Amidst bullish sentiments, Ralph Lauren Corporation (RL) is charting a course for growth, propelled by a remarkable digital surge and robust strategies. With a steadfast focus on enhancing digital capabilities, deepening customer relationships, and expanding in international markets while managing expenses deftly, the company is positioning itself for a soaring trajectory.

The Next Great Chapter Unfolds

Efforts under the Next Great Chapter plan are yielding promising results. The successful transition of Chaps to a licensed business stands as a testament to Ralph Lauren’s portfolio realignment strategy. This strategic move has freed resources to concentrate on core brands, a pivotal element of the Next Great Chapter elevation strategy. Moreover, the company’s product elevation strategy, personalized promotion, disciplined inventory management, and favorable channel and geographic mix are contributing to its positive outlook.

Digitization and Omnichannel Expansion

Ralph Lauren is making significant headway in expanding its digital and omnichannel capabilities through strategic investments. The company is prioritizing expansion in mobile, omnichannel and fulfillment, aiming to bolster user experience. The integration of AI and data to serve consumers more efficiently underscores the company’s commitment to innovation and customer-centric strategies. In addition, the launch of its first-ever full catalog Ralph Lauren mobile app underscores the company’s dedication to creating a personalized and content-rich platform.

What’s More?

The company is on track to exceed its top and bottom-line targets under the “Next Great Chapter” plan announced in June 2018. It announced measures to simplify its global organizational structure and enhance technological capabilities, demonstrating its ardent pursuit of progress and innovation.

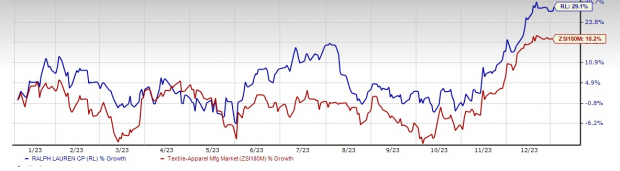

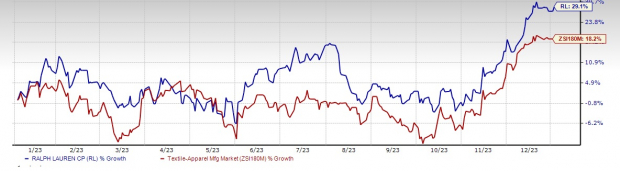

Image Source: Zacks Investment Research

Analysts are bullish on the company, with the Zacks Consensus Estimate for fiscal 2024 sales and earnings per share (EPS) reflecting positive projections. Notably, estimates demonstrate year-over-year growth in both sales and EPS, positioning Ralph Lauren as an appealing investment option. The company’s solid performance is evidenced by its 29.1% rise in shares, outperforming the industry’s growth of 18.2% over the past year. Additionally, the company’s Value Score of B further strengthens its position.

Eye These Solid Picks

Other companies to watch include GIII Apparel (GIII), lululemon athletica (LULU), and Royal Caribbean (RCL). GIII Apparel, in particular, stands out with a Zacks Rank #1 (Strong Buy), and a remarkable earnings surprise average of 541.8% over the trailing four quarters. Meanwhile, lululemon athletica and Royal Caribbean carry a Zacks Rank #2 (Buy) each, with their strong growth trajectories and solid performance further enhancing their investment appeal.

Zacks Names #1 Semiconductor Stock

For investors searching for the next big thing, there’s a semiconductor stock with substantial room for growth. With boundless opportunities in Artificial Intelligence, Machine Learning, and Internet of Things, this stock is set to capitalize on the burgeoning demand in the global semiconductor market, projected to explode from $452 billion in 2021 to $803 billion by 2028. The future looks bright for this potential leader in the industry.

See This Stock Now for Free >>

Delve deeper into these stocks and make informed investment decisions. Remember, knowledge is power in the world of finance.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.