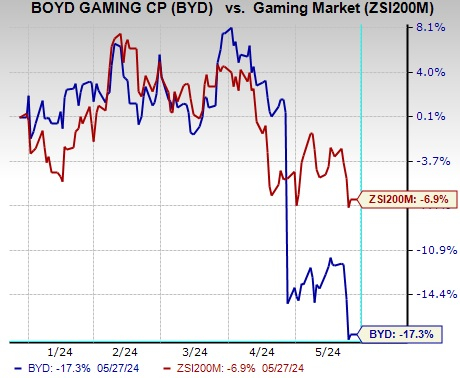

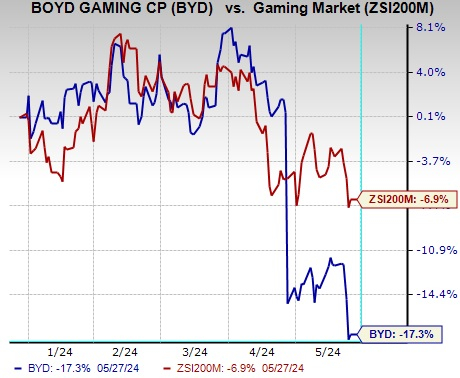

However, shares of this Zacks Rank #3 (Hold) company have lost 17.3% in the year-to-date period compared with the Zacks Gaming industry’s 6.9% decline. The company’s growth prospects are hindered to a great extent by high-cost scenarios, market softness and competitive pressures in its Las Vegas Locals segment.

Furthermore, the earnings estimates for 2024 have inched down in the past seven days to $6.06 from $6.07 per share. The estimated value portrays a 4% decline from the last year’s reported value.

Image Source: Zacks Investment Research

Let’s delve deeper and analyze the factors.

Attractive Factors of the Stock

Expansion Initiatives: Boyd Gaming’s focus on accretive expansion initiatives, organic as well as inorganic, is encouraging. The company indulges in extensive acquisition strategies to strengthen its product portfolio and expand its market reach in new and existing markets. Also, noteworthy collaborations add to its expansion initiatives, thus aiding it in creating value for its customers.

Given the impressive performance of the Sky River Casino (which BYD manages on behalf of the Wilton Rancheria Tribe) upon its opening, the Wilton Rancheria Tribe is now finalizing plans for a major expansion of the property. The expanded property will include additional casino space, a hotel tower and meeting and convention facilities. Also, Boyd Gaming declared that its land-based project at Treasury Chest Casino (expected to be completed by June 2024) is nearing completion. Furthermore, during the first-quarter 2024earnings call the company stated enhancement and renovation updates on rooms at Gold Coast, Ameristar St. Charles and Blue Chip. It expects to initiate similar projects at the Orleans IP and Valley Forge later in 2024.

Focus on Local Markets: Boyd Gaming considers the local market in Las Vegas to be a major driver for its portfolios. With restaurants and bars open, frequent visitations by locals are likely to spurt the company’s growth. During the first quarter, BYD reported positive customer trends regarding guest counts, frequency and spending along with growth in the convention business.

During the same quarter, BYD witnessed increased visitation to Las Vegas thanks to continuous growth in the convention business and the travel resumption of Hawaiian customers due to the upliftment of COVID-related restrictions in Hawaii. Given the ongoing growth trends in visitation, convention business and employment, the company is optimistic about the health of the Southern Nevada economy.

Online Betting Bodes Well: Online betting is one of the primary top-line and growth drivers of Boyd Gaming and it intently focuses on seeking and implementing opportunities to expand and diversify the product offerings. One such notable initiative has been the legalization of sports gambling. The company’s sports-betting partnership with FanDuel Group and the acquisition of Pala Interactive accompanied by various new sports book openings align with its online strategy.

In the first quarter, the Online segment generated $146.2 million in revenues, up 19% year over year. The uptrend was backed by FanDuel’s robust performance along with an increase of $20.0 million in reimbursements of gaming taxes and other expenses paid on behalf of online partners. Moreover, with Pala Interactive’s technology (featuring a player account management system and iGaming products) and operational and marketing expertise, the company is optimistic and anticipates the initiative to advance its position in the emerging iGaming market.

Factors Marring Prospects

High Costs & Expenses: Despite several margin-enhancement initiatives, Boyd Gaming has been grappling with higher wages, utilities and property insurance expenses. During the first quarter of 2024, selling, general and administrative expenses increased year over year to $108.2 million from $100.3 million. Total operating costs and expenses were $741.1 million, up from $679.1 million reported in the prior year.

Going forward, the company intends to monitor the economic situation to gauge the impacts of interest rate hikes and inflationary pressures. Cost pressures, which are likely to moderate going through 2024, are going to stay for some time as stated by the company.

Stiff Competition: Boyd Gaming is persistently facing intense competition from various casinos and hotel casinos. Apart from gaming services, other non-gaming resorts and vacation destinations provide challenges to the company. Its operations, therefore, are facing heightened competition with new entries in the already high-supply market.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has increased 44.6% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has hiked 70.7% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has surged 87.9% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 16.6% and 61.9%, respectively, from the year-ago levels.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.