Kronos Worldwide, Inc. has been on a rollercoaster ride with its KRO stock, surging approximately 15% in the last three months. What’s the driving force behind this climb, you ask? Look no further than the higher demand for titanium dioxide (TiO2) and the relaxing pricing pressure. Cost-saving initiatives play a crucial role in boosting margins, setting the stage for further growth.

If you’ve been eyeing KRO, now might just be the time to take the plunge. The company is brimming with promise, and the potential for sustained momentum is bright.

Come along as we delve into the factors that paint KRO as a captivating choice for investors in the current landscape.

Shining Bright Above the Rest

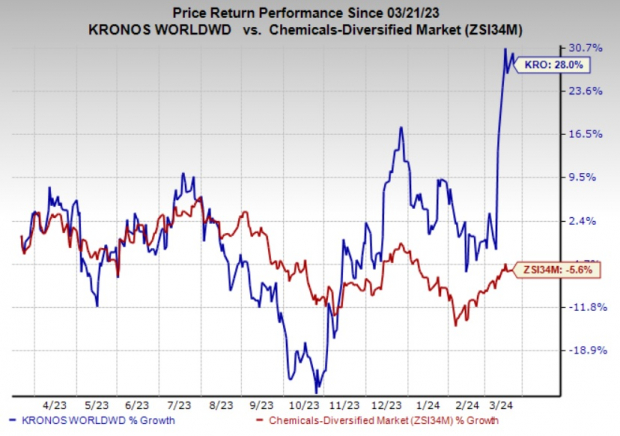

KRO has not only weathered the storm but soared above its industry over the past year. With shares up by a whopping 28%, Kronos Worldwide has outpaced a stark 5.6% industry decline.

Growth on the Horizon

Set your sights on the future with Kronos Worldwide, where earnings projections for 2024 show an anticipated growth rate of 176.7%. As if that weren’t enough, the company is expected to witness a further surge of 125.8% in earnings by 2025.

Riding the Upward Trend

Over the last couple of months, analysts have turned increasingly bullish on KRO. Estimates for both 2024 and 2025 have seen positive revisions – 73.7% and 11.9% upwards, respectively. It’s these favorable estimate adjustments that instill confidence in investors and keep the stock afloat.

The Titanium Touch: Driving KRO Forward

Forecasted to benefit from escalating TiO2 demand, Kronos Worldwide marks its territory in a market where consumption has been on a steady uptrend since 2000. With key regions like Western Europe, North America, South America, and the Asia Pacific soaring in TiO2 utilization, the outlook remains bright. Eager to capitalize on the situation, the company foresees an uptick in consumer demand in 2024. Moreover, with cost-control strategies and enhanced production rates in play, the stage is set for robust growth in 2024 and beyond.

By slashing costs via targeted workforce reductions and efficiency enhancements in 2023, KRO has set a solid foundation for improved margins in 2024. As the company gears up for heightened production volumes and stronger sales in the coming year, the future looks promising indeed.

Seeking Greener Pastures? Consider These

In the vast realm of basic materials, Kronos Worldwide isn’t the only shining star. Companies like Carpenter Technology Corporation, Denison Mines Corp., and Hawkins, Inc. are also worth a gander. With soaring earnings estimates and impressive stock performances, these contenders are not to be underestimated.

Eager to dive deeper into the world of stock recommendations? Why not explore what Zacks Investment Research has to offer! After all, there’s no harm in fishing for pearls of wisdom in the vast ocean of investment opportunities.

Seeking the next big semiconductor stock? Look no further! With a tiny fraction of NVIDIA’s size yet brimming with potential, this new champion is on the cusp of a monumental boom. Fueled by rapid earnings growth and an expanding clientele, could this be your ticket to riding the wave of Artificial Intelligence, Machine Learning, and Internet of Things? The global semiconductor sector is gearing up for unprecedented growth – wouldn’t you want a slice of that pie?

Discover This Stock Now for Free >>

Want to keep abreast of the latest insights from Zacks Investment Research? Dive into the pool of opportunities with the 7 Best Stocks for the Next 30 Days. Click now to get your hands on this insightful report!