Tandem Diabetes Care, Inc. TNDM shows promising growth potential with a wave of innovative products hitting the market. The company is actively expanding through acquisitions, partnerships, and operational enhancements. Despite its sound financial footing, Tandem Diabetes faces challenges due to its heavy reliance on insulin pumps and fierce competition.

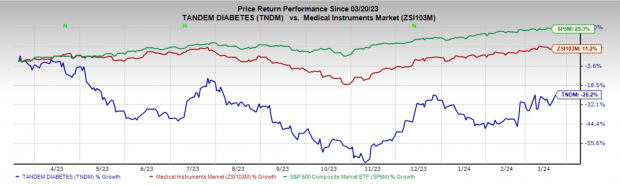

Over the past year, TNDM stock has dipped 325.2%, underperforming the industry’s 11.2% growth and the S&P 500’s 29.3% increase. With a market capitalization of $1.88 billion, Tandem Diabetes anticipates a robust earnings growth rate of 34.6% for 2025, outpacing the industry’s 23.1%. In the last four quarters, TNDM boasted an average earnings surprise of 1.5%.

Now, let’s delve deeper into the nuances.

The Tailwinds: Innovation Steers Tandem’s Growth

Impressive Product Innovation: Tandem Diabetes rolled out a series of new products in 2023 to enhance pump adoption and extend the benefits of its technology to a wider diabetic population. TNDM introduced the t:slim X2 with DexCom’s G7, providing users with a choice in continuous glucose monitor (CGM) integration – a market first in the U.S. Furthermore, their Tandem Mobi pump platform enables full control via a dedicated mobile app, offering unrivaled convenience and mobility.

Image Source: Zacks Investment Research

The company’s diabetes management platform, Tandem Source, is now accessible to all TNDM pump users and their healthcare providers in the U.S., with global availability projected for 2024. Looking ahead, Tandem is developing extended wear infusion sets and a tubeless patch pump option for Mobi, catering to diverse user preferences. With various clinical studies underway, Tandem Diabetes remains at the forefront of diabetes care innovation.

Strategic Developments: Tandem Diabetes pursues growth through strategic acquisitions and collaborations. In 2023, the company acquired AMF Medical SA, the Swiss developer of the Sigi Patch Pump, expanding its product portfolio. Collaborations with Dexcom and Abbott further bolstered TNDM’s presence in the glucose monitoring arena. The introduction of Tandem Source streamlines data reporting and enhances user experience, underscoring the company’s commitment to innovation.

Moreover, Tandem’s shift to a European distribution center is poised to optimize international operations, boost sales efficiency, and foster closer partnerships with global distributors – a move set to drive long-term growth.

Drawing Heed to the Headwinds

Heavy Dependence on Insulin Pumps: While TNDM reaps substantial revenue from insulin pump sales, challenges in wider market acceptance pose a significant hurdle. Factors such as skepticism from diabetes communities and healthcare providers can impede product adoption. Critical appraisal of product safety, efficacy, and ease of use vis-a-vis competitors further clouds Tandem’s growth trajectory.

Tough Competitive Landscape: Operating in a fiercely competitive market, Tandem Diabetes faces formidable rivals ranging from industry giants to nimble startups. Regulatory constraints and evolving market dynamics constrain Tandem’s strategic options, limiting avenues for differentiation and pricing strategies.

Estimate Trend and Recommendations

The Zacks Consensus Estimate projects Tandem Diabetes’ 2024 loss per share at $1.62, up from $1.38 in the past 30 days. Revenue estimates for 2024 stand at $847.3 million, indicating a 13.3% increase from the previous year.

Promising Healthcare Picks Beyond Tandem Diabetes

Notable stocks in the broader medical space include Cardinal Health CAH, Stryker SYK, and DaVita DVA. Cardinal Health, a Zacks Rank #2 stock, boasts steady earnings growth and strong market performance over the past year. Meanwhile, Stryker and DaVita, both highly rated in the Zacks ranking, exhibit robust financial metrics and solid growth prospects.

With Tandem Diabetes navigating a dynamic industry landscape, investors should weigh opportunities and challenges judiciously. Despite headwinds, TNDM’s strategic initiatives and innovative product pipeline bode well for long-term growth and differentiation.