Cintas Corporation CTAS has been benefiting from strength in its Uniform Rental and Facility Services segment, driven by strong demand in the energy market. The segment’s revenues rose 9.4% year over year in the fiscal third quarter (ended February 2024). Strong demand for its products and services, pricing actions and robust customer retention have been boosting the First Aid and Safety Services segment’s performance. Revenues from the segment climbed 13.4% year over year in the fiscal third quarter.

Given the strength across its businesses, the company expects revenues to be in the range of $9.57-$9.60 billion in fiscal 2024, indicating year-over-year growth of 8.7% at the mid-point.

The company’s focus on the enhancement of its product portfolio, along with investments in technology and existing facilities, should continue to drive its performance. Also, Cintas’ focus on operational executions and pricing actions is helping it to maintain a healthy margin. For instance, in the first nine months of fiscal 2024, the gross margin increased 150 basis points to 48.7% from the year-ago reported number.

Cintas’ measures to reward its shareholders through dividend payments and share buybacks are noteworthy. In the first nine months of fiscal 2024, it paid dividends of $393.3 million and repurchased shares worth $468.1 million. Also, the company hiked its quarterly dividend by 17.4% to $1.35 per share in July 2023.

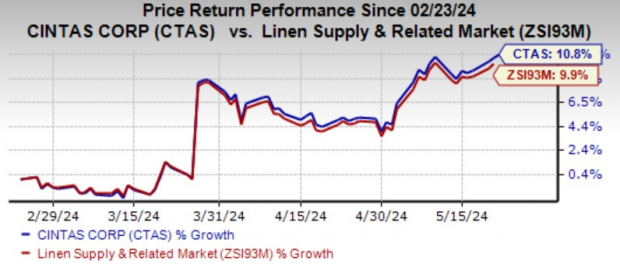

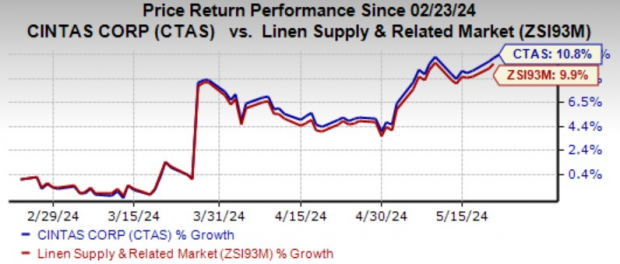

Image Source: Zacks Investment Research

In the past three months, shares of the Zacks Rank #3 (Hold) company have risen 10.8% compared with the industry’s 9.9% growth.

However, CTAS has been dealing with the adverse impacts of high costs. In the third quarter, its cost of sales (comprising costs related to uniform rental and facility services as well as others) rose 5.4% year over year to $1.22 billion due to higher material and labor costs. Selling and administrative expenses also climbed 13.6% year over year. Escalating costs, if left unchecked, may negatively impact profitability in the quarters ahead.

Stocks to Consider

Some better-ranked stocks from the Zacks Industrial Products sector have been discussed below.

Luxfer Holdings LXFR presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 122.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for LXFR’s 2024 earnings has increased 13.5% in the past 60 days.

Crane Company CR presently carries a Zacks Rank of 2. It delivered a trailing four-quarter average earnings surprise of 15.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has risen 3.3%.

Tennant Company TNC currently carries a Zacks Rank of 2. TNC delivered a trailing four-quarter average earnings surprise of 38%.

In the past 60 days, the Zacks Consensus Estimate for 2024 earnings has inched up 1.9%.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Cintas Corporation (CTAS) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Luxfer Holdings PLC (LXFR) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.