The Medical Magic GMED is like a magician mastering new tricks. It is set to soar, fueled by the recent NuVasive merger that merges the best of both companies, creating a symphony of musculoskeletal procedural solutions and enabling technologies to rock the medical world.

In the midst of the musculoskeletal space, GMED flaunts a remarkable product portfolio in expandables, biologics, MIS screws, 3D-printed implants, and cervical offerings, all shining like gems in the treasure chest. Moreover, the company’s robust solvency paints a promising picture for its stocks.

However, lurking in the shadows are macroeconomic headwinds and competitive pitfalls haunting GMED’s operations.

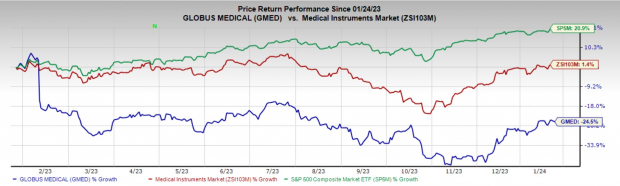

Over the past year, this Zacks Rank #3 (Hold) stock has taken a dip of 24.5% while the industry has grown by 1.4% and the S&P 500 composite has soared by 20.9%. The renowned medical device company has a market capitalization of $7.79 billion. Globus Medical has an earnings yield of 4.69% against the -5.38% of the industry. GMED’s earnings have outshone estimates in each of the trailing four quarters, with an average surprise of 5.44%.

Let’s dig deeper into the roller-coaster journey of GMED.

Soaring High

NuVasive, A Strategic Merger: In September 2023, Globus Medical completed the merger with NuVasive. Marrying GMED’s complementary commercial organization, the combined company envisions soaring as a global musculoskeletal powerhouse, focused on rapid innovation, catering to unmet clinical needs, and enhancing offerings to surgeons and patients.

Together, they expect to summon the best-in-class technologies to create a differentiated and comprehensive procedural solution offering, addressing unmet clinical needs and supporting surgeons and patients. The combined operational footprints enable them to better leverage each other’s manufacturing and supply chain resources, boosting production and reducing capital investment.

Image Source: Zacks Investment Research

The combined company aims to outpace market growth, maintaining financial discipline, drive sales growth, and sustain mid-30s EBITDA, accelerate EPS growth, and amplify cash flows for investors.

Strong Musculoskeletal Prospects: Globus Medical is grabbing a bigger slice of the pie in the musculoskeletal solutions space, piggybacking on the stellar performance of its implantable devices, biologics, accessories, and unique surgical instruments used in a wide array of spinal, orthopedic, and neurosurgical procedures.

Over the past couple of quarters, this business has registered above-market growth, thanks to competitive rep recruiting and robust robotic pull-through. Previously, the company introduced three new game-changing products: REFLECT, MARVEL, and Ossifuse. It also continues to make significant strides in launching its prone, lateral patient positioning system. Expect an avalanche of product launches throughout the Musculoskeletal portfolio in 2024.

Strong Liquidity: GMED concluded the third quarter of 2023 with cash and marketable securities of $468.9 million compared with $612.8 million at the end of the second quarter, with no debt on its balance sheet.

The Dark Underbelly

Macroeconomic Concerns Curb Profit: Like other industry players, GMED is grappling with negative trends in the global economy, including interest rate fluctuations, inflation hikes, and financial market volatility. In the third quarter, the cost of goods sold surged by 139.6%.

These macroeconomic ups and downs, along with rising wage and raw material costs, are triggering a significant elevation in the company’s operating expenses. SG&A expenses in the reported quarter shot up by 46.6% from the year-ago quarter, while research and development expenses escalated by 56.8% year over year.

Competitive Landscape: The musculoskeletal devices market is teeming with fierce competition. The orthopedic industry is a battleground, with behemoths like Zimmer Biomet, Johnson & Johnson’s DePuy, and Medtronic vying for dominance. GMED has to continuously innovate or acquire new products to weather the competitive storm and hold its ground.

Reading the Road Ahead

The Zacks Consensus Estimate for GMED’s 2023 earnings per share (EPS) has remained unchanged at $2.31 in the past 30 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $1.56 billion, indicating a staggering 52.2% rise from the year-ago reported number.

Hidden Gems in the Medical Mine

In the broader medical space, some better-ranked stocks include Haemonetics HAE, DaVita DVA, and HealthEquity HQY.

Haemonetics boasts an estimated earnings growth rate of 28.4% for fiscal 2024 compared with the industry’s 15.3%. HAE’s earnings have surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 16.1%. Its shares have slumped by 6.5% against the industry’s 6.5% fall in the past year.

HAE carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita, currently holding a Zacks Rank #2, has a long-term estimated earnings growth rate of 17.3% compared with the industry’s 11.3%. Shares of the company have ascended by 35.3% compared with the industry’s 8.8% growth over the past year.

DVA’s earnings surpassed estimates in each of the trailing four quarters, with an average surprise of 36.6%, and an impressive 48.4% earnings surprise in the last reported quarter.

HealthEquity, currently at Zacks Rank #2, has an estimated long-term earnings growth rate of 27.5% compared with the industry’s 13.9%. HQY’s shares have surged by 31.2% against the industry’s 6% decline over the past year.

HQY’s earnings have surpassed estimates in each of the trailing four quarters, with an average surprise of 16.5% and an impressive 22.5% earnings surprise in the last reported quarter.

DaVita Inc. (DVA) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.