One thing is certain about the stock market – it defies the laws of nature. Gravity has no effect on stocks, and what goes up doesn’t necessarily have to come down, at least not for a very long time. This holds especially true for a sizzling hot sector that has captured the imagination of the investing public, like artificial intelligence (AI).

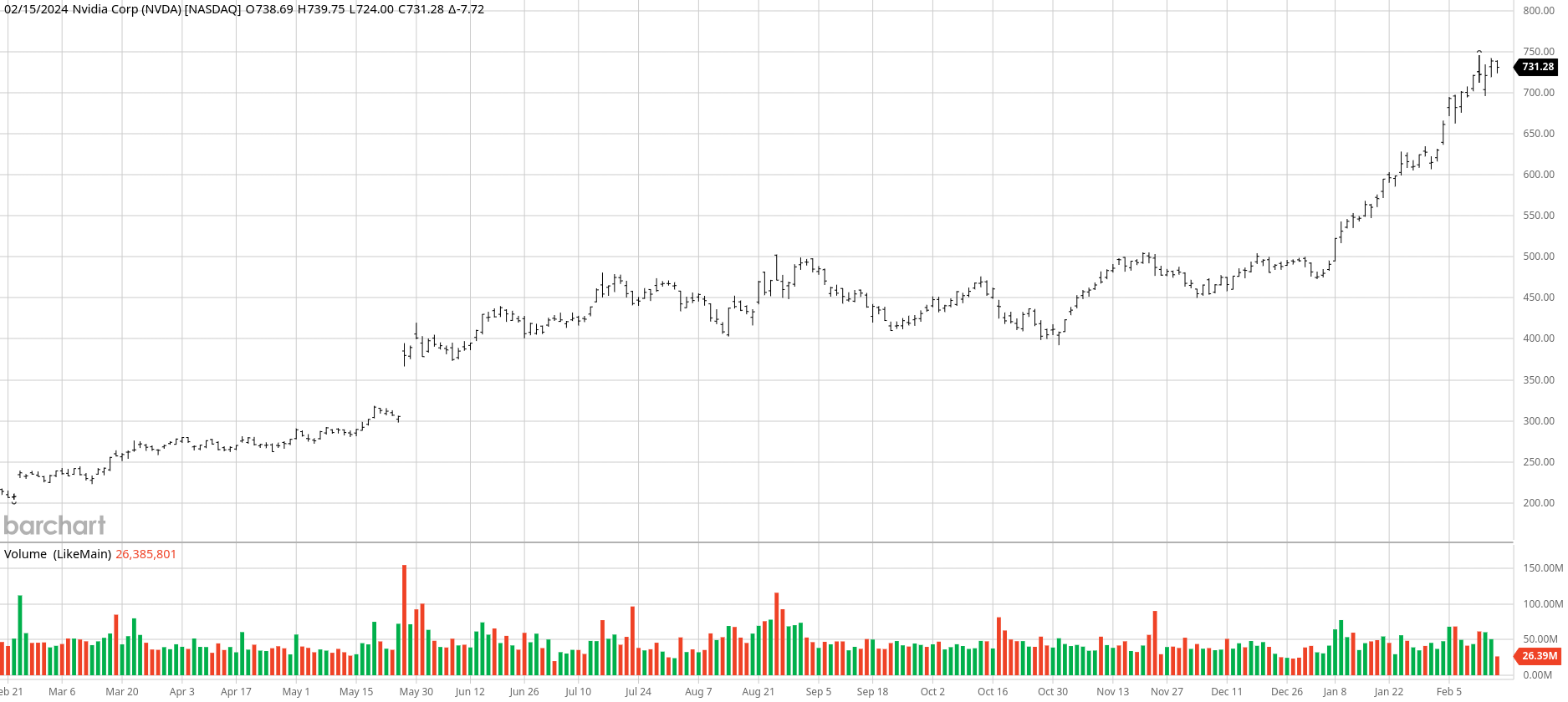

At the forefront of the AI boom stands the semiconductor powerhouse, Nvidia (NVDA). Its stock has been charging forward since the beginning of 2023, and the momentum seems unstoppable. With an imminent earnings report on the horizon, let’s delve into Nvidia to explore what could potentially slow down this runaway freight train.

Assessment of Nvidia’s Current Valuation

Is it possible for a stock to be considered reasonably priced after surging by 220% in a year? That’s precisely what Nvidia has achieved, catapulting past both Alphabet (GOOGL) and Amazon (AMZN) to claim the rank of the third-largest U.S.-listed company, boasting a market capitalization of $1.825 trillion.

Even after this extraordinary ascent, there is a case to be made that Nvidia may still be reasonably valued. With earnings estimates escalating almost as rapidly as its stock price, Nvidia’s current trading multiple is a modest 35 times this year’s expected profits. This appears relatively conservative for a company in the midst of a growth surge projected to quadruple its revenue.

Nvidia’s last quarter saw revenue surge by a staggering 206% year-on-year to reach $18.1 billion. The surge was fueled by generative AI and investments in large language models, propelling demand. The data center revenue soared by 279%, while the compute revenue skyrocketed by 324%. Additionally, Nvidia’s capital-light model, through outsourcing to Taiwan Semiconductor Manufacturing (TSM), boosted its operating margin to an impressive 57%, driving operating profit up an astounding 1,259% to $10.4 billion year-over-year.

For evaluating growth stocks, the price/earnings growth (PEG) ratio is a frequently used metric. By this measure, FactSet currently places Nvidia at a five-year forward PEG ratio of just 0.71, making it cheaper than other tech stocks such as Apple (AAPL).

Nvidia has built a competitive advantage similar to Apple’s, leveraging its proprietary software, CUDA – a programming platform launched in 2007 that enables developers to use GPUs for general-purpose computing beyond graphics design. This has made CUDA the default platform in AI computing, reflecting its strong following in the tech ecosystem, which is unlikely to be disrupted any time soon.

Furthermore, with its 2020 acquisition of Mellanox Technologies, Nvidia has secured the cabling technology essential for constructing supercomputers, complementing its full-service AI offering for businesses.

The Road Ahead for Nvidia Stock

Despite its ongoing success, Nvidia does face certain risks. While the requirement for continuous AI model training and retraining should maintain the demand for Nvidia’s GPUs, a significant shift in spending towards other chip types could occur due to the widespread use of smaller AI models and the application of AI to specific tasks, known as inferencing.

To sustain its current growth trajectory, Nvidia’s AI enterprise software needs to deliver tangible productivity improvements in the workplace. If this materializes – a likely scenario in my opinion – the scramble for Nvidia’s hardware will persist through 2024 and beyond.

Forecasts indicate a gross margin of approximately 73% to 74% between the 2024 fiscal year and the 2026 fiscal year, significantly wider than the 59% recorded in the 2023 fiscal year. Nvidia’s margin profile and scalable business model are poised to drive substantial free cash flow potential, projected to reach $45 billion in the 2025 fiscal year and $55 billion in the 2026 fiscal year, compared to around $5 billion in the 2023 fiscal year.

With its expanding range of software, Nvidia stands to command a larger portion of the overall AI market, even if its share of chip sales diminishes.

Standing in the way of Nvidia’s stock juggernaut would be akin to challenging the construction of a new AI computing infrastructure. Any general market weakness could present a ripe opportunity to purchase Nvidia’s stock at under $750.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.