Ingersoll Rand Inc. (IR) is uniquely positioned to thrive thanks to its diverse market presence. This provides a safety net, enabling it to offset a dip in one market with strength in others.

The company has experienced a surge in orders across various sectors, such as compressors, vacuum and blowers, power tools, and lifting within the Industrial Technologies & Services unit. Additionally, strategic pricing adjustments and benefits from acquisitions bode well for the Precision & Science Technologies segment. Ingersoll Rand anticipates a robust revenue growth of 14-16% year over year in 2023, with organic revenues projected to climb 9-11%.

Focusing on business expansion, IR has made strategic acquisitions, including Slovakia-based Oxywise and Canada-based Fraserwoods, to fortify its presence in high-growth, sustainable markets. Furthermore, the acquisition of Howden Roots has widened its low-pressure compression and vacuum product offerings, adding centrifugal compression capabilities. Notably, these acquisitions are expected to bolster revenues by $360 million in 2023.

The company’s strong free cash flow generation supports its shareholder-friendly activities. In the first nine months of 2023, Ingersoll Rand’s free cash flow surged by 60.2% year over year to a substantial $720.2 million. During the same period, IR dispensed dividends of $24.3 million and repurchased shares worth $132.8 million.

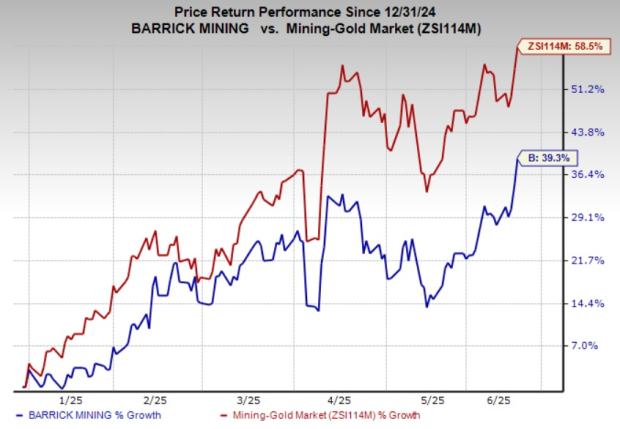

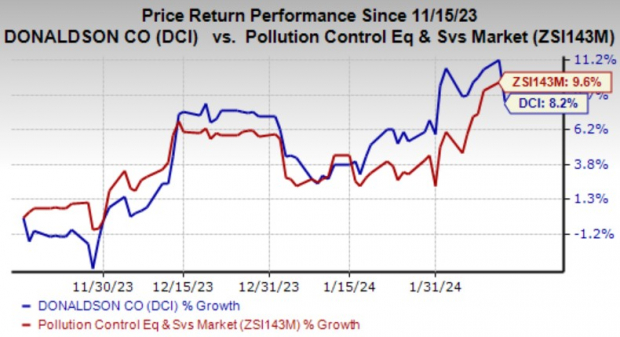

Image Source: Zacks Investment Research

In the past three months, Ingersoll Rand, a Zacks Rank #3 (Hold) company, has surged by 33.4%. This exceeds the industry’s growth of 21.4%.

However, the Precision & Science Technologies segment faced challenges in the life sciences business due to softer demand in the oxygen concentration and biopharma end markets. In the third quarter of 2023, the segment’s revenues fell by 1.8% on a reported basis and 5.3% organically.

It’s important to note that the company has been grappling with rising costs and operating expenses. For example, its cost of sales soared by 12.7% year over year in the first nine months of 2023 due to high raw material costs. Selling and administrative expenses also surged by 14.9% in the same period.

Exploring Alternatives

We’ve identified three alternative stocks in the same category that are currently rated Zacks Rank #2 (Buy): Graco Inc. (GGG), Flowserve Corporation (FLS), and Parker-Hannifin Corporation (PH).

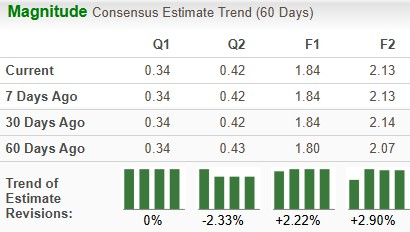

Graco has a tracked average earnings surprise of 7.2% over the last four quarters. The Zacks Consensus Estimate for GGG’s 2023 earnings has remained unchanged in the past 60 days, accompanying a 21.8% jump in its stock price over the last three months.

Flowserve boasts a tracked average earnings surprise of 27.3% over the last four quarters. The consensus estimate for FLS’ 2023 earnings remained steady in the past 60 days, and the company’s shares have surged by 14.5% over the past three months.

Parker-Hannifin has delivered an average earnings surprise of 11.8% over the past four quarters. Over the past 60 days, the consensus estimate for PH’s fiscal 2024 earnings has improved by 0.4%, while its stock has risen by 27.5% in the last three months.

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Flowserve Corporation (FLS): Free Stock Analysis Report

Graco Inc. (GGG): Free Stock Analysis Report

Ingersoll Rand Inc. (IR): Free Stock Analysis Report

Click here to read this article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.