Aflac Incorporated AFL is weaving a tale of resilience and growth, thanks to its diligent cost-curbing strategies, global investments, expansive domestic network, and diverse product offerings. Hailing from Columbus, GA, Aflac stands as a leading provider of supplemental health and life insurance products, solidifying its presence in the United States and Japan with a market cap of $48.9 billion.

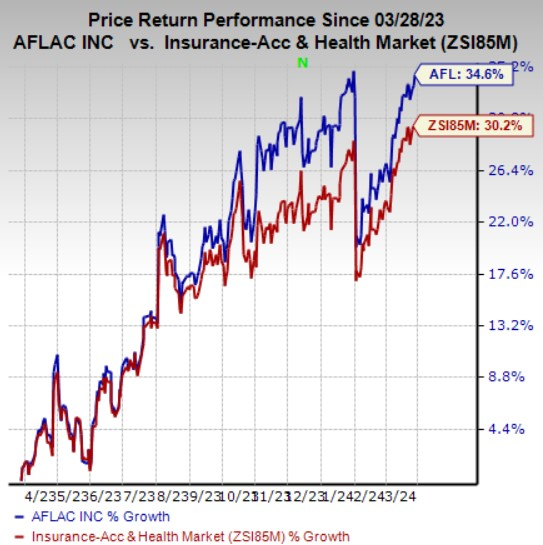

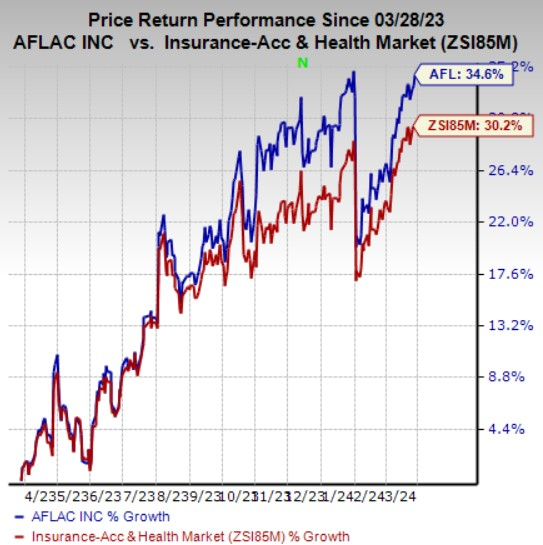

Zacks Rank & Price Performance

In recent times, AFL has been bestowed with a Zacks Rank #3 (Hold). Over the past year, the stock surged impressively by 34.6%, overshadowing the industry average growth of 30.2%. A testament to the company’s steadfast trajectory amidst market dynamics and competition.

Image Source: Zacks Investment Research

Trend in Estimates

Looking ahead, the Zacks Consensus Estimate for AFL’s 2024 earnings points to a promising $6.43 per share, reflecting a substantial 3.2% jump from the previous year. Indicating optimism in the company’s growth trajectory, the estimate has seen an upward trend of 1.1% over the last 60 days. Furthermore, the consensus for current-year revenues stands at $17.3 billion.

Key Drivers

Aflac is strategically positioned for imminent success, especially evident in the expected growth of its Aflac Japan segment. The upsurge in sales is backed by innovative product launches, robust distribution strategies, and the promising performance of Japan Post. The recent introduction of a medical product in mid-September has shown early signs of success, reinforcing the company’s promising future outlook.

Not to be outshined, the management’s positive outlook for the U.S. business heralds an era of growth. The anticipation of improved productivity and contributions from multiple platforms like network, dental, vision, and group life and disability, signifies a robust performance in the making. A strategic collaboration with Trupanion aims to bolster the company’s pet insurance business footprint in North America, painting a bright future for U.S. operations.

A notable highlight from the 2023-2024 Aflac WorkForces Report illuminates the crucial role of benefits programs in employee satisfaction and well-being. With 82% of employers crediting supplemental health insurance for aiding in recruitment, AFL’s growth prospects are further heightened.

Embracing efficiency, Aflac anticipates a decline in the combined ratio below the previous year’s levels, courtesy of a significant improvement in the company’s expense ratio. Operating in the 35-37% expense ratio range over time reinforces the company’s commitment to enhancing margins. Furthermore, the implementation of cost-saving initiatives and focus on maintaining an agile workforce are poised to fortify bottom-line growth in the long haul.

Propelled by a robust balance sheet boasting $4.3 billion in cash and cash equivalents as of December 31, 2023, Aflac stands primed for shareholder value enhancements. With anticipated debt maturities of $1.3 billion over the next five years, the company embarks on initiatives with financial flexibility at its core.

In an emphatic display of confidence, Aflac repurchased shares worth $700 million in the fourth quarter alone. With 77.7 million shares still eligible for buybacks at the quarter’s end, the company affirms its dedication to rewarding shareholders. The 19% year-over-year increase in dividends, with each share now worth 50 cents for the fourth quarter of 2023, paints a vibrant picture of shareholder value enhancement.

Despite a decline in net cash from operations over recent years, Aflac remains undeterred. With a systematic approach and strategic planning, the company is poised to overcome challenges and pave the path for sustainable long-term growth.

Key Picks

Shining brightly alongside Aflac in the broader Finance landscape are key players like AMERISAFE, Inc. AMSF, Employers Holdings, Inc. EIG, and Unum Group UNM. While Amerisafe and Employers Holdings don the mantle of a Zacks Rank #1 (Strong Buy), Unum Group proudly wears a Zacks Rank #2 (Buy). Witnessing stability and growth, these entities present compelling investment opportunities in an ever-evolving market paradigm.

As the market orchestrates its intricate dance of investments and opportunities, Aflac stands tall amidst its peers, showcasing resilience, growth, and unwavering commitment to shareholder value. Embarking on a path of strategic expansion and operational efficiency, Aflac beckons prudent investors to join its journey of prosperity and promise.