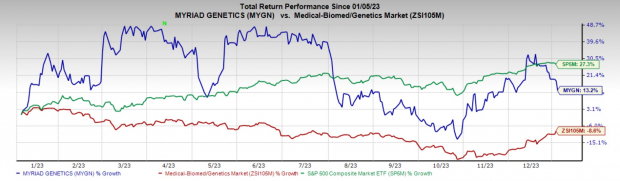

Myriad Genetics MYGN is poised for growth in the coming quarters, supported by a substantial improvement in testing volume across all its businesses. Despite this, it faces foreign exchange headwinds and stiff competition. Over the past year, the Zacks Rank #3 (Hold) stock has outperformed the industry with a 13.4% gain, compared to an industry decline of 8.6% and a 27.3% rise of the S&P 500 composite.

The renowned genetic testing and precision medicine company has a market capitalization of $1.63 billion. Myriad Genetics surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average earnings surprise of 24.24%. It is imperative to delve deeper into the company’s current position.

Positive Momentum

Enormous Opportunity in Oncology Testing: The company is positioned to capitalize on the burgeoning potential in the breast cancer screening market. According to a report by Grand View Research, the United States’ breast cancer screening market is expected to reach nearly $6.8 billion by 2028. Notably, in the third quarter of 2023, hereditary cancer testing volumes from the oncology business climbed 15% year over year, surpassing the estimated industry growth. This demonstrates the strength of its franchises and an improved brand reputation. Furthermore, the prostate cancer test, Prolaris, sustained its momentum, with third-quarter revenues rising 18% year over year.

myChoiceCDx Demonstrates Solid Progress: Myriad Genetics’ progress with the myChoiceCDx test across the globe is noteworthy. The company continues to record robust revenue growth from companion diagnostics, including significant revenue share from its proprietary myChoiceCDx test. Notably, in September 2023, the company announced two key milestones in its strategic partnership with Illumina, which broadens clinical research opportunities and drives companion diagnostics development for gene-based therapies.

Robust Solvency With Minimal Leverage: Myriad Genetics finished the third quarter of 2023 with $76 million in cash and cash equivalents, compared with $56.9 million at the end of the second quarter of 2023. The long-term debt at the end of the third quarter was $38.5 million, emphasizing a solid solvency level, with ample cash for debt repayment, particularly during challenging economic periods.

Challenges Ahead

Foreign Exchange Headwinds: Myriad Genetics is susceptible to exchange rate fluctuations between foreign currencies and the U.S. dollar, given a significant portion of its revenues and expenses are settled in foreign currencies.

Intensifying Competition: With the entry of new players, Myriad Genetics faces increased price competition. Management highlighted that the company is currently contending with competition in its key BRACAnalysis market, expecting intensified competition in its current fields due to technological advancements.

Estimate Trend

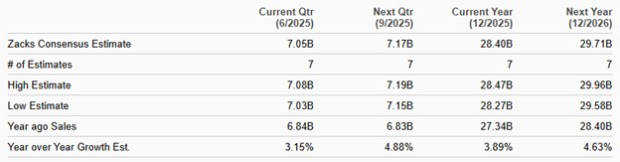

The Zacks Consensus Estimate for MYGN’s 2023 loss per share has slightly decreased from 31 cents to 30 cents in the past 90 days. Meanwhile, the consensus estimate for the company’s 2023 revenues stands at $750.9 million, indicating a 10.7% rise from the year-ago reported number.

Other Strong Picks

Notable stocks in the broader medical space include DaVita Inc. (DVA), HealthEquity, Inc. (HQY), and Integer Holdings Corporation (ITGR). DaVita, with a Zacks Rank #1 (Strong Buy), boasts an estimated long-term growth rate of 17.3% and has consistently outperformed earnings estimates. Similarly, HealthEquity, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 27.5%, while Integer Holdings has recorded substantial gains.

Key Takeaway: While Myriad Genetics confronts certain headwinds, its strong growth prospects in the oncology testing market and solid solvency level make it a stock worth retaining. Investors can also consider other promising stocks in the medical space, such as DaVita Inc., HealthEquity, and Integer Holdings, for potential growth opportunities.