The tale of Masimo Corporation (MASI) unfurls like a thrilling narrative in the realm of medical technology. This Zacks Rank #2 (Buy) entity, with stellar research and development (R&D) initiatives, is set to scale new heights and delight investors. Riding on the wave of a robust fourth-quarter performance, coupled with recent regulatory approvals, Masimo appears primed for a prosperous journey ahead. Yet, lurking shadows of overdependence on its Signal Extraction Technology (SET) division and macroeconomic headwinds cast a shadow over this promising narrative.

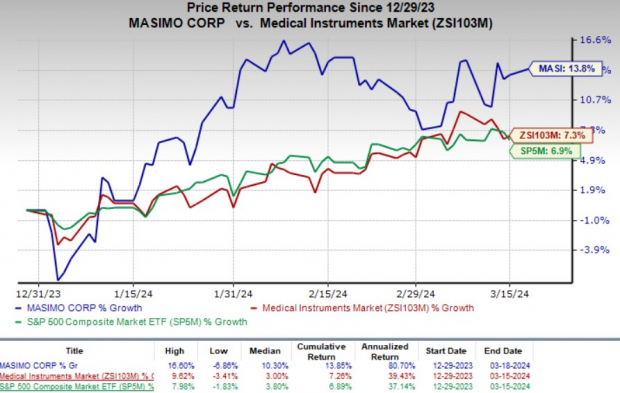

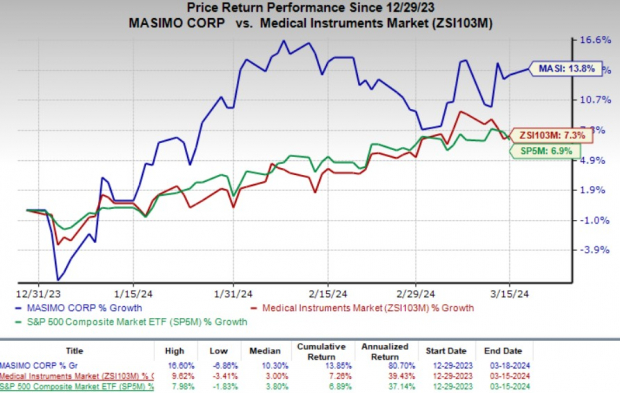

Masimo boasts a market capitalization of $7 billion and anticipates a 2.6% revenue growth in 2024. Not just that, the company’s earnings yield of 2.6% stands out against the industry’s negative yield, reflecting a strong financial backbone amidst the ever-changing tides of the market.

Image Source: Zacks Investment Research

But what truly sets Masimo apart are the threads of innovation intricately woven into its fabric—let’s delve deeper into this captivating narrative.

Regulatory Approvals: Masimo’s recent rendezvous with regulatory green lights is nothing short of a validation of its pioneering work. The FDA’s stamp of approval on various products like the MightySat Medical Pulse Oximeter and the Masimo W1 medical watch fuels our optimism for Masimo’s exciting trajectory.

Research and Product Development: Masimo’s dedication to innovation is akin to a master craftsman honing his art. Its R&D endeavors are the cornerstone of its success, guiding its path to technical excellence and market leadership. The collaboration with Cercacor on advancing rainbow technology among other endeavors only adds more colors to its palette of achievements.

Resilience of Q4: Masimo’s fourth-quarter performance paints a portrait of resilience and adaptability. With the healthcare sector shifting gears away from the shadows of COVID-19, Masimo’s strategic insights are paving the way for a future bright with possibilities. As customer behaviors echo a pre-pandemic melody, Masimo is tuning its sensors to capture the harmonic growth patterns once again.

Challenges on the Horizon

Overdependence on Masimo SET: Masimo’s reliance on its primary offerings like the Masimo SET platform poses a double-edged sword. While it has been a springboard for success, overdependence raises alarms for potential vulnerability in the face of market shifts.

Economic Vicissitudes: Masimo’s products, though indispensable in the medical landscape, are discretionary and sensitive to the winds of the economy. Any downturns characterized by inflationary pressures, economic contractions, or dwindling consumer confidence could cast a pall over Masimo’s growth trajectory.

The Forecast Looks Bright

Venturing into the realm of estimates, Masimo presents a promising outlook for 2024. Following a positive trend in estimate revisions, we witness a bullish sentiment as the Zacks Consensus Estimate for earnings per share climbs by 8.4% to $3.48.

Meanwhile, the Zacks Consensus Estimate for first-quarter 2024 revenues stands at $488.5 million, signaling a 13.6% decline from the year-ago period. Despite this slight dip, Masimo’s trajectory remains oriented towards positivity and growth.

Diversifying the Landscape

Masimo Corporation price | Masimo Corporation Quote

Exploring Other Gems in the Medical Space

In a garden of flourishing medical stocks, Masimo shines bright, much like other top-ranked entities such as DaVita Inc. (DVA), Cardinal Health, Inc. (CAH) and rising star Cencora (COR).

DaVita’s meteoric rise, Cardinal Health’s steady ascent, and Cencora’s promising growth unveil a tapestry of potential in the broader medical domain. With estimates painting a rosy picture, these entities are not only partners in progress but also beacons of hope for the discerning investor.

As we voyage through the ever-evolving seas of the market, Masimo and its companions offer a compass to navigate the varying currents and emerge victorious in the realm of healthcare investments.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof… and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with “black gold.”

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you’ll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don’t want to miss these recommendations.

Download your free report now to see them.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.